Rogers 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Impairment of Goodwill, Indefinite-Lived Intangible Assets and

Long-Lived Assets

Indefinite-lived intangible assets, including goodwill and spec-

trum/broadcast licences, as well as long-lived assets, including PP&E

and other intangible assets, are assessed for impairment on at least

an annual basis or more often if events or circumstances warrant.

These impairment tests involve the use of both undiscounted and

discounted net cash flow analyses to assess the recoverability of the

carrying value of these assets and the fair value of both indefinite-

lived and long-lived assets, if applicable. These analyses involve

estimates of future cash flows, estimated periods of use and appli-

cable discount rates.

Income Tax Estimates

We use judgment in the estimation of income taxes and future

income tax assets and liabilities. In the preparation of our

Consolidated Financial Statements, we are required to estimate

income taxes in each of the jurisdictions in which we operate. This

involves estimating actual current tax exposure, together with asses-

sing temporary differences that result from differing treatments

in items for accounting purposes versus tax purposes, and in esti-

mating the recoverability of the benefits arising from tax loss

carryforwards. We are required to assess whether it is more likely

than not that future income tax assets will be realized prior to

the expiration of the related tax loss carryforwards. Judgment is

required to determine if a valuation allowance is needed against

either all or a portion of our future income tax assets. Various

considerations are reflected in this judgment, including future prof-

itability of related companies, tax planning strategies that are being

implemented or could be implemented to recognize the benefits

of these tax assets, as well as the expiration of the tax loss carryfor-

wards. Judgments and estimates made to assess the tax treatment

of items and the need for a valuation allowance impact the future

income tax balances as well as net income through the current

and future income tax provisions. As at December 31, 2007, and

as detailed in Note 7 to the 2007 Audited Consolidated Financial

Statements we have non-capital income tax loss carryforwards

of approximately $2,001 million. Our net future income tax asset,

prior to valuation allowances, totals approximately $609 million

at December 31, 2007 (2006 – $836 million). The recorded valua-

tion allowance results in a future income tax asset of $490 million,

reflecting that it is more likely than not that certain income tax

assets will be realized.

Pension Plans

When accounting for defined benefit pension plans, assumptions

are made in determining the valuation of benefit obligations and

the future performance of plan assets. Delayed recognition of dif-

ferences between actual results and expected or estimated results

is a guiding principle of pension accounting. This principle results in

recognition of changes in benefit obligations and plan performance

over the working lives of the employees receiving benefits under the

plan. The primary assumptions and estimates include the discount

rate, the expected return on plan assets and the rate of compensa-

tion increase. Changes to these primary assumptions and estimates

would impact pension expense and the deferred pension asset.

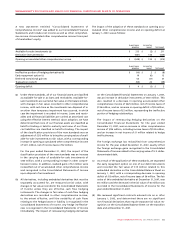

The following table illustrates the increase (decrease) in the accrued

benefit obligation and pension expense for changes in these pri-

mary assumptions and estimates:

Impact of Changes in Pension-Related Assumptions

Accrued Benefit Obligation at Pension Expense

(In millions of dollars) End of Fiscal 2007 Fiscal 2007

Discount rate 5.25% 5.25%

Impact of: 1% increase $ (111) $ (11)

1% decrease 126 19

Rate of compensation increase 3.50% 3.50%

Impact of: 0.25% increase $ 5 $ 2

0.25% decrease (5) (2)

Expected rate of return on assets N/A 6.75%

Impact of: 1% increase N/A (6)

1% decrease N/A 6

Allowance for Doubtful Accounts

A significant portion of our revenue is earned from selling on credit

to individual consumers and business customers. The allowance for

doubtful accounts is calculated by taking into account factors such

as our historical collection and write-off experience, the number

of days the customer is past due and the status of the customer’s

account with respect to whether or not the customer is continuing

to receive service. As a result, fluctuations in the aging of subscriber

accounts will directly impact the reported amount of bad debt

expense. For example, events or circumstances that result in a dete-

rioration in the aging of subscriber accounts will in turn increase

the reported amount of bad debt expense. Conversely, as circum-

stances improve and customer accounts are adjusted and brought

current, the reported bad debt expense will decline.

NEW ACCOUNTING STANDARDS

Financial Instruments

In 2005, the CICA issued Handbook Section 3855, Financial

Instruments – Recognition and Measurement, Handbook Section

1530, Comprehensive Income, Handbook Section 3251, Equity, and

Handbook Section 3865, Hedges. The new standards were adopted

commencing January 1, 2007, and were generally required to be

adopted retrospectively without restatement.