Pitney Bowes 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

72

additional restructuring charges in 2008 associated with these actions, however, we continue to evaluate additional actions in

conjunction with this program. We expect to complete the majority of this program by the end of 2008.

In addition, asset impairments also include the write-down of certain intangible assets for $8.5 million.

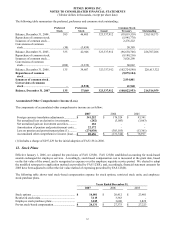

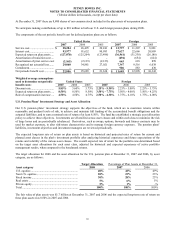

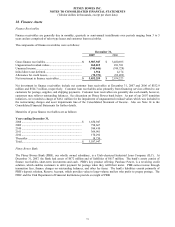

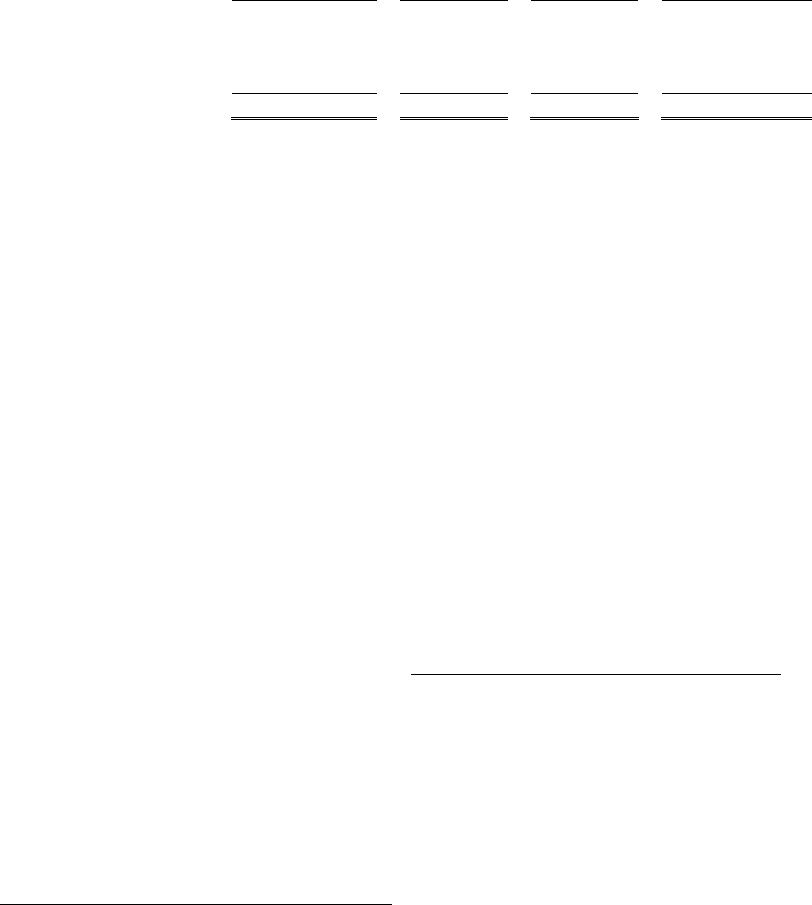

The pre-tax restructuring charges and asset impairments are composed of:

Restructuring

charges

Non-cash

charges

Cash

payments

Balance

December 31,

2007

Severance and benefit costs ............................... $ 85,137 $ - $ (3,886) $ 81,251

Asset impairments ............................................. 173,081 (173,081) - -

Other exit costs .................................................. 5,795 - - 5,795

Total .................................................................. $ 264,013 $(173,081) $ (3,886) $ 87,046

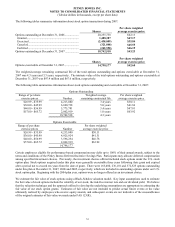

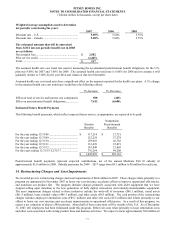

In January 2003, we undertook restructuring initiatives related to realigned infrastructure requirements and reduced

manufacturing needs for digital equipment. In connection with this plan, we recorded pre-tax restructuring charges of $36

million and $54 million for the years ended December 31, 2006 and 2005, respectively. The 2005 charge is net of a $30

million gain on the sale of our main plant manufacturing facility. The activities associated with this program were

substantially completed in 2006. During 2007, 2006, and 2005 we made restructuring payments of $29 million, $51 million

and $48 million (net of the $30 million gain), respectively. At December 31, 2007, we have a remaining liability associated

with this program of $5 million.

See Note 1 to the Consolidated Financial Statements for our accounting policy related to restructuring charges and asset

impairments.

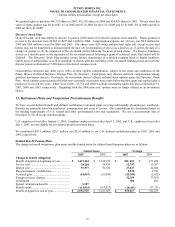

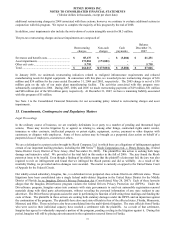

15. Commitments, Contingencies and Regulatory Matters

Legal Proceedings

In the ordinary course of business, we are routinely defendants in or party to a number of pending and threatened legal

actions. These may involve litigation by or against us relating to, among other things, contractual rights under vendor,

insurance or other contracts; intellectual property or patent rights; equipment, service, payment or other disputes with

customers; or disputes with employees. Some of these actions may be brought as a purported class action on behalf of a

purported class of employees, customers or others.

We are a defendant in a patent action brought by Ricoh Company, Ltd. in which there are allegations of infringement against

certain of our important mailing products, including the DM SeriesTM. Ricoh Corporation et al. v. Pitney Bowes Inc. (United

States District Court, District of New Jersey, filed November 26, 2002). The plaintiff in this action is seeking both large

damage and injunctive relief. We prevailed at the trial held in this matter in the fall of 2006. The jury found the Ricoh

patents at issue to be invalid. Even though a finding of invalidity means that the plaintiff’ s claim must fail, the jury was also

required to rule on infringement and found that we infringed the Ricoh patents and did so willfully. As a result of the

invalidity finding, we prevailed and no damages were awarded. The matter is currently on appeal to the United States Court

of Appeals for the Federal Circuit.

Our wholly-owned subsidiary, Imagitas, Inc., is a defendant in ten purported class actions filed in six different states. These

litigations have been consolidated into a single federal multi-district litigation in the United States District for the Middle

District of Florida, In re: Imagitas, Driver’ s Privacy Protection Act (Consolidated, May 28, 2007). Each of these lawsuits

alleges that the Imagitas DriverSource program violates the federal Drivers Privacy Protection Act (DPPA). Under the

DriverSource program, Imagitas enters into contracts with state governments to mail out automobile registration renewal

materials along with third party advertisements, without revealing the personal information of any state resident to any

advertiser. The DriverSource program assists the state in performing its function of delivering these mailings and funding the

costs of them. The plaintiffs in these actions are seeking both statutory damages under the DPPA and an injunction against

the continuation of the program. The plaintiffs have also sued state officials in four of the affected states, Florida, Minnesota,

Missouri, and Ohio. Those suits have also been consolidated into the multi-district litigation. The state officials from Florida

who were sued in their individual capacity have reached a settlement with the plaintiffs. As a result of that settlement,

Imagitas has agreed to voluntarily suspend a portion of the program, pending a ruling in the litigation against it. During this

period, Imagitas will still be placing advertisements in the registration renewal forms in Florida.