Rogers 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 31

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

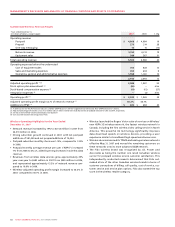

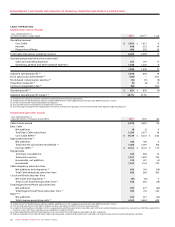

During 2007, wireless data revenue increased by 49% over 2006

to $683 million. This increase in data revenue reflects the contin-

ued growth of text and multimedia messaging services, wireless

Internet access, BlackBerry devices, downloadable ring tones,

music and games, and other wireless data services and applications.

In 2007, data revenue represented approximately 13.2% of total

network revenue, compared to 10.6% in 2006.

Wireless Equipment Sales

The year-over-year increase in revenue from equipment sales,

including activation fees and net of equipment subsidies, reflects

an increased volume of handset upgrades associated with the

growing subscriber base.

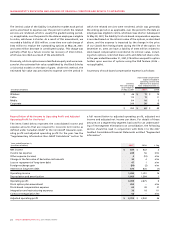

Wireless Network Revenue

The increase in network rev-

enue in 2007 compared to 2006

was driven by the continued

growth of Wireless’ postpaid

subscriber base and improve-

ments in postpaid ARPU. The

year-over-year increase in post-

paid ARPU reflects the impact of

higher data revenue, as well as

increased long-distance, add-on

features and roaming revenue.

Wireless has experienced growth

in roaming revenues from sub-

scribers using services outside of

Canada as well as strong growth

in inbound roaming revenues

from visitors to Canada who uti-

lize Wireless’ network.

Prepaid revenue increased as a result of improved ARPU and a

larger subscriber base. The year-over-year improvement in ARPU is

a result of increased data usage and more attractive prepaid offer-

ings, including unlimited evening and weekend plans.

Wireless’ success in the continued reduction in postpaid churn

reflects proactive and targeted customer retention activities, the

commitment to customer care and improvements in network cov-

erage and quality. Prepaid churn has improved during 2007 due to

changes in offerings and investments in retention programs.

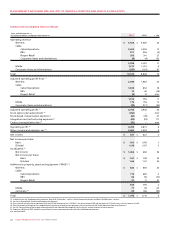

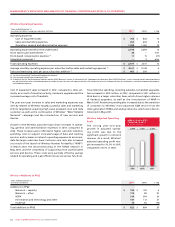

Summarized Wireless Subscriber Results

Years ended December 31,

(Subscriber statistics in thousands, except ARPU, churn and usage) 2007 2006 Chg

Postpaid

Gross additions 1,352 1,375 (23)

Net additions 581 580 1

Adjustment to postpaid subscriber base (1) (65) – (65)

Total postpaid retail subscribers 5,914 5,398 516

Average monthly revenue per user (“ARPU”) (2) $ 72.21 $ 67.27 $ 4.94

Average monthly usage (minutes) 573 545 28

Monthly churn (1) 1.15% 1.32% (0.17%)

Prepaid

Gross additions 635 615 20

Net additions 70 30 40

Adjustment to prepaid subscriber base (1) (26) – (26)

Total prepaid retail subscribers 1,424 1,380 44

ARPU (2) $ 16.46 $ 13.49 $ 2.97

Monthly churn (1) 3.42% 3.70% (0.28%)

(1) During 2007, Wireless decommissioned its TDMA and analog networks and simultaneously revised certain aspects of its subscriber reporting for data-only subscribers. The deactivation of the remaining

TDMA subscribers and the change in subscriber reporting resulted in the removal of approximately 65,000 subscribers from Wireless’ postpaid subscriber base and the removal of approximately 26,000

subscribers from Wireless’ prepaid subscriber base. These adjustments are not included in the determination of postpaid or prepaid monthly churn.

(2) As defined. See the “Key Performance Indicators and Non-GAAP Measures” section. As calculated in the “Supplementary Information: Non-GAAP Calculations” section.

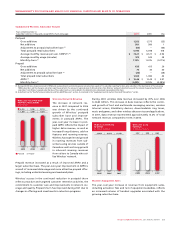

200720062005

5,9145,3984,818

1,4241,3801,350

Postpaid Prepaid

WIRELESS POSTPAID AND

PREPAID SUBSCRIBERS

(In thousands)

20072006

$5,154$4,313$3,614

WIRELESS NETWORK

REVENUE

(In millions of dollars)

2006

2007

2005

20072006

$683$459$297

WIRELESS DATA

REVENUE

(In millions of dollars)

200

6

2007

2005