Pitney Bowes 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

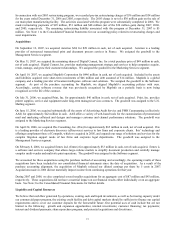

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108, Considering the

Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements (“SAB 108”).

SAB 108 provided guidance on how prior year misstatements should be considered when quantifying misstatements in

current year financial statements for the purposes of determining whether the current year’ s financial statements are

materially misstated. SAB 108 allowed registrants to adjust for the cumulative effect of certain errors relating to prior years

in the carrying amount of assets and liabilities as of the beginning of the current year, with an offsetting adjustment to the

opening balance of retained earnings in the year of adoption provided that management had properly concluded that the

errors were not material to prior periods. SAB 108 was effective for fiscal years ending after November 15, 2006. In 2006,

we determined that the accounting for certain leveraged lease transactions in Canada was misstated due to changes in

assumptions having occurred prior to 2000 which impacted net income from the leases. Such changes in assumptions

required the leveraged lease pricing models to be revised. These misstatements were immaterial to periods prior to 2006,

however correction in that period would have had the effect of reducing our pre-tax income and our tax provision by $48

million and $43 million, respectively, which was considered material to the 2006 financial statements. Accordingly, we

corrected these misstatements by adjusting opening retained earnings in 2006 by $5 million. As part of this adjustment, we

also decreased our investment in leveraged leases by $33 million, increased other non-current liabilities by $15 million and

decreased deferred taxes on income by $43 million.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities,

including an amendment of FASB Statement No. 115, Accounting for Certain Investments in Debt and Equity Securities

(“FAS 159”), which permits entities to choose to measure many financial assets and financial liabilities and certain other

assets and liabilities at fair value on an instrument-by-instrument basis. The fair value election once made is irrevocable.

Unrealized gains and losses on items for which the fair value option has been elected are reported in earnings. FAS 159 is

effective for fiscal years beginning after November 15, 2007. We do not expect to adopt the fair value option allowed by this

standard.

In December 2007, the FASB issued SFAS No. 141 (R), Business Combinations (“FAS 141 (R)”). FAS 141(R) establishes

principles and requirements for how a company (a) recognizes and measures in their financial statements the identifiable

assets acquired, the liabilities assumed, and any noncontrolling interest (previously referred to as minority interest); (b)

recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and (c)

determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects

of a business combination. FAS 141 (R) requires fair value measurements at the date of acquisition, with limited exceptions

specified in the Statement. Some of the major impacts of this new standard include expense recognition for transaction costs

and restructuring costs. FAS 141 (R) is effective for fiscal years beginning on or after December 15, 2008 and will be

applied prospectively. We are currently evaluating the impact of adopting this Statement.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements, an

amendment of ARB No. 51 (“FAS 160”). FAS 160 addresses the accounting and reporting for the outstanding noncontrolling

interest (previously referred to as minority interest) in a subsidiary and for the deconsolidation of a subsidiary. It also

establishes additional disclosures in the consolidated financial statements that identify and distinguish between the interests

of the parent’ s owners and of the noncontrolling owners of a subsidiary. FAS 160 requires changes in ownership interest that

do not result in deconsolidation to be accounted for as equity transactions. This Statement requires that a parent recognize a

gain or loss in net income when a subsidiary is deconsolidated. This gain or loss is measured using the fair value of the

noncontrolling equity investment. This Statement is effective for fiscal years beginning on or after December 15, 2008. FAS

160 requires retroactive adoption of the presentation and disclosure requirements for existing minority interests. All other

requirements of FAS 160 are applied prospectively. We are currently evaluating the impact of adopting this Statement.

Legal and Regulatory Matters

Legal

See Legal Proceedings in Item 3 of this Form 10-K for information regarding our legal proceedings.

Other

The European Union has instituted two environmental directives that impact our international operations. The Waste

Electrical and Electronic Equipment legislation, effective August 13, 2005, makes manufacturers responsible for the disposal

of their equipment. The Restriction of Hazardous Substances directive (RoHS) effective July 2006, requires the removal of

substances that are now considered actually or potentially hazardous, from future equipment placements. As a result of the

RoHS directive, we have sought and received re-approval for the placement of postage meters from the appropriate postal

authorities in each country.