Rogers 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CABLE ADDITIONS TO PP&E

The Cable Operations segment categorizes its PP&E expenditures

according to a standardized set of reporting categories that were

developed and agreed to by the U.S. cable television industry and

which facilitate comparisons of additions to PP&E between different

cable companies. Under these industry definitions, Cable Operations

additions to PP&E are classified into the following five categories:

• Customerpremiseequipment(“CPE”),whichincludestheequip-

ment for digital set-top terminals, Internet modems and the

associated installation costs;

• Scalableinfrastructure,whichincludesnon-CPEcoststomeet

business growth and to provide service enhancements, including

many of the costs to-date of the cable telephony initiative;

• Lineextensions,whichincludesnetworkcoststoenternewser-

vice areas;

• Upgrades and rebuild, which includes the costs to modify or

replace existing co-axial cable, fibre-optic equipment and net-

work electronics; and

• Support capital,whichincludes the costsassociatedwiththe

purchase, replacement or enhancement of non-network assets.

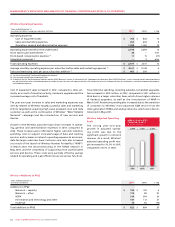

2007 CABLE ADDITIONS TO PP&E

(%)

Cable Operations 87%

Retail 3%

Business Solutions 10%

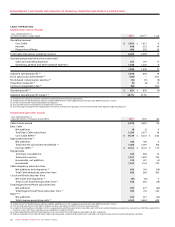

Summarized Cable PP&E Additions

Years ended December 31,

(In millions of dollars) 2007 2006 (1) % Chg

Additions to PP&E

Customer premise equipment $ 304 $ 307 (1)

Scalable infrastructure 167 184 (9)

Line extensions 57 64 (11)

Upgrades and rebuild 43 10 n/m

Support capital 139 120 16

Total Cable Operations (2) 710 685 4

Rogers Business Solutions (3) 83 98 (15)

Rogers Retail 21 11 91

$ 814 $ 794 3

(1) Certain prior year amounts have been reclassified to conform with the current year presentation.

(2) Included in Cable and Internet PP&E additions are costs related to the integration of Call-Net of $5 million and $28 million, for the years ended December 31, 2007, and December 31, 2006, respectively.

(3) Included in RBS PP&E additions are costs related to the integration of Call-Net of $6 million and $15 million, for the years ended December 31, 2007, and December 31, 2006, respectively.

The year-over-year increase in additions to PP&E is attributable to

an increase in spending at Cable Operations, and Rogers Retail,

offset by lower spending at RBS.

Cable Operations PP&E additions are primarily attributable to

higher spending on support capital relating to a larger subscriber

base. Spending on upgrades and rebuilds was driven by upgrades

and improvements to its cable systems in the Atlantic provinces and

rural areas in Ontario.

RBS PP&E additions decreased during 2007 compared to 2006 pri-

marily due to the purchase of Group Telecom/360Networks assets

from Bell Canada in 2006.

The increase in Rogers Retail PP&E additions is attributable to

improvements made to certain retail stores acquired from Wireless

in January 2007 and to improvements related to new retail stores.

MEDIA

MEDIA’S BUSINESS

Media operates our radio and television broadcasting operations,

our consumer and trade publishing operations, our televised home

shopping service and Rogers Sports Entertainment. In addition to

Media’s more traditional broadcast and print media platforms, it also

delivers content and conducts e-commerce over the Internet relating

to many of its individual broadcasting and publishing properties.

Media’s Broadcasting group (“Broadcasting”) comprises 52 radio

stations across Canada; multicultural OMNI television stations; the

five station Citytv television network; a specialty sports television

service that provides regional sports programming across Canada

(“Rogers Sportsnet”), and Canada’s only nationally televised shop-

ping service (“The Shopping Channel”). Media also holds 50%

ownership in Dome Productions, a mobile production and distribu-

tion joint venture that is a leader in HDTV production in Canada.

Broadcasting also owns The Biography Channel Canada and

G4TechTV Canada and holds interests in several Canadian specialty

television services, including Viewers Choice Canada.

Media’s Publishing group (“Publishing”) publishes 78 consumer

magazines and trade and professional publications and directories

in Canada.

In addition to its organic growth, Media expanded its business in

2007 through the following initiatives: the acquisition of five radio

stations located in Edmonton and Fort McMurray, Alberta, including

licences in several small Alberta markets; and the acquisition of