Rogers 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(e) The unamortized deferred transitional gain of $54 million at

December 31, 2006, which arose on the change from marked-

to-market accounting to hedge accounting that was calculated

as at July 1, 2004, was eliminated upon adoption, the impact of

which was a decrease to opening deficit of $37 million, net of

income taxes of $17 million.

(f) Effective January 1, 2007, we record all transaction costs for

financial assets and financial liabilities in the Consolidated

Statements of Income as incurred. We had previously deferred

these costs and amortized them over the term of the related

asset or liability. The carrying value of deferred costs at

December 31, 2006, of $39 million, net of income taxes of

$20 million, was charged to opening deficit on transition on

January 1, 2007.

Inventories

In 2007, the CICA issued Handbook Section 3031, Inventories (“CICA

3031”). CICA 3031 aligns Canadian GAAP with International Financial

Reporting Standards (“IFRS”) and establishes the principles for mea-

surement, recognition and disclosure of inventories. We adopted

this new standard effective January 1, 2007, retrospectively without

restatement. The application of this standard did not have a mate-

rial impact on our Consolidated Financial Statements.

RECENT C ANADIAN ACCOUNTING PRONOUNCEMENTS

Financial Instruments

In 2006, the CICA issued Handbook Section 3862, Financial Instru-

ments – Disclosures, and Handbook Section 3863, Financial

Instruments – Presentation. These standards enhance existing dis-

closure requirements and place greater emphasis on disclosures

related to recognized and unrecognized financial instruments

and how those risks are managed. Disclosures required by these

standards will be included in the Company’s interim and annual

financial statements commencing January 1, 2008.

Capital Disclosures

In 2006, the CICA issued Handbook Section 1535, Capital Disclosures

(“CICA 1535”). CICA 1535 requires that an entity disclose information

that enables users of its financial statements to evaluate an entity’s

objectives, policies and processes for managing capital, including

disclosures of any externally imposed capital requirements and

the consequences for non-compliance. Disclosures required by the

new standard will be included in our Interim and Annual Financial

Statements commencing January 1, 2008.

Goodwill and Intangible Assets

In 2008, the CICA issued Handbook Section 3064, Goodwill and

Intangible Assets (“CICA 3064”). CICA 3064, which replaces Section

3062, Goodwill and Intangible Assets, and Section 3450, Research

and Development Costs, establishes standards for the recognition,

measurement and disclosure of goodwill and intangible assets.

The provisions relating to the definition and initial recognition of

intangible assets, including internally generated intangible assets,

are equivalent to the corresponding provisions of IFRS IAS 38,

Intangible Assets. This new standard is effective for our Interim and

Annual Consolidated Financial Statements commencing January 1,

2009. We are assessing the impact of the new standard.

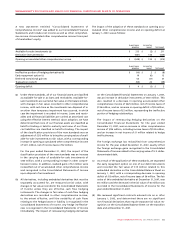

U.S. GAAP DIFFERENCES

We prepare our financial statements in accordance with Canadian

GAAP. U.S. GAAP differs from Canadian GAAP in certain respects.

The areas of principal differences and their impact on our 2007

Audited Consolidated Financial Statements are described in

Note 26 to the 2007 Audited Consolidated Financial Statements.

The significant differences in accounting relate to:

• GainOnSaleandIssuanceofSubsidiarySharestoNon-Controlling

Interest;

• GainonSaleofCableSystems;

• Pre-OperatingCostsCapitalized;

• CapitalizedInterest;

• AcquisitionofCableAtlantic;

• FinancialInstruments;

• Stock-BasedCompensation;

• Pensions;

• IncomeTaxes;

• InstallationRevenuesandCosts;and

• AcquisitionofWireless.

Recent U.S. accounting pronouncements are also discussed in

Note 26 to the 2007 Audited Consolidated Financial Statements.