Pitney Bowes 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

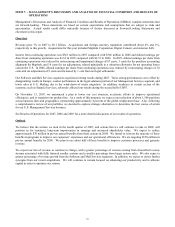

In connection with our 2003 restructuring program, we recorded pre-tax restructuring charges of $36 million and $54 million

for the years ended December 31, 2006 and 2005, respectively. The 2005 charge is net of a $30 million gain on the sale of

our main plant manufacturing facility. The activities associated with this program were substantially completed in 2006. We

made restructuring payments of $29 million, $51 million and $48 million (net of the $30 million gain) during 2007, 2006,

and 2005, respectively. The remaining restructuring liability associated with this program at December 31, 2007 is $5

million. See Note 1 to the Consolidated Financial Statements for our accounting policy related to restructuring charges and

asset impairments.

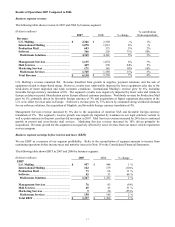

Acquisitions

On September 12, 2007, we acquired Asterion SAS for $28 million in cash, net of cash acquired. Asterion is a leading

provider of outsourced transactional print and document process services in France. We assigned the goodwill to the

Management Services segment.

On May 31, 2007, we acquired the remaining shares of Digital Cement, Inc. for a total purchase price of $49 million in cash,

net of cash acquired. Digital Cement, Inc. provides marketing management strategy and services to help companies acquire,

retain, manage, and grow their customer relationships. We assigned the goodwill to the Marketing Services segment.

On April 19, 2007, we acquired MapInfo Corporation for $446 million in cash, net of cash acquired. Included in the assets

and liabilities acquired were short-term investments of $46 million and debt assumed of $14 million. MapInfo is a global

company and a leading provider of location intelligence software and solutions. We assigned the goodwill to the Software

segment. As part of the purchase accounting for MapInfo, we aligned MapInfo’ s accounting policies with ours.

Accordingly, certain software revenue that was previously recognized by MapInfo on a periodic basis is now being

recognized over the life of the contract.

On July 31, 2006, we acquired Print, Inc. for approximately $46 million in cash, net of cash acquired. Print, Inc. provides

printer supplies, service and equipment under long-term managed services contracts. The goodwill was assigned to the U.S.

Mailing segment.

On June 15, 2006, we acquired substantially all the assets of Advertising Audit Service and PMH Caramanning (collectively

AAS) for approximately $42 million in cash. AAS offers a variety of web-based tools for the customization of promotional

mail and marketing collateral and designs and manages customer and channel performance solutions. The goodwill was

assigned to the Marketing Services segment.

On April 24, 2006, we acquired Ibis Consulting, Inc. (Ibis) for approximately $65 million in cash, net of cash acquired. Ibis

is a leading provider of electronic discovery (eDiscovery) services to law firms and corporate clients. Ibis’ technology and

offerings complement those of Compulit, which we acquired in 2005, and expands our range of solutions and services for the

complex litigation support needs of law firms and corporate legal departments. The goodwill was assigned to the

Management Services segment.

On February 8, 2006, we acquired Emtex Ltd. (Emtex) for approximately $33 million in cash, net of cash acquired. Emtex is

a software and services company that allows large-volume mailers to simplify document production and centrally manage

complex multi-vendor and multi-site print operations. The goodwill was assigned to the Software segment.

We accounted for these acquisitions using the purchase method of accounting and accordingly, the operating results of these

acquisitions have been included in our consolidated financial statements since the date of acquisition. As a result of the

purchase accounting alignment, the acquisition of MapInfo reduced our diluted earnings per share by 5 cents in 2007.

Acquisitions made in 2006 did not materially impact income from continuing operations for that year.

During 2007 and 2006, we also completed several smaller acquisitions for an aggregate cost of $87 million and $43 million,

respectively. These acquisitions did not have a material impact on our financial results either individually or on an aggregate

basis. See Note 3 to the Consolidated Financial Statements for further details.

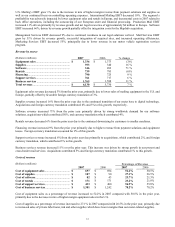

Liquidity and Capital Resources

We believe that cash flow generated by operations, existing cash and liquid investments, as well as borrowing capacity under

our commercial paper program, the existing credit facility and debt capital markets should be sufficient to finance our capital

requirements and to cover our customer deposits for the foreseeable future. Our potential uses of cash include but are not

limited to the following: growth and expansion opportunities; internal investments; customer financing; tax payments;

interest and dividend payments; share repurchase program; and potential acquisitions and divestitures.