Pitney Bowes 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

65

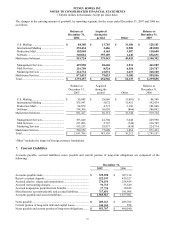

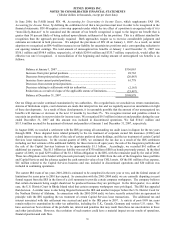

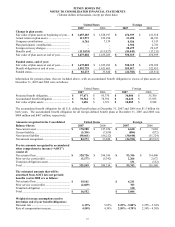

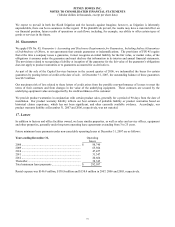

The fair value of stock options granted and related assumptions are as follows:

Years ended December 31,

2007 2006 2005

Expected dividend yield......................................... 2.9%

2.9% 2.8%

Expected stock price volatility (1) ......................... 13.7%

17.6% 18.5%

Risk-free interest rate (2) ....................................... 4.7%

4.6% 3.5%

Expected life – years (3) ........................................ 5

5 5

Weighted-average fair value per option granted.... $6.69

$7.13 $7.29

(1) Our estimates of expected stock price volatility are based on historical price changes of our stock.

(2) The risk-free interest rate is based on U.S. Treasuries with a term equal to the expected option term.

(3) The expected life is based on historical experience.

Restricted Stock and Restricted Stock Units

Our stock plan permits the issuance of restricted stock and restricted stock units. Restricted stock units are stock awards that

are granted to employees and entitle the holder to shares of common stock as the award vests, typically over a four year

service period. The fair value of the awards is determined on the grant date based on our stock price at that date. We issued

334,442 shares and 256,519 shares of restricted stock units in 2007 and 2006, respectively. The weighted average grant price

was $47.91 and $42.63 for 2007 and 2006, respectively. The intrinsic value of the outstanding restricted stock units at

December 31, 2007 was $3.7 million, with a weighted average remaining term of 2.8 years.

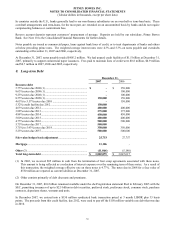

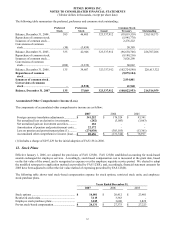

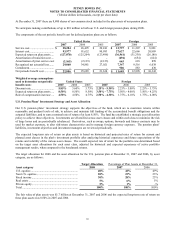

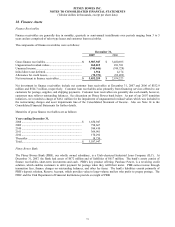

The following table summarizes information about restricted stock unit transactions during 2007:

Shares / Units

Weighted average

grant date fair value

Restricted stock units outstanding at December 31, 2006.......................... 237,020 $42.63

Granted ......................................................................................................... 334,442 $47.91

Vested ........................................................................................................... (64,609) $42.89

Forfeited........................................................................................................ (46,374) $45.98

Restricted stock units outstanding at December 31, 2007......................... 460,479 $46.09

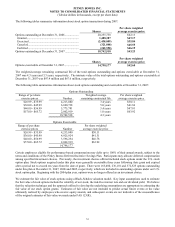

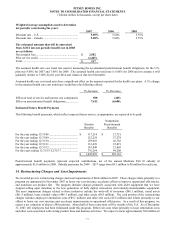

Restricted stock awards are subject to one or more restrictions, which may include continued employment over a specified

period or the attainment of specified financial performance goals. Where a restricted stock award is subject to both tenure

and attainment of financial performance goals, the restrictions would be released, in total or in part, only if the executive is

still employed by us at the end of the performance period and if the performance objectives are achieved. Where the sole

restriction of a restricted stock award is continued employment over a specified period, such period may not be less than

three years. The compensation expense for each award is recognized over the performance period. We issued 8,150 shares

of restricted stock in 2005. We did not issue any shares of restricted stock during 2006 and 2007. We recorded

compensation expense, net of tax, of $0.7 million, $1.3 million and $1.4 million in 2007, 2006 and 2005, respectively.

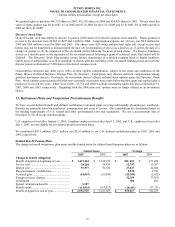

Employee Stock Purchase Plans

The U.S. Employee Stock Purchase Plan enables substantially all U.S. and Canadian employees to purchase shares of our

common stock at a discounted offering price and is considered a compensatory plan in accordance with FAS 123(R). In

2007, the offering price was 85% of the average price of our common stock on the New York Stock Exchange on the offering

date. At no time will the exercise price be less than the lowest price permitted under Section 423 of the Internal Revenue

Code. The U.K. S.A.Y.E. Plan also enables eligible employees of our participating U.K. subsidiaries to purchase shares of

our stock at a discounted offering price which, in 2007, was 90% of the average closing price of our common stock on the

New York Stock Exchange for the three business days preceding the offering date. We may grant rights to purchase up to

6,664,027 common shares to our regular employees under the U.S. and U.K. Plans. Compensation expense relating to the

U.S. Plan is recognized over a twelve month participation period. Compensation expense for the U.K. Plan is recognized

over participation periods of 3 or 5 years.