Pitney Bowes 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

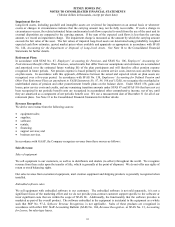

1. Description of Business and Summary of Significant Accounting Policies

Description of Business

We are a provider of leading-edge, global, integrated mail and document management solutions for organizations of all sizes.

We operate in two business groups: Mailstream Solutions and Mailstream Services. We operate both inside and outside the

United States. See Note 19 to the Consolidated Financial Statements for financial information concerning revenue, earnings

before interest and taxes (EBIT) and identifiable assets, by reportable segment and geographic area.

Basis of Presentation and Consolidation

We have prepared the Consolidated Financial Statements of the Company in conformity with accounting principles generally

accepted in the United States of America (GAAP). Operating results of acquired companies are included in the Consolidated

Financial Statements from the date of acquisition. Intercompany transactions and balances have been eliminated in

consolidation.

Use of Estimates

The preparation of the Consolidated Financial Statements in conformity with GAAP requires us to make estimates and

assumptions that affect the amounts of assets, liabilities, revenues and expenses that are reported in the Consolidated

Financial Statements and accompanying disclosures, including the disclosure of contingent assets and liabilities. These

estimates are based on our best knowledge of current events, historical experience, actions that we may undertake in the

future, and on various other assumptions that are believed to be reasonable under the circumstances. As a result, actual

results could differ from those estimates and assumptions.

Cash Equivalents and Short-Term Investments

Cash equivalents include short-term, highly liquid investments with maturities of three months or less at the date of

acquisition. We place our temporary cash and highly liquid short-term investments with a maturity of greater than three

months but less than one year from the reporting date with financial institutions or investment managers and/or invest in

highly rated short-term obligations.

Accounts Receivable and Allowance for Doubtful Accounts

We estimate our accounts receivable risks and provide allowances for doubtful accounts accordingly. We believe that our

credit risk for accounts receivable is limited because of our large number of customers and the relatively small account

balances for most of our customers. Also, our customers are dispersed across different business and geographic areas. We

evaluate the adequacy of the allowance for doubtful accounts on a periodic basis. The evaluation includes historical loss

experience, length of time receivables are past due, adverse situations that may affect a customer’ s ability to repay and

prevailing economic conditions. We make adjustments to our allowance if the evaluation of allowance requirements differs

from the actual aggregate reserve. This evaluation is inherently subjective and estimates may be revised as more information

becomes available.

Allowance for Credit Losses

We estimate our finance receivables risks and provide allowances for credit losses accordingly. Our financial services

businesses establish credit approval limits based on the credit quality of the customer and the type of equipment financed.

We charge finance receivables through the allowance for credit losses after collection efforts are exhausted and we deem the

account uncollectible. Our financial services businesses base credit decisions primarily on a customer’ s financial strength

and we may also consider collateral values. We believe that our concentration of credit risk for finance receivables in our

internal financing division is limited because of our large number of customers, small account balances and customer

geographic and industry diversification.

Our general policy for finance receivables contractually past due for over 120 days is to discontinue revenue recognition. We

resume revenue recognition when payments reduce the account to 60 days or less past due.

We evaluate the adequacy of allowance for credit losses on a periodic basis. Our evaluation includes historical loss

experience, the nature and volume of its portfolios, adverse situations that may affect a customer’ s ability to repay, and

prevailing economic conditions. We make adjustments to our allowance for credit losses if the evaluation of reserve

requirements differs from the actual aggregate reserve. This evaluation is inherently subjective and estimates may be revised

as more information becomes available.