Pitney Bowes 2007 Annual Report Download - page 69

Download and view the complete annual report

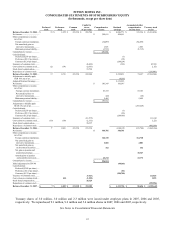

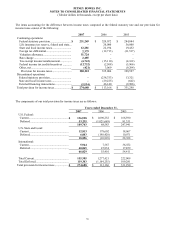

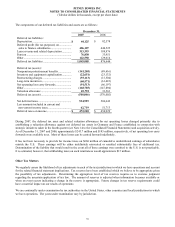

Please find page 69 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

51

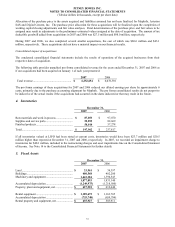

Net income in 2007 includes a gain of $11.3 million from the conclusion of certain tax issues net of the accrual of interest

expense of $5.8 million on uncertain tax positions.

Interest expense included in discontinued operations was $19.2 million and $11.5 million for the years ended December 31,

2006 and 2005, respectively. Interest expense recorded in discontinued operations consisted of interest on third-party debt

that was assumed by Cerberus. We have not allocated other consolidated interest expense to discontinued operations.

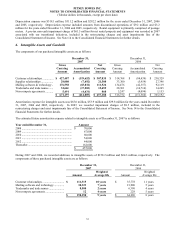

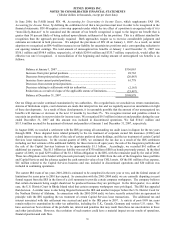

3. Acquisitions

On September 12, 2007, we acquired Asterion SAS for $28 million in cash, net of cash acquired. Asterion is a leading

provider of outsourced transactional print and document process services in France. We assigned the goodwill to the

Management Services segment.

On May 31, 2007, we acquired the remaining shares of Digital Cement, Inc. for a total purchase price of $49 million in cash,

net of cash acquired. Digital Cement, Inc. provides marketing management strategy and services to help companies acquire,

retain, manage, and grow their customer relationships. We assigned the goodwill to the Marketing Services segment.

On April 19, 2007, we acquired MapInfo Corporation for $446 million in cash, net of cash acquired. Included in the assets

and liabilities acquired were short-term investments of $46 million and debt assumed of $14 million. MapInfo is a global

company and a leading provider of location intelligence software and solutions. We assigned the goodwill to the Software

segment. As part of the purchase accounting for MapInfo, we aligned MapInfo’ s accounting policies with ours.

Accordingly, certain software revenue that was previously recognized by MapInfo on a periodic basis is now being

recognized over the life of the contract.

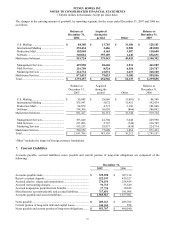

On July 31, 2006, we acquired Print, Inc. for approximately $46 million in cash, net of cash acquired. Print, Inc. provides

printer supplies, service and equipment under long-term managed services contracts. The goodwill was assigned to the U.S.

Mailing segment.

On June 15, 2006, we acquired substantially all the assets of Advertising Audit Service and PMH Caramanning (collectively

AAS) for approximately $42 million in cash. AAS offers a variety of web-based tools for the customization of promotional

mail and marketing collateral and designs and manages customer and channel performance solutions. The goodwill was

assigned to the Marketing Services segment.

On April 24, 2006, we acquired Ibis Consulting, Inc. (Ibis) for approximately $65 million in cash, net of cash acquired. Ibis

is a leading provider of electronic discovery (eDiscovery) services to law firms and corporate clients. Ibis’ technology and

offerings complement those of Compulit, which we acquired in 2005, and expands our range of solutions and services for the

complex litigation support needs of law firms and corporate legal departments. The goodwill was assigned to the

Management Services segment.

On February 8, 2006, we acquired Emtex Ltd. (Emtex) for approximately $33 million in cash, net of cash acquired. Emtex is

a software and services company that allows large-volume mailers to simplify document production and centrally manage

complex multi-vendor and multi-site print operations. The goodwill was assigned to the Software segment.