Rogers 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 25

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

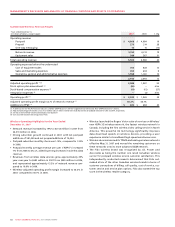

Net Income and Net Income per Share

We recorded net income of

$637 million in 2007, or basic

net income per share of $1.00

(diluted – $0.99), compared to

net income of $622 million, or

basic net income per share of

$0.99 (diluted – $0.97) for the

year ended December 31, 2006.

This increase in net income was

primarily due to the growth in

operating income, as well as the

decrease in interest on long-term

debt, offset by the one-time

non-cash charge related to the

introduction of a cash settle-

ment feature for employee stock

options of $452 million.

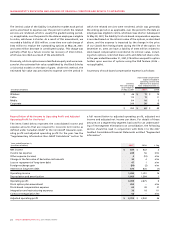

Income Tax Expense

Due to our non-capital loss carryforwards, our income tax expense

for the years ended December 31, 2007 and 2006 substantially rep-

resents non-cash income taxes. As illustrated in the table below,

our effective income tax rate for the years ended December 31,

2007 and 2006 was 28.1% and 8.3%, respectively. The effective

income tax rate for the year ended December 31, 2007 was less than

the 2007 statutory income tax rate of 35.2% primarily due to ben-

efits realized from changes to prior year income tax filing positions

as well as a $25 million future income tax recovery recorded with

respect to the Vidéotron termination payment to reverse a charge

recorded by us in 2006 (see Note 7 of our 2007 Audited Consolidated

Financial Statements). In addition, we recorded a future income tax

recovery associated with the reclassification of contributed surplus

upon the introduction of a cash settlement feature for employee

stock options (see the section entitled “Stock-based Compensation

Expense”). The 2006 effective income tax rate was less than the

2006 statutory rate of 35.8% due primarily to a decrease in the valu-

ation allowance recorded in respect of non-capital losses.

Income tax expense varies from the amounts that would be com-

puted by applying the statutory income tax rate to income before

income taxes for the following reasons:

20072006

$1,066$684$47

CONSOLIDATED ADJUSTED

NET INCOME

(In millions of dollars)

2006

2007

2005

Years ended December 31,

(In millions of dollars) 2007 2006

Statutory income tax rate 35.2% 35.8%

Income before income taxes $ 886 $ 678

Computed income tax expense $ 312 $ 243

Increase (decrease) in income taxes resulting from:

Difference between rates applicable to subsidiaries in other jurisdictions (12) (12)

Change in the valuation allowance for future income tax assets (20) (168)

Videotron termination payment (25) 25

Adjustments to future income tax assets and liabilities for changes in

substantively enacted income tax rates 47 (14)

Stock-based compensation (17) 15

Benefits realized from changes to prior year income tax filing positions and other adjustments (36) (33)

Income tax expense $ 249 $ 56

Effective income tax rate 28.1% 8.3%

Other Expense (Income)

In 2007, investment income received from certain of our invest-

ments was offset by a writedown to reflect what was deemed to be

an “other than temporary decline” in the value of an investment,

and certain other writedowns, resulting in a net expense of $4 mil-

lion. Other income of $10 million in 2006 was primarily associated

with investment income received from certain of our investments.

Change in Fair Value of Derivative Instruments

In 2007, the change in fair value of the derivative instruments was

primarily the result of the changes in fair value of cross-currency

interest rate exchange agreements and forward contracts not

accounted for as hedges. In 2006, the changes in fair value of the

derivative instruments were primarily the result of the changes in

the Canadian dollar relative to that of the U.S. dollar, as described

below, and the resulting change in fair value of our cross-currency

interest rate exchange agreements not accounted for as hedges.

Loss on Repayment of Long-Term Debt

During 2007, we redeemed Wireless’ US$155 million 9.75% Senior

Debentures due 2016 and Wireless’ US$550 million Floating Rate

Senior Notes due 2010. These redemptions resulted in a loss on

repayment of long-term debt of $47 million, including aggregate

redemption premiums of $59 million offset by a write-off of the fair

value increment arising from purchase accounting of $12 million.

During 2006, we redeemed $25 million (US$22 million) of RCI’s (via

Rogers Telecom Holdings Inc., formerly Call-Net) 10.625% Senior

Secured Notes due 2008, resulting in a loss on repayment of long-

term debt of $1 million.