Rogers 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 23

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

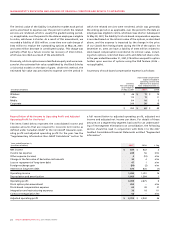

Our consolidated revenue was $10,123 million in 2007, an increase of

$1,285 million, or 15%, from $8,838 million in 2006. Of the increase,

Wireless contributed $923 million, Cable $357 million, and Media

$107 million, offset by an increase in corporate items and elimina-

tions of $102 million.

Our consolidated adjusted operating profit was $3,703 million, an

increase of $761 million, or 26%, from $2,942 million in 2006. Of

this increase, Wireless contributed $602 million, Cable contributed

$100 million, and Media contributed $20 million. On a consolidated

basis, we recorded net income of $637 million for the year ended

December 31, 2007, compared to net income of $622 million in 2006.

Refer to the respective individual segment discussions for details of

the revenue, operating expenses, operating profit and additions to

PP&E of Wireless, Cable and Media.

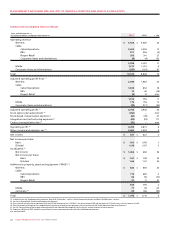

2007 Performance Against Targets

The following table sets forth the guidance ranges for selected full

year financial and operating metrics that we provided for 2007, as

revised during the year, versus the actual results we achieved for the

year. Certain of the measures included below are not defined under

Canadian GAAP. See the sections entitled “Key Performance Indica-

tors and non-GAAP Measures” and “Supplementary Information:

Non-GAAP Calculations” for further details.

Our actual 2007 revenue and adjusted operating profit compared

favourably to our annual 2007 guidance, largely reflecting strong

performances across each of our three segments, including strong

average revenue per user (“ARPU”) growth in Wireless, higher than

expected net additions to our Wireless subscriber base and strong

additions to Cable’s RGUs. PP&E additions exceeded our guidance

partially in order to support the higher than expected level of sub-

scriber growth as well as investments in future growth initiatives.

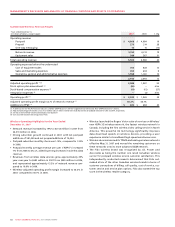

Stock-based Compensation Expense

On May 28, 2007, our employee stock option plans were amended

to attach cash settled share appreciation rights (“SARs”) to all new

and previously granted options. The SAR feature allows the option

holder to elect to receive in cash an amount equal to the intrinsic

value, being the excess market price of the Class B Non-Voting

share over the exercise price of the option, instead of exercising

the option and acquiring Class B Non-Voting shares. All outstand-

ing stock options are now classified as liabilities and are carried at

their intrinsic value, as adjusted for vesting, measured as the differ-

ence between the current stock price and the option exercise price.

Original 2007 Guidance Updated from Original 2007

(Millions of dollars, except subscribers) (At February 15, 2007) Guidance (At July 31, 2007) Actual

Consolidated

Revenue $ 9,700 to $ 10,000 $ 9,700 to $ 10,100 $ 10,123

Adjusted operating profit (1) 3,250 to 3,400 3,250 to 3,585 3,703

PP&E expenditures 1,625 to 1,750 1,625 to 1,750 1,796

Free cash flow (2) 800 to 1,000 800 to 1,150 1,290

Revenue

Wireless (network revenue) $ 4,900 to $ 5,000 $ 4,900 to $ 5,150 $ 5,154

Cable (3) 3,515 to 3,600 3,515 to 3,600 3,558

Media 1,275 to 1,325 1,275 to 1,325 1,317

Adjusted operating profit (1)

Wireless (4) $ 2,250 to $ 2,350 $ 2,250 to $ 2,535 $ 2,620

Cable 935 to 975 935 to 975 1,016

Media 150 to 160 150 to 160 176

Additions to PP&E

Wireless (4) $ 675 to $ 725 $ 675 to $ 725 $ 807

Cable (5) 815 to 880 815 to 880 803

Media 85 to 95 85 to 95 77

Net subscriber additions (000s)

Retail wireless postpaid and prepaid (6) 500 to 600 500 to 600 651

Residential cable revenue generating units (RGUs) (7) 625 to 725 625 to 725 655

(1) Excludes the impact of the introduction of a cash settlement feature for employee stock options, including the one-time non-cash charge upon adoption of $452 million recorded in the second quarter

of 2007 and the ongoing impact of stock-based compensation expense. Also excludes integration and restructuring related expenditures and the impact of a one-time charge resulting from the

renegotiation of an Internet-related services agreement.

(2) Free cash flow is defined as adjusted operating profit less integration and restructuring expenses, PP&E expenditures and interest expense and is not a term defined under Canadian GAAP.

(3) Original 2007 Cable revenue guidance was revised to reflect the reclassification from revenue to cost of sales of approximately $100 million of intercompany wireless equipment subsidies received by

Rogers Retail. This reclassification had no impact on reported consolidated revenue, consolidated operating profit or Cable operating profit.

(4) Excludes operating losses and PP&E expenditures related to the Inukshuk fixed wireless initiative of $31 million and $15 million, in 2007, respectively.

(5) Excludes PP&E expenditures related to the acquisition of Call-Net of $11 million in 2007.

(6) Wireless subscriber net additions exclude adjustments associated with the Time Division Multiple Access (“TDMA”) and analog network decommissioning and the revision of certain aspects of subscriber

reporting for data-only subscribers.

(7) Residential cable RGUs are comprised of basic cable subscribers, digital cable households, residential high-speed Internet subscribers and residential cable and circuit-switched telephony subscribers.