Pitney Bowes 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

49

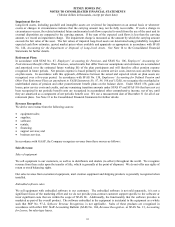

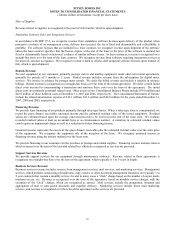

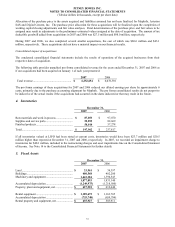

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“FAS 157”), to define how the fair value of

assets and liabilities should be measured in accounting standards where it is allowed or required. In addition to defining fair

value, the statement establishes a framework within GAAP for measuring fair value and expands required disclosures

surrounding fair-value measurements. While it will change the way companies currently measure fair value, it does not

establish any new instances where fair value measurement is required. FAS 157 defines fair value as an amount that a

company would receive if it sold an asset or paid to transfer a liability in a normal transaction between market participants in

the same market where the company does business. It emphasizes that the value is based on assumptions that market

participants would use, not necessarily only the company that might buy or sell the asset. The FASB issued FASB Staff

Position (FSP) No. FAS 157-a, Application of FASB Statement No. 157 to FASB Statement No. 13 and Its Related

Interpretive Accounting Pronouncements That Address Leasing Transactions, which eliminated lease accounting from the

scope of this standard. FAS 157, as issued, is effective for fiscal years beginning after November 15, 2007. The FASB

issued FASB Staff Position (FSP) No. FAS 157-b, Effective Date of FASB Statement No. 157, which delays the effective date

by one year for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value

in the financial statements on a recurring basis, at least annually. We do not expect the adoption of this statement for

financial assets and liabilities, effective January 1, 2008, will have a material impact on our financial position, results of

operations, or cash flow. We continue to evaluate the impact of adopting this statement for the nonfinancial items deferred

until January 1, 2009.

In September 2006, the FASB issued SFAS No. 158, Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans an amendment of FASB Statements No. 87, 88, 106 and 132(R) (“FAS 158”), which required

recognition of the overfunded or underfunded status of pension and other postretirement benefit plans on the balance sheet.

Under FAS 158, gains and losses, prior service costs and credits, and any remaining transition amounts under SFAS 87 and

SFAS 106 that have not yet been recognized through net periodic benefit cost were recognized in accumulated other

comprehensive income, net of tax effects, until they are amortized as a component of net periodic cost. Our adoption of the

provisions of FAS 158 reduced stockholders’ equity by $297 million at December 31, 2006. FAS 158 did not affect our

results of operations or cash flows.

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108, Considering the

Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements (SAB 108). SAB

108 provided guidance on how prior year misstatements should be considered when quantifying misstatements in current

year financial statements for the purposes of determining whether the current year’ s financial statements are materially

misstated. SAB 108 allowed registrants to adjust for the cumulative effect of certain errors relating to prior years in the

carrying amount of assets and liabilities as of the beginning of the current year, with an offsetting adjustment to the opening

balance of retained earnings in the year of adoption provided that management had properly concluded that the errors were

not material to prior periods. SAB 108 was effective for fiscal years ending after November 15, 2006. In 2006, we

determined that the accounting for certain leveraged lease transactions in Canada was misstated due to changes in

assumptions having occurred prior to 2000 which impacted net income from the leases. Such changes in assumptions

required the leveraged lease pricing models to be revised. These misstatements were immaterial to periods prior to 2006,

however correction in that period would have had the effect of reducing our pre-tax income and our tax provision by $48

million and $43 million, respectively, which was considered material to the 2006 financial statements. Accordingly, we

corrected these misstatements by adjusting opening retained earnings in 2006 by $4.6 million. As part of this adjustment, we

also decreased our investment in leveraged leases by $33 million, increased other non-current liabilities by $15 million and

decreased deferred taxes on income by $43 million.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities,

including an amendment of FASB Statement No. 115, Accounting for Certain Investments in Debt and Equity Securities

(“FAS 159”), which permits entities to choose to measure many financial assets and financial liabilities and certain other

assets and liabilities at fair value on an instrument-by-instrument basis. The fair value election once made is irrevocable.

Unrealized gains and losses on items for which the fair value option has been elected are reported in earnings. FAS 159 is

effective for fiscal years beginning after November 15, 2007. We do not expect to adopt the fair value option allowed by this

standard.

In December 2007, the FASB issued SFAS No. 141 (R), Business Combinations (“FAS 141 (R)”). FAS 141(R) establishes

principles and requirements for how a company (a) recognizes and measures in their financial statements the identifiable

assets acquired, the liabilities assumed, and any noncontrolling interest (previously referred to as minority interest); (b)

recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and (c)

determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects

of a business combination. FAS 141 (R) requires fair value measurements at the date of acquisition, with limited exceptions

specified in the Statement. Some of the major impacts of this new standard include expense recognition for transaction costs