Rogers 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 37

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

• Launchedthreenew“tripleplay”packageswhichcombinedigital

cable, high-speed Internet and Rogers Home Phone services

in discrete packages and with easy to understand price points.

These packages range from a basic starter package to a VIP Plus

package, with the selection allowing our customers to choose

the television, high-speed Internet and Home Phone plan that

best meets their needs.

• Completed the acquisition of the remaining 80% of the out-

standing shares of Futureway that it did not already own and the

outstanding stock options. Futureway is a facilities-based pro-

vider of telecommunications and high-speed Internet services

operating in and around the Greater Toronto Area.

• Expandedtheavailabilityofitsresidentialtelephonyserviceto

approximately 94% of homes passed by its cable networks.

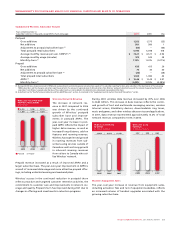

Total operating revenue increased $357 million or 11%, from 2006,

and total adjusted operating profit increased to $1,016 million or by

$100 million, an 11% increase from 2006. See the following segment

discussions for a detailed discussion of operating results.

OPER ATING HIGHLIGHTS FOR THE YEAR ENDED

DECEMBER 31, 2007

• Increasedsubscriberbasesby290,000cabletelephonysubscrib-

ers, 165,000 high-speed residential Internet subscribers, 219,000

digital cable households and 18,000 basic cable subscribers.

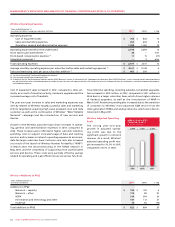

• Entered into a renegotiated agreement with Yahoo! Inc.

(“Yahoo!”)thatwilleliminatemonthlypersubscriberfeesand

see both companies work jointly on advertising revenue oppor-

tunities leveraging Rogers’ high-speed Internet access portal

and subscriber base. In connection with this new agreement,

wemadeaone-timepaymenttoYahoo!inthefourthquarter

of 2007 of $52 million, and Cable’s cost of providing its Internet

service will be reduced by approximately $25 million per year

over the four year term of the new agreement. Rogers’ branding

of its Internet service is being transitioned to “Rogers Hi-Speed

Internet”, while the on-line portal will continue to be branded as

“RogersYahoo!”.

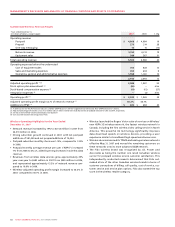

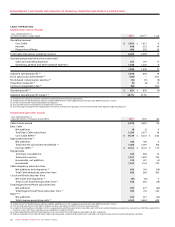

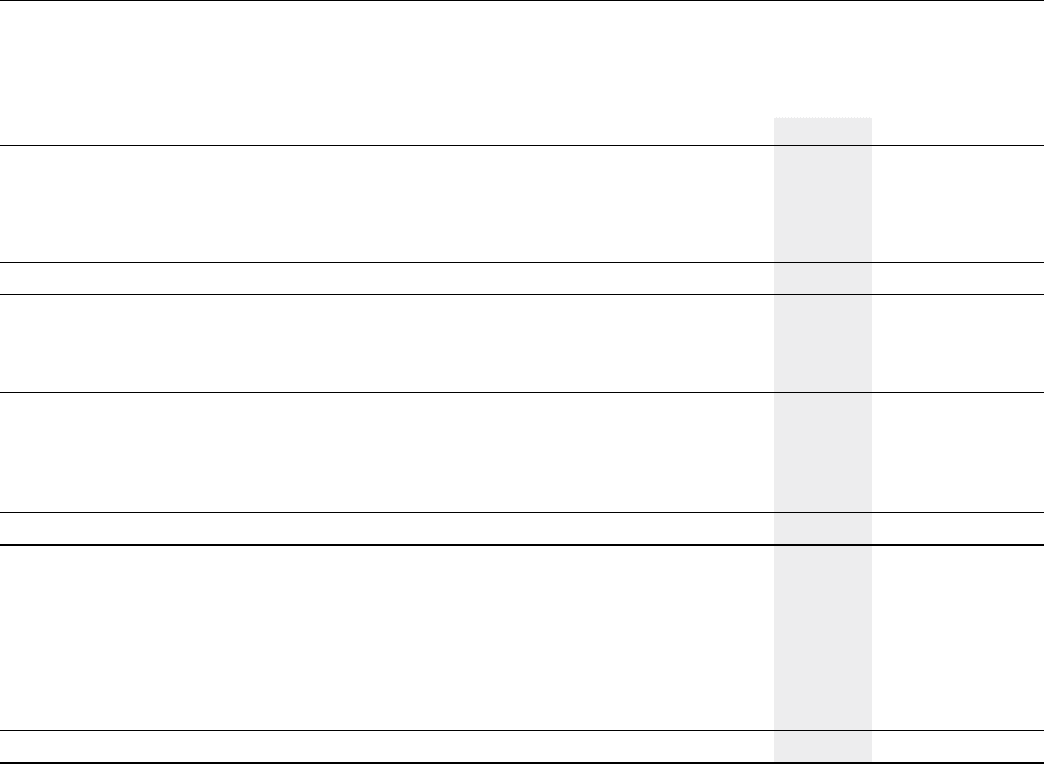

Summarized Cable Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2007 (1) 2006 (2) % Chg

Operating revenue

Cable Operations (3) $ 2,603 $ 2,299 13

RBS 571 596 (4)

Rogers Retail 393 310 27

Intercompany eliminations (9) (4) 125

Total operating revenue 3,558 3,201 11

Operating profit (loss) before the undernoted

Cable Operations (3) 1,008 854 18

RBS 12 49 (76)

Rogers Retail (4) 13 n/m

Adjusted operating profit (4) 1,016 916 11

Stock option plan amendment (5) (113) – n/m

Stock-based compensation expense (5) (11) (11) –

Integration and restructuring expenses (6) (38) (15) 153

Contract renegotiation fee (7) (52) – n/m

Operating profit (4) $ 802 $ 890 (10)

Adjusted operating profit (loss) margin (4)

Cable Operations (3) 38.7% 37.1%

RBS 2.1% 8.2%

Rogers Retail (1.0%) 4.2%

Additions to PP&E (4)

Cable Operations (3) $ 710 $ 685 4

RBS 83 98 (15)

Rogers Retail 21 11 91

Total additions to PP&E $ 814 $ 794 3

(1) The operating results of Futureway are included in Cable’s results of operations from the date of acquisition on June 22, 2007.

(2) Certain prior year amounts have been reclassified to conform to the current year presentation.

(3) Cable Operations segment includes Core Cable services, Internet services and Rogers Home Phone services.

(4) As defined. See the “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information: Non-GAAP Calculations” sections.

(5) See the section entitled “Stock-based Compensation Expense”.

(6) Costs incurred related to the integration of the operations of Call-Net, the restructuring of RBS and the closure of 21 Retail stores in the first quarter of 2006.

(7) One-time charge resulting from the renegotiation of an Internet-related services agreement. See the section entitled “Cable Operations Operating Expenses”.