Pitney Bowes 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

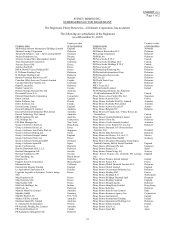

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

78

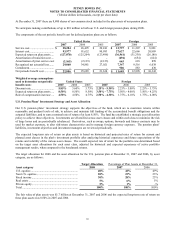

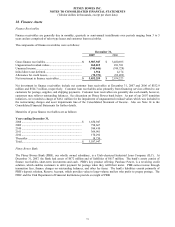

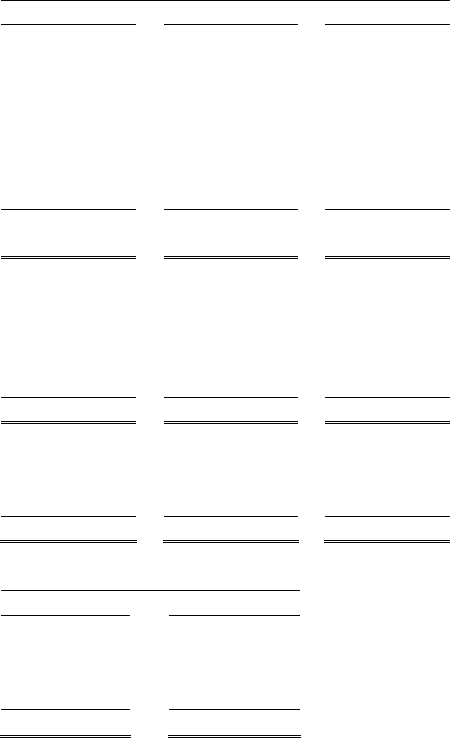

Reconciliation of Segment Amounts to Consolidated Totals:

Years ended December 31,

2007 2006 2005

EBIT:

Total EBIT for reportable segments ................................ $ 1,396,641 $ 1,368,162 $ 1,262,604

Unallocated amounts:

Interest, net .................................................................... (241,871) (212,596) (187,876)

Corporate expense ......................................................... (210,544) (208,099) (199,410)

Restructuring charges and asset impairments ................ (264,013) (35,999) (53,650)

Other items ................................................................... (2,576) 3,022 (10,000)

MapInfo Purchase Accounting ...................................... (16,926) - -

Income from continuing operations

before income taxes and minority interest ..................... $ 660,711

$ 914,490 $ 811,668

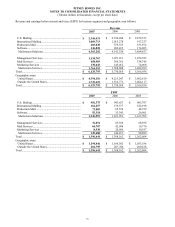

Depreciation and amortization:

Total depreciation and amortization for reportable

segments ....................................................................... $ 368,431

$ 336,064 $ 309,032

Corporate depreciation.................................................... 14,710

15,216 14,821

Discontinued operations ................................................. -

11,978 8,110

Consolidated depreciation and amortization................... $ 383,141

$ 363,258 $ 331,963

Capital expenditures:

Total additions for reportable segments.......................... $ 242,133

$ 306,832 $ 283,843

Unallocated amounts ...................................................... 22,523

21,045 7,707

Consolidated capital expenditures ................................... $ 264,656

$ 327,877 $ 291,550

December 31,

2007 2006

Total assets:

Total identifiable assets by reportable segments ............ $ 8,778,474 $ 7,928,437

Cash and cash equivalents and short-term investments.. 440,455 301,614

General corporate assets ................................................. 331,014 378,893

Consolidated assets........................................................... $ 9,549,943 $ 8,608,944

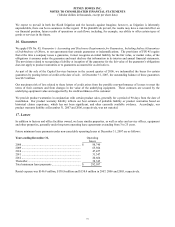

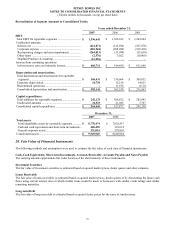

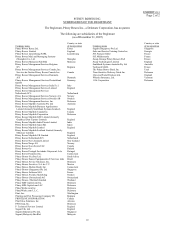

20. Fair Value of Financial Instruments

The following methods and assumptions were used to estimate the fair value of each class of financial instruments:

Cash, Cash Equivalents, Short-term Investments, Accounts Receivable, Accounts Payable and Notes Payable

The carrying amounts approximate fair value because of the short maturity of these instruments.

Investment Securities

The fair value of investment securities is estimated based on quoted market prices, dealer quotes and other estimates.

Loans Receivable

The fair value of loans receivable is estimated based on quoted market prices, dealer quotes or by discounting the future cash

flows using current interest rates at which similar loans would be made to borrowers with similar credit ratings and similar

remaining maturities.

Long-term Debt

The fair value of long-term debt is estimated based on quoted dealer prices for the same or similar issues.