Pitney Bowes 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

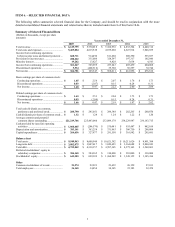

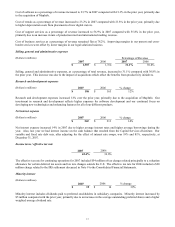

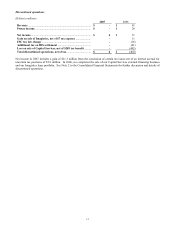

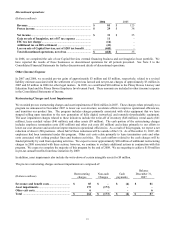

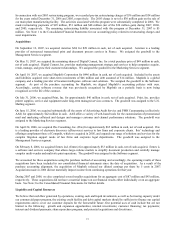

Discontinued operations

(Dollars in millions)

2006 2005

Revenue ....................................................................................... $ 81 $ 125

Pretax income.............................................................................. $ 29 $ 38

Net income................................................................................... $ 31 $ 35

Gain on sale of Imagistics, net of $7 tax expense ..................... 11 -

FSC tax law change .................................................................... (16) -

Additional tax on IRS settlement .............................................. (41) -

Loss on sale of Capital Services, net of $285 tax benefit ......... (445) -

Total discontinued operations, net of tax.................................. $ (460) $ 35

In 2006, we completed the sale of our Capital Services external financing business and our Imagistics lease portfolio. We

have reported the results of these businesses as discontinued operations for all periods presented. See Note 2 to the

Consolidated Financial Statements for further discussion and details of discontinued operations.

Other (Income) Expense

In 2007 and 2006, we recorded pre-tax gains of approximately $3 million and $5 million, respectively, related to a revised

liability estimate associated with the settlement of a previous lawsuit and net pre-tax charges of approximately $3 million in

2007 and $2 million in 2006 for other legal matters. In 2005, we contributed $10 million to the Pitney Bowes Literacy and

Education Fund and the Pitney Bowes Employee Involvement Fund. These amounts are included in other (income) expense

in the Consolidated Statements of Income.

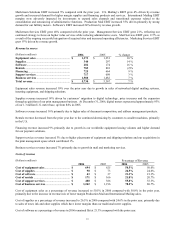

Restructuring Charges and Asset Impairments

We recorded pre-tax restructuring charges and asset impairments of $264 million in 2007. These charges relate primarily to a

program we announced in November 2007 to lower our cost structure, accelerate efforts to improve operational efficiencies,

and transition our product line. The program includes charges primarily associated with older equipment that we have

stopped selling upon transition to the new generation of fully digital, networked, and remotely-downloadable equipment.

The asset impairment charges related to these initiatives include the write-off of inventory ($48 million), rental assets ($61

million), lease residual values ($46 million), and other assets ($9 million). The cash portion of the restructuring charges

includes employee termination costs ($85 million) and other exit costs ($6 million) and relates primarily to our efforts to

lower our cost structure and accelerate improvements in operational efficiencies. As a result of this program, we expect a net

reduction of about 1,500 positions. About half of these reductions will be outside of the U.S. As of December 31, 2007, 401

employees had been terminated under this program. Other exit costs relate primarily to lease termination costs and other

costs associated with exiting product lines and business activities. The cash outflows related to the cash charges will be

funded primarily by cash from operating activities. We expect to incur approximately $20 million of additional restructuring

charges in 2008 associated with these actions, however, we continue to evaluate additional actions in conjunction with this

program. We expect to complete the majority of this program by the end of 2008. We are targeting to achieve $150 million

in pre-tax annual benefits from these initiatives by 2009.

In addition, asset impairments also include the write-down of certain intangible assets for $9 million.

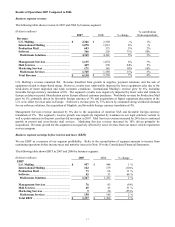

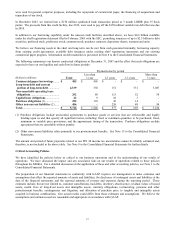

The pre-tax restructuring charges and asset impairments are composed of:

(Dollars in millions)

Restructuring

charges

Non-cash

Charges

Cash

payments

Balance

December 31,

2007

Severance and benefit costs............................. $ 85 $ - $ (4) $ 81

Asset impairments ........................................... 173 (173) - -

Other exit costs................................................. 6 - - 6

Total ................................................................. $ 264 $ (173) $ (4) $ 87