Rogers 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

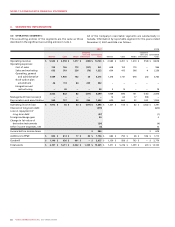

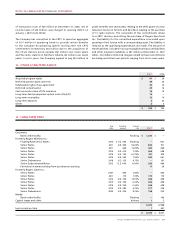

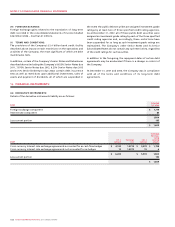

Further details of long-term debt are as follows:

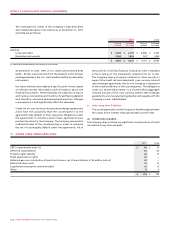

(A) REORGANIZATION OF LONG-TERM DEBT:

On June 29, 2007, the $1 billion Cable bank credit facility, the

$700 million Wireless bank credit facility and the $600 million Media

bank credit facility were cancelled and the Company entered into a

new unsecured $2.4 billion bank credit facility, the initial proceeds

of which were used to repay and cancel each of the Cable, Wireless

and Media bank credit facilities.

On July 1, 2007, the Company completed an intracompany

amalgamation of RCI and certain of its wholly owned subsidiaries,

including Rogers Cable Inc. and Rogers Wireless Inc. The

amalgamated entity continues as Rogers Communications Inc. and

Rogers Cable Inc. and Rogers Wireless Inc. are no longer separate

corporate entities and have ceased to be reporting issuers. This

intracompany amalgamation does not impact the consolidated

results previously reported by the Company. In addition, the

operating subsidiaries of Rogers Cable Inc. and Rogers Wireless Inc.

were not part of and were not impacted by the amalgamation.

As a result of the amalgamation, on July 1, 2007, Rogers

Communications Inc. assumed all of the rights and obligations

under all of the outstanding Rogers Cable Inc. and Rogers Wireless

Inc. public debt indentures and cross-currency interest rate

exchange agreements. As part of the amalgamation process, on

June 29, 2007, Rogers Cable Inc. and Rogers Wireless Inc. released all

security provided by bonds issued under the Rogers Cable Inc. deed

of trust and the Rogers Wireless Inc. deed of trust for all of the

then outstanding Rogers Cable Inc. and Rogers Wireless Inc. senior

public debt and cross-currency interest rate exchange agreements.

As a result, none of the senior public debt or cross-currency interest

rate exchange agreements remain secured by such bonds effective

as of June 29, 2007.

As a result of these actions, the outstanding public debt and

cross-currency interest rate exchange agreements and the new

$2.4 billion bank credit facility are unsecured obligations of

Rogers Communications Inc. The Rogers Communications Inc.

public debt originally issued by Rogers Cable Inc. has Rogers

Cable Communications Inc. (“RCCI”), a wholly owned subsidiary,

as a co-obligor and Rogers Wireless Partnership (“RWP”), a wholly

owned subsidiary, as an unsecured guarantor while the Rogers

Communications Inc. public debt originally issued by Rogers Wireless

Inc. has RWP as a co-obligor and RCCI as an unsecured guarantor.

Similarly, RCCI and RWP have provided unsecured guarantees for

the new bank credit facility and the cross currency interest rate

exchange agreements. Accordingly, Rogers Communications Inc.’s

bank debt, senior public debt and cross-currency interest rate

exchange agreements now rank pari passu on an unsecured basis.

The Company’s subordinated public debt remains subordinated to

its senior debt.

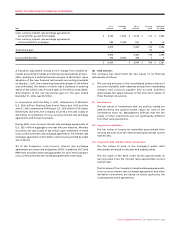

(B) BANK CREDIT FACILITY:

(i) Corporate bank credit facility:

The RCI credit facility provides the Company with up

to $2.4 billion from a consortium of Canadian financial

institutions. The bank credit facility is available on a fully

revolving basis until maturity on July 2, 2013, and there are

no scheduled reductions prior to maturity. The interest rate

charged on the bank credit facility ranges from nil to 0.50%

per annum over the bank prime rate or base rate or 0.475%

to 1.75% over the bankers’ acceptance rate or the London

Inter-Bank Offered Rate (“LIBOR”). The Company’s bank credit

facility is unsecured and ranks pari passu with the Company’s

senior public debt and cross-currency interest rate exchange

agreements. The bank credit facility requires that the Company

satisfy certain financial covenants, including the maintenance

of certain financial ratios.

(ii) Cancelled Wireless bank credit facility:

Prior to its repayment and cancellation on June 29, 2007,

Wireless’ bank credit facility provided Wireless with up

to $700 million from a consortium of Canadian financial

institutions. There were no amounts outstanding under

Wireless’ bank credit facility at December 31, 2006. Interest

rates under the bank credit facility ranged from the bank

prime rate or base rate to the bank prime rate or base rate

plus 1.75% per annum, the bankers’ acceptance rate plus 1% to

2.75% per annum and LIBOR plus 1% to 2.75% per annum.

(iii) Cancelled Cable bank credit facility:

Prior to its repayment and cancellation on June 29, 2007,

Cable’s bank credit facility provided Cable with up to $1 billion

of available credit, comprised of a $600 million Tranche A credit

facility and a $400 million Tranche B credit facility, both of

which were available on a fully revolving basis until maturity

on July 2, 2010, and there were no scheduled reductions prior

to maturity. There were no amounts outstanding under Cable’s

bank credit facility at December 31, 2006.

The interest rate charged on the Cable bank credit facility

ranged from nil to 2.0% per annum over the bank prime rate

or base rate or 0.625% to 3.25% per annum over the bankers’

acceptance rate or LIBOR.

(iv) Cancelled Media bank credit facility:

Prior to its repayment and cancellation on June 29, 2007,

Media’s 2006 bank credit facility provided Media with up

to $600 million from a consortium of Canadian financial

institutions. There was $160 million outstanding under Media’s

bank credit facility at December 31, 2006. Borrowings under

this facility were available to Media for general corporate

purposes on a fully revolving basis until the facility was

cancelled on June 29, 2007. The interest rates charged on this

credit facility ranged from the bank prime rate or U.S. base

rate plus nil to 2.0% per annum and the bankers’ acceptance

rate or LIBOR plus 1.0% to 3.0% per annum.