Rogers 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

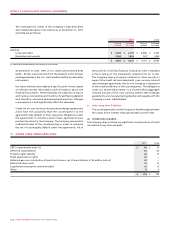

On January 7, 2008, the Board approved an increase in the annual

dividend from $0.50 to $1.00 per Class A Voting and Class B

Non-Voting share to be paid quarterly on each outstanding

Class A Voting and Class B Non-Voting share. Consequently, the

Class A Voting shares may receive a dividend at a quarterly rate

of up to $0.25 per share only after the Class B Non-Voting shares

have been paid a dividend at a quarterly rate of $0.25 per share.

The Class A Voting and Class B Non-Voting shares share equally in

dividends after payment of a dividend of $0.25 per share for each class.

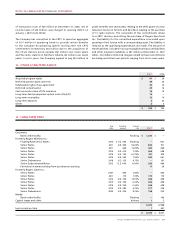

Dividend

Date declared Date paid per share

April 25, 2006 July 4, 2006 $ 0.0375

October 30, 2006 January 2, 2007 0.0400

$ 0.0775

February 15, 2007 April 2, 2007 $ 0.0400

May 28, 2007 July 3, 2007 0.1250

July 31, 2007 October 1, 2007 0.1250

November 1, 2007 January 2, 2008 0.1250

$ 0.4150

Stock options, share units and share purchase plans:

As a result of the Company’s two-for-one stock split (note 19(a (ii)),

the numbers of options, restricted share units and deferred share

units outstanding were adjusted, in accordance with existing

provisions of the plans for these awards, such that the holders of

these awards would be in the same economic position before and

after effecting the stock split. Consequently, these adjustments did

not result in a new measurement date for these awards.

These amounts are exclusive of the $452 million charge related

to the amendment of the stock option plans on May 28, 2007, as

described below:

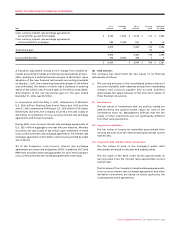

(A) STOCK OPTIONS:

(i) Amendments to stock option plans:

On May 28, 2007, the Company’s 1994 Stock Option Plan

(“1994 Plan”), 1996 Stock Option Plan (“1996 Plan”) and 2000

Stock Option Plan (“2000 Plan”) were amended to allow for cash

settled SARs to be attached to all new and previously granted

options. The SAR feature allows option holders to elect to receive

an amount in cash equal to the intrinsic value, being the excess

market price of the Class B Non-Voting share over the exercise

price of the option, instead of exercising the option and acquiring

Class B Non-Voting shares.

All prior period numbers of options, restricted share units and

deferred share units as well as exercise prices and fair values per

individual award have been retroactively adjusted to reflect the

two-for-one stock split.

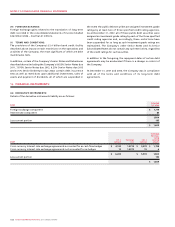

A summary of stock-based compensation expense is as follows:

As a result, effective May 28, 2007, all outstanding stock options

are classified as liabilities and are carried at their intrinsic value as

adjusted for vesting. The intrinsic value is marked-to-market each

period and is amortized to expense over the period in which the

related services are rendered, which is usually the graded vesting

period or, as applicable, over the period to the date an employee

is eligible to retire, whichever is shorter. Prior to May 28, 2007, all

stock options were classified as equity and were measured at the

estimated fair value established by the Black-Scholes or binomial

models on the date of grant. Under this method, the estimated fair

value was amortized to expense over the period in which the related

services were rendered, which is usually the vesting period or, as

applicable, over the period to the date an employee was eligible

to retire, whichever was shorter. The impact of the amendment to

the stock option plans at May 28, 2007, was an increase in liabilities

of $502 million, a decrease in contributed surplus of $50 million and

a one-time non-cash charge of $452 million. In addition, a future

income tax recovery of $160 million was recorded on May 28, 2007,

as a result of the amendment.

20. STOCK-BASED COMPENSATION:

2007 2006

Stock-based compensation:

Stock options (a) $ 34 $ 32

Restricted share units (b) 21 12

Deferred share units (c) 7 5

$ 62 $ 49