Pitney Bowes 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

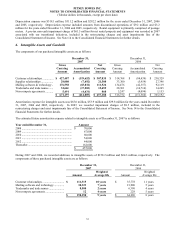

(Tabular dollars in thousands, except per share data)

53

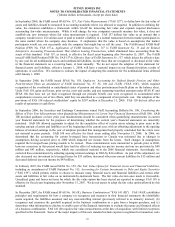

Allocation of the purchase price to the assets acquired and liabilities assumed has not been finalized for MapInfo, Asterion

SAS and Digital Cement, Inc. The purchase price allocation for these acquisitions will be finalized upon the completion of

working capital closing adjustments and fair value analyses. Final determination of the purchase price and fair values to be

assigned may result in adjustments to the preliminary estimated values assigned at the date of acquisition. The amount of tax

deductible goodwill added from acquisitions in 2007 and 2006 was $27.5 million and $98.0 million, respectively.

During 2007 and 2006, we also completed several smaller acquisitions, the cost of which was $86.6 million and $43.1

million, respectively. These acquisitions did not have a material impact on our financial results.

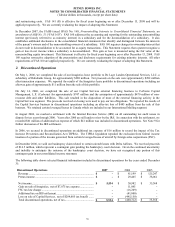

Consolidated impact of acquisitions

The condensed consolidated financial statements include the results of operations of the acquired businesses from their

respective dates of acquisition.

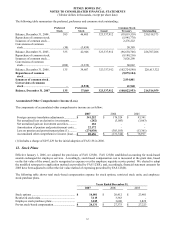

The following table provides unaudited pro forma consolidated revenue for the years ended December 31, 2007 and 2006 as

if our acquisitions had been acquired on January 1 of each year presented:

2007 2006

Total revenue ..................................................... $ 6,252,694 $ 6,078,392

The pro forma earnings of these acquisitions for 2007 and 2006 reduced our diluted earnings per share by approximately 6

cents, primarily due to the purchase accounting alignment for MapInfo. The pro forma consolidated results do not purport to

be indicative of the actual results if the acquisitions had occurred on the dates indicated or that may result in the future.

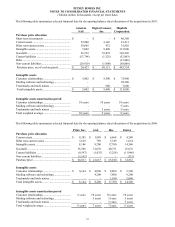

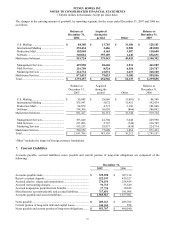

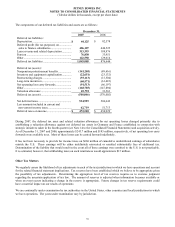

4. Inventories

December 31,

2007

2006

Raw materials and work in process ....................... $ 87,053 $ 97,870

Supplies and service parts...................................... 52,895 82,669

Finished products................................................... 58,014 57,278

Total.......................................................................

$ 197,962

$ 237,817

If all inventories valued at LIFO had been stated at current costs, inventories would have been $23.7 million and $20.5

million higher than reported at December 31, 2007 and 2006, respectively. In 2007, we recorded an impairment charge to

inventories for $48.1 million, included in the restructuring charges and asset impairments line on the Consolidated Statement

of Income. See Note 14 to the Consolidated Financial Statements for further details.

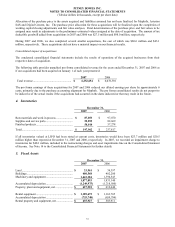

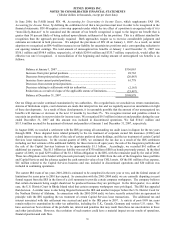

5. Fixed Assets

December 31,

2007

2006

Land....................................................................... $ 33,961

$ 34,397

Buildings................................................................ 400,548

402,200

Machinery and equipment ..................................... 1,443,384

1,394,543

1,877,893

1,831,140

Accumulated depreciation ..................................... (1,249,975) (1,218,500)

Property, plant and equipment, net ........................ $ 627,918

$ 612,640

Rental equipment................................................... $ 1,189,675

$ 1,163,705

Accumulated depreciation ..................................... (753,748) (659,794)

Rental property and equipment, net ....................... $ 435,927

$ 503,911