Rogers 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 93

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

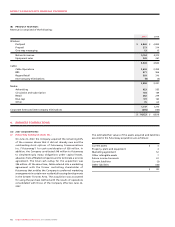

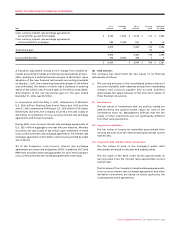

In assessing the realizability of future income tax assets,

management considers whether it is more likely than not that

some portion or all of the future income tax assets will be realized.

The ultimate realization of future income tax assets is dependent

upon the generation of future taxable income during the years

in which the temporary differences are deductible. Management

considers the scheduled reversals of future income tax liabilities,

the character of the future income tax assets and available tax

planning strategies in making this assessment.

To the extent that management believes that the realization of

future income tax assets does not meet the more likely than not

realization criterion, a valuation allowance is recorded against the

future income tax assets.

In making an assessment of whether future income tax assets are

more likely than not to be realized, management regularly prepares

information regarding the expected use of such assets by reference

to its internal income forecasts. Based on management’s estimates

of the expected realization of future income tax assets, during 2006

the Company reduced the valuation allowance to reflect that it

is more likely than not that certain future income tax assets will

be realized. Approximately $300 million of the reduction in the

valuation allowance related to future income tax assets arising

from acquisitions. Accordingly in 2006, the benefit related to these

future income tax assets was reflected as a reduction of goodwill

in the amount of $209 million and other intangible assets in the

amount of $91 million.

The valuation allowance at December 31, 2007, includes $65 million of

foreign future income tax assets, $16 million relating to capital loss

carryforwards and $38 million relating to unrealized capital losses

on U.S. dollar denominated debt and certain investments.

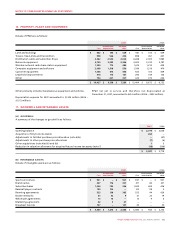

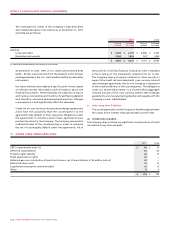

In 20 00, the Company received a $241 million payment

(the “Termination Payment”) from Le Group Vidéotron Ltée

(“Vidéotron”) in respect of the termination of a merger agreement

between the Company and Vidéotron. In 2006, the Company received

a Notice of Reassessment from the Canada Revenue Agency (“CRA”)

in respect of the Termination Payment. The Company challenged

the Notice of Reassessment and, in 2006, recorded a future income

tax charge of $25 million based on the expected resolution of this

issue. During the year ended December 31, 2007, the Company was

advised by the CRA that its challenge was successful and, as a result,

a future income tax recovery of $25 million was recorded to reverse

the charge recorded in 2006.

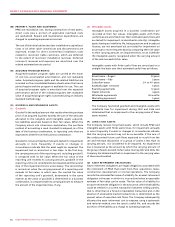

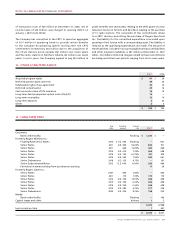

Income tax expense varies from the amounts that would be

computed by applying the statutory income tax rate to income

before income taxes for the following reasons:

2007 2006

Statutory income tax rate 35.2% 35.8%

Computed income tax expense $ 312 $ 243

Increase (decrease) in income taxes resulting from:

Difference between rates applicable to subsidiaries in other jurisdictions (12) (12)

Change in the valuation allowance for future income tax assets (20) (168)

Vidéotron termination payment (25) 25

Adjustments to future income tax assets and liabilities for changes in substantively enacted rates 47 (14)

Stock-based compensation (17) 15

Benefits relating to changes to prior year tax filing positions and other items (36) (33)

Income tax expense $ 249 $ 56

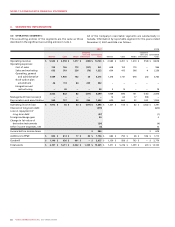

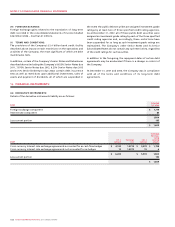

As at December 31, 2007, the Company has the following

non-capital income tax losses available to reduce future years’

income for income tax purposes:

Income tax losses expiring in the year ending December 31:

2008 $ 184

2009 85

2010 79

2011 –

2012 –

Thereafter 1,653

$ 2,001

As at December 31, 2007, the Company had approximately

$122 million in non-capital income tax losses available in foreign

subsidiaries expiring between 2021 and 2027.

As at December 31, 2007, the Company had approximately

$113 million in capital losses available.