Rogers 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 87

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

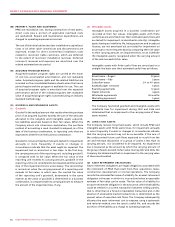

(ii) Capital disclosures:

In 2006, the CICA issued Handbook Section 1535, Capital

Disclosures (“CICA 1535”). CICA 1535 requires that an entity

disclose information that enables users of its financial statements

to evaluate an entity’s objectives, policies and processes for

managing capital, including disclosures of any externally

imposed capital requirements and the consequences for non-

compliance. Disclosures required by the new standard will be

included in the Company’s interim and annual consolidated

financial statements commencing January 1, 2008.

(iii) Goodwill and intangible assets:

In 2008, the CICA issued Handbook Section 3064, Goodwill and

Intangible Assets (“CICA 3064”). CICA 3064, which replaces

Section 3062, Goodwill and Intangible Assets, and Section

3450, Research and Development Costs, establishes standards

for the recognition, measurement and disclosure of goodwill

and intangible assets. The provisions relating to the definition

and initial recognition of intangible assets, including

internally generated intangible assets, are equivalent to the

corresponding provisions of IFRS IAS 38, Intangible Assets.

This new standard is effective for the Company’s interim

and annual consolidated financial statements commencing

January 1, 2009. The Company is assessing the impact of the

new standard on its consolidated financial statements.

(R) USE OF ESTIMATES:

The preparation of financial statements requires management to

make estimates and assumptions that affect the reported amounts

of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the reported

amounts of revenue and expenses during the year. Actual results

could differ from those estimates.

Key areas of estimation, where management has made difficult,

complex or subjective judgments, often as a result of matters

that are inherently uncertain, include the allowance for doubtful

accounts and certain accrued liabilities, the ability to use income

tax loss carryforwards and other future income tax assets and

liabilities, capitalization of internal labour and overhead, useful

lives of depreciable assets and intangible assets with finite

useful lives, discount rates and expected returns on plan assets

affecting pension expense and the deferred pension asset and

the recoverability of long-lived assets, goodwill and intangible

assets, which require estimates of future cash flows. For business

combinations, key areas of estimation and judgment include the

allocation of the purchase price and related integration and

severance costs.

Significant changes in the assumptions, including those with

respect to future business plans and cash flows, could materially

change the recorded carrying amounts.

(S) RECENT CANADIAN ACCOUNTING PRONOUNCEMENTS:

(i) Financial instruments:

In 2006, the CICA issued Handbook Section 3862, Financial

Instruments – Disclosures, and Handbook Section 3863,

Financial Instruments – Presentation. These standards enhance

existing disclosure requirements and place greater emphasis

on disclosures related to recognized and unrecognized

financial instruments and how those risks are managed.

Disclosures required by these standards will be included in

the Company’s interim and annual consolidated financial

statements commencing January 1, 2008.