Pitney Bowes 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

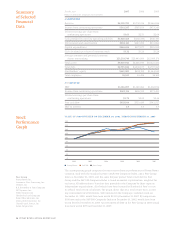

For the year 2007 2006 2005

(Dollars in thousands, except per share amounts)

AS REPORTED

Revenue $6,129,795 $5,730,018 $5,366,936

Income from continuing operations $361,247 $565,659 $473,243

Diluted earnings per share from

continuing operations $1.63 $2.51 $2.04

Cash provided by (used in) operating activities $1,060,465 $(286,574) $530,441

Depreciation and amortization $383,141 $363,258 $331,963

Capital expenditures $264,656 $327,877 $291,550

Cash dividends per share of common stock $1.32 $1.28 $1.24

Average common and potential common

shares outstanding 221,219,746 225,443,060 232,089,178

Total assets $9,549,943 $8,608,944 $10,621,382

Total debt $4,755,842 $4,338,157 $4,707,365

Stockholders’ equity $643,303 $699,189 $1,364,249

Total employees 36,165 34,454 34,165

AS ADJUSTED

EBIT $1,186,097 $1,160,063 $1,063,194

Income from continuing operations $601,114 $606,765 $571,491

Diluted earnings per share from

continuing operations $2.72 $2.69 $2.46

Free cash fl ow $923,914 $523,439 $542,527

EBIT to interest 4.9 5.5 5.7

Summary

of Selected

Financial

Data

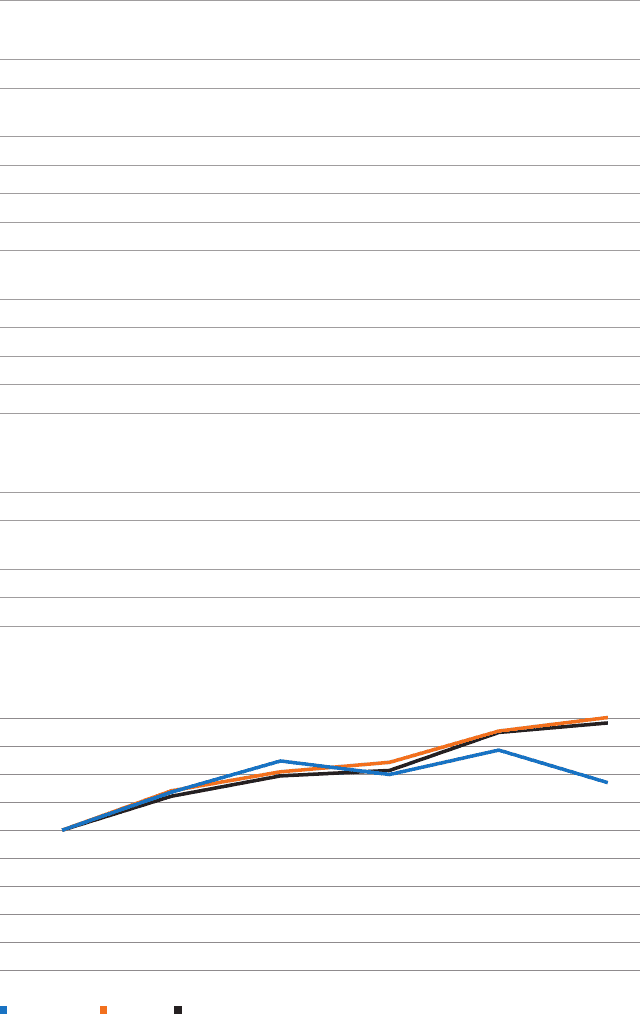

The accompanying graph compares the most recent fi ve-year performance of Pitney Bowes

common stock with the Standard & Poor’s (S&P) 500 Composite Index, and a Peer Group

Index at December 31, 2007, over the same fi ve-year period. Total return for the Peer

Group and the S&P 500 Composite Index is based on market capitalization, weighted for

each year. All information is based on data provided to the Company by three separate

independent organizations, all of which have been licensed by Standard & Poor’s to use

its offi cial total return calculation. The graph shows that on a total return basis, assum-

ing reinvestment of all dividends, $100 invested in the Company’s common stock on

December 31, 2002, would have been worth $135 by December 31, 2007. By comparison,

$100 invested in the S&P 500 Composite Index on December 31, 2002, would have been

worth $183 by December 31, 2007. An investment of $100 in the Peer Group in 2002 would

have been worth $179 on December 31, 2007.

Stock

Performance

Graph

VALUE OF $100 INVESTED ON DECEMBER 31, 2002, THROUGH DECEMBER 31, 2007

180

0

2002

Pitney Bowes S&P 500 Peer Group

2003 2004 2005 2006 2007

20

40

60

80

100

120

140

160

Peer Group

Pitney Bowes Inc.

Automatic Data Processing, Inc.

Diebold, Inc.

R.R. Donnelley & Sons Company

DST Systems, Inc.

FedEx Corporation

Hewlett-Packard Company

Ikon Offi ce Solutions, Inc.

Lexmark International, Inc.

United Parcel Service, Inc.

Xerox Corporation

14 PITNEY BOWES ANNUAL REPORT 2007