Rogers 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

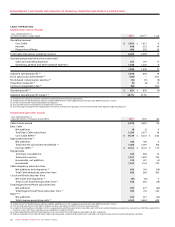

Media Operating Revenue

The increase in Media revenue in 2007 compared to 2006 reflects

growth across all of Media’s divisions. Rogers Publishing revenue in

2007 was positively impacted by increased advertising and circula-

tion revenue, which was partially offset by a decrease in revenue

related to the closure of certain publications. Rogers Radio revenue

increased due to a combination of organic growth and the acquisi-

tion of five radio stations in Alberta in January 2007. The growth

in Rogers Sports Entertainment

revenue was primarily due to

increases in admissions, corpo-

rate sponsorships and broadcast

revenue. Rogers Sportsnet rev-

enue increased over the prior

year due to higher advertising

revenue and subscriber fees.

Rogers television operations

generated strong increases in

national advertising for the year,

and the acquisition of Citytv,

which closed on October 31,

2007, contributed $28 million

to the increase in revenue. The

Shopping Chann el revenue

remained fairly consistent with

the prior year.

Media Operating Expenses

The increase in Media operating expenses, excluding the impact of

the one-time non-cash charge resulting from the introduction of

a cash settlement feature for employee stock options and stock-

based compensation expense in 2007 compared to 2006, is primarily

due to operating costs of Citytv and the five Alberta radio stations,

higher Blue Jays payroll costs at Rogers Sports Entertainment, and

higher production costs at Rogers Sportsnet resulting from addi-

tional NFL and NHL broadcasts. These increases were partially

offset by lower general and administrative costs and by the elimina-

tion of CRTC Part II fees. For further details, see the section entitled

“Government Regulation and Regulatory Developments”.

Media Adjusted Operating

Profit

The growth in Media’s adjusted

operating profit compared to

2006 reflects growth across most

of Media’s divisions, as well as

the impact of the elimination of

CRTC Part II fees, partially offset

by a decrease in adjusted oper-

ating profit at Rogers Sports

Entertainment. Excluding Rogers

Sports Entertainment, Media’s

adjusted operating profit mar-

gins would have been 16.9%

and 16.7% for the years ended

December 31, 2007 and 2006,

respectively.

Media Additions to PP&E

Additions to PP&E in 2007 primarily reflect building improvements

related to the relocation of Rogers Sportsnet and building improve-

ments to the Rogers Centre. In 2006, PP&E additions mainly related

to enhancements and renovations at the Rogers Centre.

3. CONSOLIDATED LIQUIDITY AND FINANCING

LIQUIDIT Y AND C APITAL RESOURCES

Operations

For 2007, cash generated from operations before changes in non-cash

operating working capital items, which is calculated by eliminat-

ing the effect of all non-cash items from net income, increased

to $3,135 million from $2,386 million in 2006. The $749 million

increase is primarily the result of a $761 million increase in adjusted

operating profit.

Taking into account the changes in non-cash operating working

capital items for the year ended December 31, 2007, cash generated

from operations was $2,825 million, compared to $2,449 million

in 2006.

The cash flow generated from operations of $2,825 million, together

with the following items, resulted in total net funds of approxi-

mately $3,932 million raised in the year ended December 31, 2007:

• receiptof$1,080millionaggregatenetadvancesborrowedunder

our bank credit facilities; and

• receiptof$27millionfromtheissuanceofClassBNon-Voting

shares under the exercise of employee stock options.

Net funds used during 2007 totalled approximately $3,974 million,

the details of which include:

• additions to PP&E of $1,816 million, including $20 million of

related changes in non-cash working capital;

• therepaymentatmaturityinFebruaryofCable’s$450million

Senior Notes due 2007;

• theredemptioninMayofWireless’US$550millionFloatingRate

Notes due 2010 ($609 million aggregate principal amount and

$12 million premium);

• theredemptioninJuneofWireless’US$155million9.75%Senior

Debentures due 2016 ($166 million aggregate principal amount

and $47 million premium);

• theaggregatenetpaymentof$35millionincurredonthesettle-

ment of two cross-currency interest rate exchange agreements

and forward contracts in conjunction with the redemption of

Wireless’ US$550 million Floating Rate Senior Notes due 2010 in

May 2007 and the redemption of Wireless’ US$155 million 9.75%

Senior Debentures due 2016 in June 2007;

• thepaymentofquarterlydividendsaggregating$211millionon

our Class A Voting and Class B Non-Voting shares;

• acquisitionsandothernetinvestmentsaggregating$555million,

including the October 2007 acquisition of five Citytv television

stations for $405 million including acquisition costs, the June 2007

acquisition of Futureway Communications Inc. for $86 million and

the January 2007 acquisition of five Alberta radio stations for

$43 million;

20072006

$1,317$1,210$1,097

MEDIA

REVENUE

(In millions of dollars)

2006

2007

2005

20072006

$176$156$131

MEDIA ADJUSTED

OPERATING PROFIT

(In millions of dollars)

200

6

2007

2005