Rogers 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

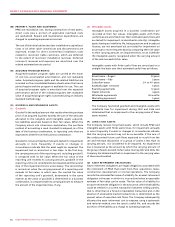

(ii) Intangible assets:

Intangible assets acquired in a business combination are

recorded at their fair values. Intangible assets with finite

useful lives are amortized over their estimated useful lives and

are tested for impairment, as described in note 2(p). Intangible

assets having an indefinite life, being spectrum and broadcast

licences, are not amortized but are tested for impairment on

an annual or more frequent basis by comparing their fair value

to their carrying amount. An impairment loss on an indefinite

life intangible asset is recognized when the carrying amount

of the asset exceeds its fair value.

Intangible assets with finite useful lives are amortized on a

straight-line basis over their estimated useful lives as follows:

Brand name – Rogers 20 years

Brand name – Fido 5 years

Subscriber bases 21/4 to 42/3 years

Baseball player contracts 5 years

Roaming agreements 12 years

Dealer networks 4 years

Wholesale agreements 38 months

Marketing agreement 5 years

The Company has tested goodwill and intangible assets with

indefinite lives for impairment during 2007 and 2006 and

determined that no impairment in the carrying value of these

assets existed.

(P) LONG-LIVED ASSETS:

The Company reviews long-lived assets, which include PP&E and

intangible assets with finite useful lives, for impairment annually

or more frequently if events or changes in circumstances indicate

that the carrying amount may not be recoverable. If the sum of

the undiscounted future cash flows expected to result from the

use and eventual disposition of a group of assets is less than its

carrying amount, it is considered to be impaired. An impairment

loss is measured as the amount by which the carrying amount of

the group of assets exceeds its fair value. During 2007 and 2006, the

Company has determined that no impairment in the carrying value

of these assets existed.

(Q) ASSET RETIREMENT OBLIGATIONS:

Asset retirement obligations are legal obligations associated with

the retirement of PP&E that result from their acquisition, lease,

construction, development or normal operations. The Company

records the estimated fair value of a liability for an asset retirement

obligation in the year in which it is incurred and when a reasonable

estimate of fair value can be made. The fair value of a liability for

an asset retirement obligation is the amount at which that liability

could be settled in a current transaction between willing parties,

that is, other than in a forced or liquidation transaction and, in the

absence of observable market transactions, is determined as the

present value of expected cash flows. The Company subsequently

allocates the asset retirement cost to expense using a systematic

and rational method over the asset’s useful life, and records the

accretion of the liability as a charge to operating expenses.

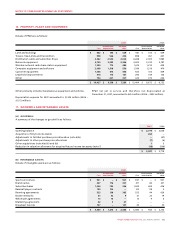

(M) PROPERTY, PLANT AND EQUIPMENT:

PP&E are recorded at cost. During construction of new assets,

direct costs plus a portion of applicable overhead costs

are capitalized. Repairs and maintenance expenditures are

charged to operating expenses as incurred.

The cost of the initial cable subscriber installation is capitalized.

Costs of all other cable connections and disconnections are

expensed, except for direct incremental installation costs

related to reconnect Cable customers, which are deferred

to the extent of reconnect installation revenues. Deferred

reconnect revenues and expenses are amortized over the

related estimated service period.

(N) ACQUIRED PROGRAM RIGHTS:

Acquired broadcast program rights are carried at the lower

of cost less accumulated amortization, and net realizable

value. Acquired program rights and the related liabilities are

recorded on the consolidated balance sheets when the licence

period begins and the program is available for use. The cost

of acquired program rights is amortized over the expected

performance period of the related programs. Net realizable

value of acquired program rights is assessed using an industry

standard methodology.

(O) GOODWILL AND INTANGIBLE ASSETS:

(i) Goodwill:

Goodwill is the residual amount that results when the purchase

price of an acquired business exceeds the sum of the amounts

allocated to the tangible and intangible assets acquired,

less liabilities assumed, based on their fair values. When the

Company enters into a business combination, the purchase

method of accounting is used. Goodwill is assigned, as of the

date of the business combination, to reporting units that are

expected to benefit from the business combination.

Goodwill is not amortized but instead is tested for impairment

annually or more frequently if events or changes in

circumstances indicate that the asset might be impaired. The

impairment test is carried out in two steps. In the first step,

the carrying amount of the reporting unit, including goodwill,

is compared with its fair value. When the fair value of the

reporting unit exceeds its carrying amount, goodwill of the

reporting unit is not considered to be impaired and the second

step of the impairment test is unnecessary. The second step

is carried out when the carrying amount of a reporting unit

exceeds its fair value, in which case, the implied fair value

of the reporting unit’s goodwill, determined in the same

manner as the value of goodwill is determined in a business

combination, is compared with its carrying amount to measure

the amount of the impairment loss, if any.