Pitney Bowes 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

61

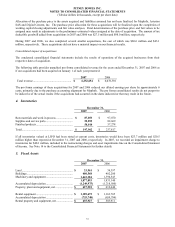

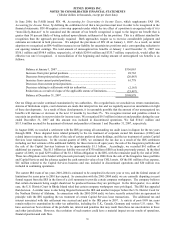

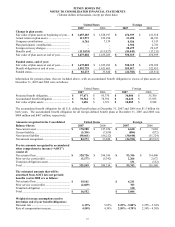

In 2006, we accrued in discontinued operations an additional tax expense of $16.2 million to record the impact of the Tax

Increase Prevention and Reconciliation Act (“TIPRA”). The TIPRA legislation repealed the exclusion from federal income

taxation of a portion of the income generated from certain leveraged leases of aircraft by foreign sales corporations. See Note

2 to the Consolidated Financial Statements for further discussion of the discontinued operations.

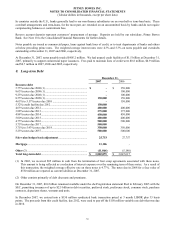

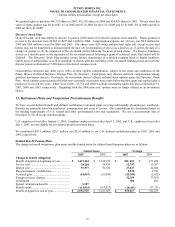

10. Preferred Stockholders’ Equity in Subsidiary Companies

Pitney Bowes International Holdings, Inc., a subsidiary of the Company, has 3,750,000 shares outstanding or $375 million of

variable term voting preferred stock owned by certain outside institutional investors. Of these shares outstanding, 750,000

were issued in December 2006. These preferred shares are entitled to 25% of the combined voting power of all classes of

capital stock. All outstanding common stock of Pitney Bowes International Holdings, Inc., representing the remaining 75%

of the combined voting power of all classes of capital stock, is owned directly or indirectly by Pitney Bowes Inc. The

preferred stock, $.01 par value, is entitled to cumulative dividends at rates set at auction. The weighted average dividend rate

in 2007 and 2006 was 4.9% and 4.4%, respectively. Preferred dividends are included in minority interest in the Consolidated

Statements of Income. The preferred stock is subject to mandatory redemption based on certain events, at a redemption price

not less than $100 per share, plus the amount of any dividends accrued or in arrears. No dividends were in arrears at

December 31, 2007 or 2006.

Additionally a subsidiary of the Company has 100 shares or $10 million of 9.11% Cumulative Preferred Stock, mandatorily

redeemable in 20 years, outstanding and owned by an institutional investor.

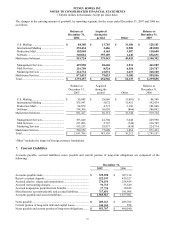

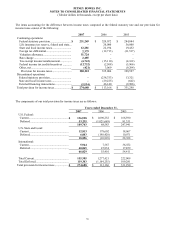

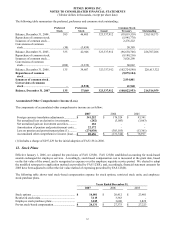

11. Stockholders’ Equity

At December 31, 2007, 480,000,000 shares of common stock, 600,000 shares of cumulative preferred stock, and 5,000,000

shares of preference stock were authorized. At December 31, 2007, 214,514,959 shares of common stock (net of

108,822,953 shares of treasury stock), 135 shares of 4% convertible cumulative preferred stock (4% preferred stock) and

37,069 shares of $2.12 convertible preference stock ($2.12 preference stock) were issued and outstanding. In the future, the

Board of Directors can issue the balance of unreserved and unissued preferred stock (599,865 shares) and preference stock

(4,962,931 shares). The Board will determine the dividend rate, terms of redemption, terms of conversion (if any) and other

pertinent features. At December 31, 2007, unreserved and unissued common stock (exclusive of treasury stock) amounted to

113,975,174 shares.

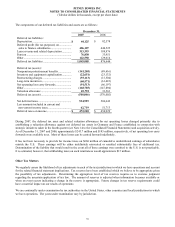

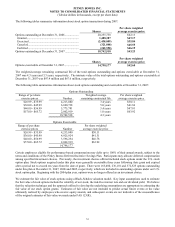

The 4% preferred stock outstanding, entitled to cumulative dividends at the rate of $2 per year, can be redeemed at our

option, in whole or in part at any time, at the price of $50 per share, plus dividends accrued to the redemption date. Each

share of the 4% preferred stock can be converted into 24.24 shares of common stock, subject to adjustment in certain events.

The $2.12 preference stock is entitled to cumulative dividends at the rate of $2.12 per year and can be redeemed at our option

at the rate of $28 per share. Each share of the $2.12 preference stock can be converted into 16.53 shares of common stock,

subject to adjustment in certain events.

At December 31, 2007, a total of 616,022 shares of common stock were reserved for issuance upon conversion of the 4%

preferred stock (3,272 shares) and $2.12 preference stock (612,750 shares). In addition, 21,769,139 shares of common stock

were reserved for issuance under our dividend reinvestment and other corporate plans.