Rogers 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

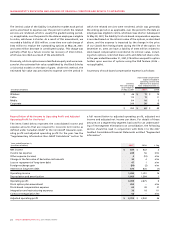

Foreign Exchange Gain

During 2007, the Canadian dollar strengthened by 17.72 cents result-

ing in a foreign exchange gain of $54 million from the translation

of the portion of our U.S. dollar-denominated debt that was

unhedged for accounting purposes. During 2006, the foreign

exchange gain of $2 million arose primarily from the strengthening

of the Canadian dollar during 2006 from $1.1659 at December 31,

2005 to $1.1653 at December 31, 2006, favourably affecting the trans-

lation of the unhedged portion of our U.S. dollar-denominated

debt.

Interest on Long-Term Debt

The decrease in interest expense from 2006 is primarily due to the

repayment of long-term debt in 2007, including the impact of the

settlement of certain of our cross-currency interest rate exchange

agreements.

The decrease in debt was largely the result of the February 2007

repayment at maturity of Cable’s $450 million 7.60% Senior Notes

due 2007, the May 2007 redemption of Wireless’ US$550 million

Floating Rate Senior Notes due 2010 and the June 2007 redemp-

tion of Wireless’ US$155 million 9.75% Senior Debentures due

2016. These repayments were partially offset by the $1,080 million

net increase in bank debt at December 31, 2007, compared to

December 31, 2006.

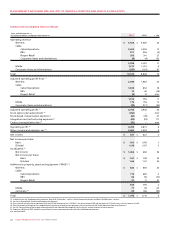

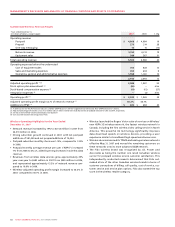

Operating Income

The 16% increase in our operating income is primarily due to the

growth in revenue of $1,285 million exceeding the growth in oper-

ating expenses of $1,061 million, and the increase in depreciation

and amortization expense of $19 million compared to 2006.

Depreciation and Amortization Expense

The increase in depreciation and amortization expense for the year

ended December 31, 2007, over 2006 reflects an increase in depreci-

ation and amortization related to PP&E. This was partially offset by

a decrease in amortization of intangible assets resulting from the

reduction in the carrying value of certain intangible assets due to

the reduction in the valuation allowance recorded in 2006 related

to future income tax assets acquired as part of business acquisitions

in prior periods.

Adjusted Operating Profit

Wireless, Cable and Media all contributed to the increase in

adjusted operating profit. Refer to the individual segment discus-

sions for details of the respective increases in adjusted operating

profit.

Adjusted operating profit increased to $3,703 million in 2007, com-

pared to $2,942 million in 2006. Adjusted operating profit excludes:

(i) the impact of a $452 million one-time non-cash charge related

to the introduction of a cash settlement feature for stock options

during 2007; (ii) stock-based compensation expense of $62 million

in 2007 and $49 million in 2006; (iii) integration and restructuring

expenses of $38 million in 2007 and $18 million in 2006; and (iv) the

impact of a one-time charge of $52 million resulting from the rene-

gotiation of an Internet-related services agreement in 2007.

For details on the determination of adjusted operating profit, which

is a non-GAAP measure, see the “Supplementary Information:

Non-GAAP Calculations” and the “Key Performance Indicators and

Non-GAAP Measures” sections.

Employees

Employee remuneration represents a material portion of our

expenses. At December 31, 2007, we had approximately 24,400

full-time equivalent employees (“FTEs”) across all of our operating

groups, including our shared services organization and corporate

office, representing an increase of approximately 1,900 from the

level at December 31, 2006. The increase is primarily due to an

increase in our shared services staffing, partially offset by reduc-

tions associated with operational efficiencies. Total remuneration

paid to employees (both full and part-time) in 2007 was approxi-

mately $1,579 million, an increase of approximately $117 million

from $1,462 million in 2006.

200 8 FINANC IAL AND OPER ATING GUIDANCE

The following table outlines our financial and operational guid-

ance for the full year 2008, which was publicly issued on January 7,

2008. Certain of the measures included below are not defined under

Canadian GAAP. See the sections entitled “Key Performance Indica-

tors and non-GAAP Measures” and “Supplementary Information:

Non-GAAP Calculations” for further details. This information is

forward-looking and should be read in conjunction with the section

above entitled “Caution Regarding Forward-Looking Statements,

Risks and Assumptions”.