Pitney Bowes 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

71

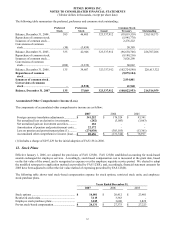

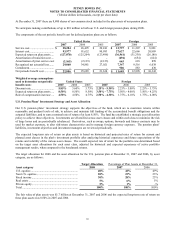

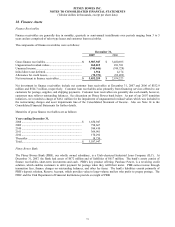

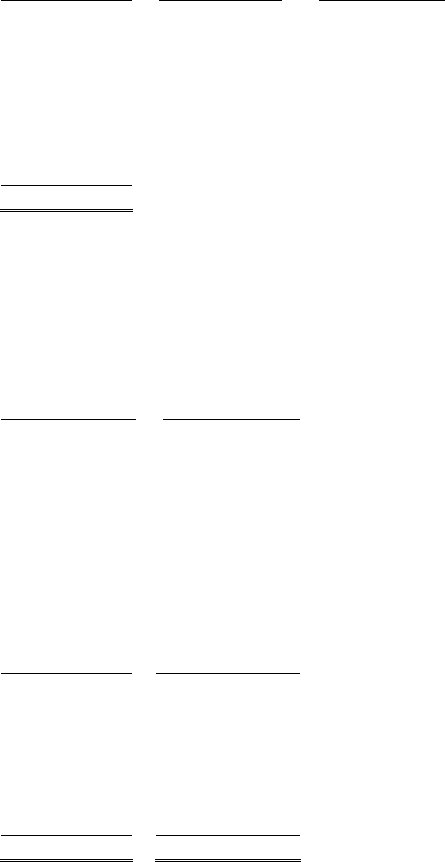

Weighted average assumptions used to determine

net periodic costs during the years:

2007 2006 2005

Discount rate – U.S. ..................................................... 5.85

%

5.60% 5.75%

Discount rate – Canada................................................. 5.00

%

5.00% 5.75%

The estimated amounts that will be amortized

from AOCI into net periodic benefit cost in 2008

are as follows:

Net actuarial loss .......................................................... $ 2,982

Prior service credit........................................................ (2,465)

Total ............................................................................. $ 517

The assumed health care cost trend rate used in measuring the accumulated postretirement benefit obligations for the U.S.

plan was 8.00% for 2007 and 7.00% for 2006. The assumed health care trend rate is 8.00% for 2008 and we assume it will

gradually decline to 5.00% by the year 2014 and remain at that level thereafter.

Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plans. A 1% change

in the assumed health care cost trend rates would have the following effects:

1% Increase 1% Decrease

Effect on total of service and interest cost components 508 (445)

Effect on postretirement benefit obligations................. 7,412 (6,688)

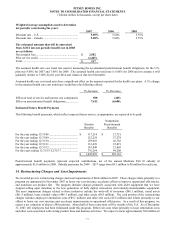

Estimated Future Benefit Payments

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

Pension

Benefits

Nonpension

Postretirement

Benefits

For the year ending 12/31/08........................................ $ 117,214 $ 27,751

For the year ending 12/31/09 ........................................ 122,219 27,278

For the year ending 12/31/10 ........................................ 129,055 26,702

For the year ending 12/31/11 ........................................ 133,439 25,419

For the year ending 12/31/12 ........................................ 143,849 23,805

For the years ending 12/31/13-12/31/17 ....................... 776,294 99,208

$ 1,422,070 $ 230,163

Postretirement benefit payments represent expected contributions, net of the annual Medicare Part D subsidy of

approximately $3.8 million in 2008. Subsidy payments for 2009 – 2017 range from $4.1 million to $6 million for each year.

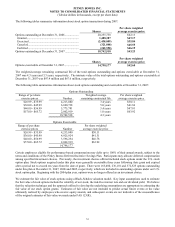

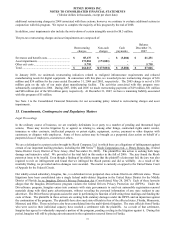

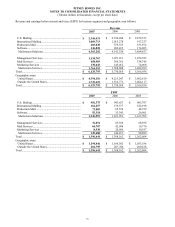

14. Restructuring Charges and Asset Impairments

We recorded pre-tax restructuring charges and asset impairments of $264 million in 2007. These charges relate primarily to a

program we announced in November 2007 to lower our cost structure, accelerate efforts to improve operational efficiencies,

and transition our product line. The program includes charges primarily associated with older equipment that we have

stopped selling upon transition to the new generation of fully digital, networked, and remotely-downloadable equipment.

The asset impairment charges related to these initiatives include the write-off of inventory ($48.1 million), rental assets

($61.5 million), lease residual values ($46.1 million), and other assets ($8.8 million). The cash portion of the restructuring

charges includes employee termination costs ($85.1 million) and other exit costs ($5.8 million) and relates primarily to our

efforts to lower our cost structure and accelerate improvements in operational efficiencies. As a result of this program, we

expect a net reduction of about 1,500 positions. About half of these reductions will be outside of the U.S. As of December

31, 2007, 401 employees had been terminated under this program. Other exit costs relate primarily to lease termination costs

and other costs associated with exiting product lines and business activities. We expect to incur approximately $20 million of