Rogers 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 71

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

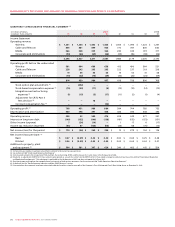

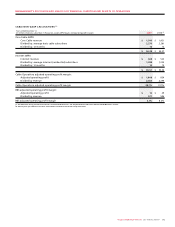

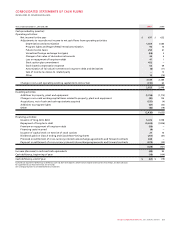

ADJUSTED QUARTERLY CONSOLIDATED FINANCIAL SUMMARY (1)

(In millions of dollars, 2007 2006

except per share amounts) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Income Statement

Operating revenue

Wireless $ 1,231 $ 1,364 $ 1,442 $ 1,466 $ 1,005 $ 1,094 $ 1,224 $ 1,257

Cable and Telecom 855 881 899 923 772 787 800 842

Media 266 348 339 364 240 334 319 317

Corporate and eliminations (54) (66) (69) (66) (33) (36) (38) (46)

2,298 2,527 2,611 2,687 1,984 2,179 2,305 2,370

Adjusted operating profit (2)

Wireless 581 664 686 658 412 490 564 521

Cable and Telecom 228 243 265 265 222 237 219 238

Media 19 45 46 63 14 53 41 48

Corporate and eliminations (14) (22) (13) (29) (30) (24) (24) (39)

814 930 984 957 618 756 800 768

Depreciation and amortization 400 398 397 408 386 395 408 395

Adjusted operating income 414 532 587 549 232 361 392 373

Interest on long-term debt (149) (152) (140) (138) (161) (155) (153) (151)

Other income (expense) 7 23 (14) – 1 17 6 (16)

Income tax reduction (expense) (86) (104) (165) (109) (39) 67 (76) (14)

Adjusted net income (loss) for the period $ 186 $ 299 $ 268 $ 302 $ 33 $ 290 $ 169 $ 192

Adjusted net income per share: (3)

Basic $ 0.29 $ 0.47 $ 0.42 $ 0.47 $ 0.05 $ 0.46 $ 0.27 $ 0.30

Diluted $ 0.29 $ 0.47 $ 0.41 $ 0.47 $ 0.05 $ 0.45 $ 0.27 $ 0.30

Additions to property, plant

and equipment (2) $ 394 $ 381 $ 397 $ 624 $ 340 $ 403 $ 415 $ 554

(1) This quarterly summary has been adjusted to exclude the impact of the adoption of a cash settlement feature for employee stock options, stock-based compensation expense, integration and restructur-

ing costs, an adjustment to CRTC Part II fees related to prior periods, a one-time charge related to the renegotiation of an Internet-related services agreement, losses on repayment of long-term debt

and the income tax impact related to the above items. Certain prior year numbers have been reclassified to conform to the current year presentation. See the “Key Performance Indicators and Non-GAAP

Measures” section. The adjustment related to Part II CRTC fees is applicable to the third quarter of 2007 and does not impact the full year 2007.

(2) As defined. See the “Key Performance Indicators and Non-GAAP Measures” section.

(3) Prior period per share amounts have been retroactively adjusted to reflect a two-for-one split of the Company’s Class A Voting and Class B Non-Voting shares on December 29, 2006.

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

As of the end of the period covered by this report (the “Evaluation

Date”), we conducted an evaluation (under the supervision and with

the participation of our management, including the Chief Executive

Officer and Chief Financial Officer), pursuant to Rule 13a-15 promul-

gated under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), of the effectiveness of the design and operation

of our disclosure controls and procedures. Based on this evaluation,

our Chief Executive Officer and Chief Financial Officer concluded

that as of the Evaluation Date such disclosure controls and proce-

dures were effective.

Management’s Report on Internal Control Over

Financial Reporting

The management of our company is responsible for establishing

and maintaining adequate internal control over financial reporting.

Our internal control system was designed to provide reasonable

assurance to our management and Board of Directors regarding

the preparation and fair presentation of published financial state-

ments in accordance with generally accepted accounting principles.

All internal control systems, no matter how well designed, have

inherent limitations. Therefore, even those systems determined to

be effective can provide only reasonable assurance with respect to

financial statement preparation and presentation.

Management maintains a comprehensive system of controls

intended to ensure that transactions are executed in accordance

with management’s authorization, assets are safeguarded, and

financial records are reliable. Management also takes steps to see

that information and communication flows are effective and to

monitor performance, including performance of internal control

procedures.

Management assessed the effectiveness of our internal control over

financial reporting as of December 31, 2007, based on the criteria

set forth in the Internal Control – Integrated Framework issued

by the Committee of Sponsoring Organizations of the Treadway

Commission (“COSO”). Based on this assessment, management has

concluded that, as of December 31, 2007, our internal control over

financial reporting is effective. Our independent auditor, KPMG LLP,

has issued an audit report that the Company maintained, in all

material respects, effective internal control over financial report-

ing as of December 31, 2007, based on the criteria established in

Internal Control – Integrated Framework issued by the COSO.