Rogers 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 21

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

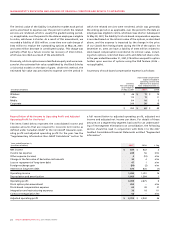

Canadian or U.S. GAAP and should not be considered as alterna-

tives to net income or any other measure of performance under

Canadian or U.S. GAAP. The non-GAAP measures presented in

this MD&A include, among other measures, adjusted operating

profit, adjusted operating profit margin, adjusted net income,

and adjusted basic and diluted net income per share. We believe

that the non-GAAP financial measures provided, which exclude:

(i) the impact of the one-time non-cash charge resulting from the

introduction of a cash settlement feature related to employee

stock options; (ii) stock-based compensation expense; (iii) inte-

gration and restructuring expenses; (iv) the impact of a one-time

charge resulting from the renegotiation of an Internet-related

services agreement; and (v) in respect of net income and net

income per share, loss on repayment of long-term debt and the

related income tax impacts of the above items, provide for a more

effective analysis of our operating performance. See the sections

entitled “Key Performance Indicators and Non-GAAP Measures”

and “Supplementary Information: Non-GAAP Calculations” for

further details.

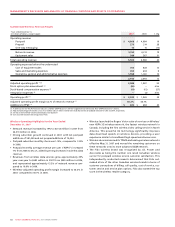

Operating Highlights and Significant Developments in 2007

• WecompletedtheamalgamationofRCIwithitswhollyowned

Cable and Wireless holding company subsidiaries, with RCI

assuming all the rights and obligations under the outstanding

Cable and Wireless public debt indentures and cross-currency

interest rate exchange agreements. As part of the amalgamation

process, RCI entered into a new unsecured $2.4 billion bank credit

facility. This amalgamation was effected principally to simplify

our corporate structure to enable the streamlining of reporting

and compliance obligations.

• We achievedinvestmentgradecreditstatusasaresultofthe

upgrade of our corporate debt ratings by credit rating agencies

Fitch, Moody’s and Standard & Poor’s.

• We introduced a cash settlement feature for outstanding

employee stock options to tax efficiently deploy cash to mitigate

dilution that would otherwise occur upon the exercise of such

options. The introduction of this cash settlement feature in

the second quarter resulted in a one-time non-cash charge for

accounting purposes of $452 million partially offset by a related

future income tax benefit of $160 million.

• We redeemed Wireless’ US$550 million principal amount of

Floating Rate Senior Notes due 2010 at the stipulated redemption

price of 102.00% and its US$155 million principal amount of 9.75%

Senior Debentures due 2016 at a redemption price of 128.42%.

• WerepaidatmaturityCable’s$450millionaggregateprincipal

amount of 7.60% Senior Secured Notes.

• Weannouncedanincreaseintheannualdividendfrom$0.16to

$0.50 per Class A Voting and Class B Non-Voting share. In addi-

tion, subsequent to the year-end, we announced an increase in

the annual dividend from $0.50 to $1.00 per Class A Voting and

Class B Non-Voting share. This reflects our Board of Directors’

continued confidence in the strategies that we have employed

to position ourself as a growing and increasingly profitable

communications company, while concurrently recognizing the

importance of returning meaningful portions of the growing

cash flows being generated by the business to shareholders.

• WeannouncedaNormalCourseIssuerBid(“NCIB”)torepurchase

up to the lesser of 15 million of our Class B Non-Voting shares and

that number of Class B Non-Voting shares that can be purchased

under the NCIB for an aggregate purchase price of $300 million.

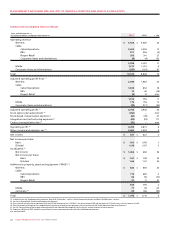

Year Ended December 31, 2007 Compared to Year Ended

December 31, 2006

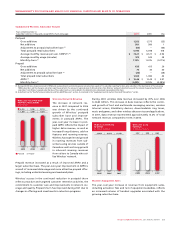

For the year ended December 31, 2007, Wireless, Cable and Media

represented 54%, 35% and 13% of our consolidated revenue,

respectively, offset by corporate items and eliminations of 2%.

Wireless, Cable and Media also represented 70%, 27% and 5% of

our consolidated adjusted operating profit, respectively, offset by

corporate items and eliminations of 2%. For more detailed discus-

sions of Wireless, Cable and Media, refer to the respective segment

discussions below.