Rogers 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 33

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

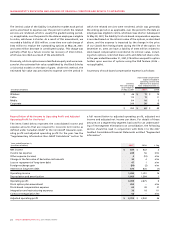

Additions to Wireless PP&E reflect spending on GSM network capac-

ity, such as channel additions and network enhancing features.

HSPA additions to PP&E were mainly for the continued roll-out to

the top 25 markets across Canada and the commencement of the

upgrade to faster network throughput speeds. Other network

related additions accounted for the primary increase in expenditures

from the prior year. These included national site build activities,

additional spending on test and monitoring equipment, sectoriza-

tion, operating support system activities and new product platforms

and services. Other additions to PP&E reflect information technol-

ogy initiatives, such as billing and back office system upgrades and

other facilities and equipment spending. The decrease in expen-

ditures relating to the Inukshuk wireless broadband initiative is a

result of a majority of the costs being incurred in 2006 for the initial

deployment of infrastructure in the largest Canadian markets.

The additions to PP&E for 2006 reflect spending on Wireless’ UMTS/

HSPA deployment as well as GSM/GPRS network capacity and

quality enhancements. Other additions include technical upgrade

projects, including new cell sites, operational support systems and

the addition of new services.

CABLE

CABLE’S BUSINESS

Cable is one of Canada’s largest providers of cable television, cable

telephony and high-speed Internet access, and is also a facilities-

based telecommunications alternative to the traditional telephone

companies. Its business consists of the following three segments:

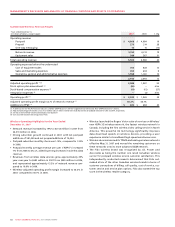

The Cable Operations segment has 2.3 million basic cable subscrib-

ers at December 31, 2007, representing approximately 30% of basic

cable subscribers in Canada. At December 31, 2007, it provided

digital cable services to approximately 1.4 million households and

high-speed Internet service to approximately 1.5 million residential

subscribers. Through Rogers Home Phone, it offers local telephone

and long-distance services to residential customers with both

voice-over-cable and circuit-switched technologies and had almost

1.0 million subscriber lines at December 31, 2007.

The RBS segment offers local and long-distance telephone,

enhanced voice and data services, and IP access to Canadian busi-

nesses and governments, as well as making some of these offerings

available on a wholesale basis to other telecommunications provid-

ers. At December 31, 2007, there were 237,000 local line equivalents

and 35,000 broadband data circuits. Cable is increasingly focusing

its business segment sales efforts on the smaller business portion of

the market within its traditional cable television footprint, where it

is able to provision and serve customers with voice and data tele-

phony services provisioned over its own infrastructure.

The Rogers Retail segment operates a retail distribution chain that

offers Rogers branded home entertainment and wireless products

and services. There were 465 stores at December 31, 2007, including

approximately 170 stores acquired in January 2007 from Wireless,

many of which provide customers with the ability to purchase any

of Rogers’ primary services (cable television, Internet, cable tele-

phony and wireless), to pay their Rogers bills, and to pick up or

return Rogers digital and Internet equipment. It also offers digital

video disc (“DVD”) and video game sales and rentals through

Canada’s second largest chain of video rental stores.

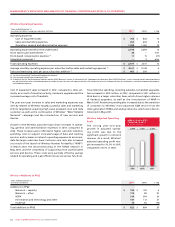

Beginning in 2007, the Cable and Internet and Rogers Home Phone

segments were combined into one segment, known as Cable

Operations, to better align with revised management and internal

reporting structures. Comparative figures have been reclassified to

reflect this new segmented reporting.

Cable’s Products and Services

Cable has highly-clustered and technologically advanced broad-

band networks in Ontario, New Brunswick and Newfoundland and

Labrador. Its Ontario cable systems, which comprise approximately

90% of its 2.3 million basic cable subscribers, are concentrated in

and around three principal clusters: (i) the Greater Toronto Area,

Canada’s largest metropolitan centre; (ii) Ottawa, the national

capital city of Canada, and (iii) the Guelph to London corridor in

southwestern Ontario. The New Brunswick and Newfoundland and

Labrador cable systems in Atlantic Canada comprise the balance of

its cable systems and subscribers.

Through its technologically advanced broadband networks, Cable

offers a diverse range of services, including analog and digital cable,

residential Internet services and voice-over-cable telephony services.

As at December 31, 2007, more than 86% of Cable’s overall network

and 99% of its network in Ontario has been upgraded to transmit

860 MHz of bandwidth. With approximately 99% of Cable’s net-

work offering digital cable services, it has a richly featured and

highly-competitive video offering, which includes high-definition

television (“HDTV”), video-on-demand (“VOD”), subscription

video-on-demand (“SVOD”), personal video recorders (“PVR”),

time-shifted programming, pay-per-view (“PPV”) movies and

events, as well as a significant line-up of digital specialty, multicul-

tural and sports programming.

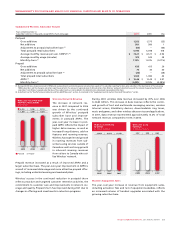

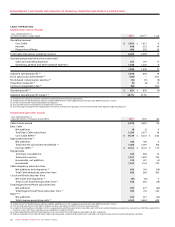

2007 WIRELESS ADDITIONS TO PP&E

(%)

HSPA 38%

Inukshuk 2%

Other 18%

Network 42%

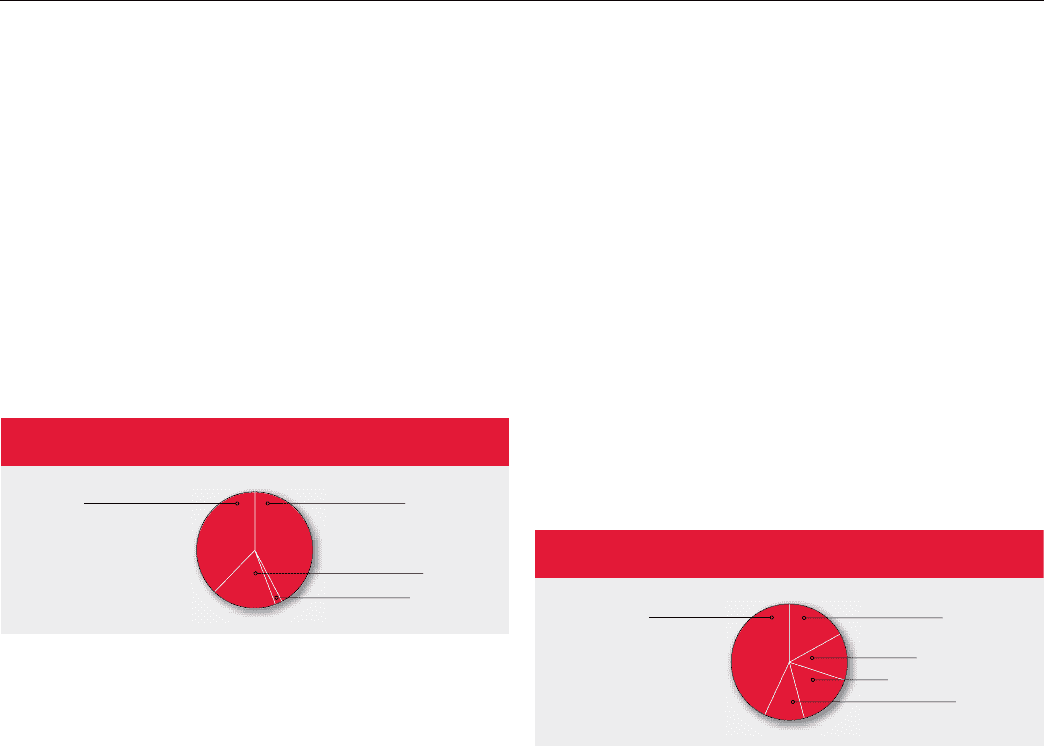

2007 CABLE REVENUE MIX

(%)

Core Cable 43% Internet 17%

Home Phone 13%

Retail 11%

Business Solutions 16%