Pitney Bowes 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

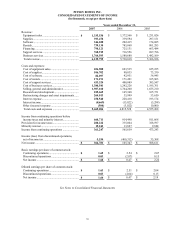

Although not affecting income, balance sheet related deferred translation gains of $165 million were recorded in 2007

resulting primarily from the stronger British pound, Euro and Canadian dollar, as compared to the U.S. dollar. During 2006,

we recorded deferred translation gains of $83 million resulting primarily from the stronger British pound, Euro and Canadian

dollar, as compared to the U.S. dollar. During 2005, we recorded deferred translation losses of $54 million resulting primarily

from the weaker British pound and Euro, partially offset by the stronger Canadian dollar as compared with the U.S. dollar.

The results of our international operations are subject to currency fluctuations. We enter into foreign exchange contracts

primarily to minimize our risk of loss from such fluctuations. Exchange rates can also impact settlement of our intercompany

receivables and payables that result from transfers of finished goods inventories between our affiliates in different countries,

and intercompany loans.

At December 31, 2007, we had $316 million of foreign exchange contracts outstanding, all maturing in 2008, to buy or sell

various currencies. As a result of the use of derivative instruments, we are exposed to counterparty risk. To mitigate such

risks, we enter into contracts with only those financial institutions that meet stringent credit requirements as set forth in our

derivative policy. We regularly review our credit exposure balances as well as the creditworthiness of our counterparties.

Maximum risk of loss on these contracts is limited to the amount of the difference between the spot rate at the date of the

contract delivery and the contracted rate.

Dividends

It is a general practice of our Board of Directors to pay a cash dividend on common stock each quarter. In setting dividend

payments, our board considers the dividend rate in relation to our recent and projected earnings and our capital investment

opportunities and requirements. We have paid a dividend each year since 1934.

Forward-Looking Statements

We want to caution readers that any forward-looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934 in this Form 10-K, other reports or press releases or made by

our management involve risks and uncertainties which may change based on various important factors. We undertake no

obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events

or otherwise. These forward-looking statements are those which talk about our current expectations as to the future and

include, but are not limited to, statements about the amounts, timing and results of possible restructuring charges and future

earnings. Words such as “estimate,” “project,” “plan,” “believe,” “expect,” “anticipate,” “intend,” and similar expressions

may identify such forward-looking statements. Some of the factors which could cause future financial performance to differ

materially from the expectations as expressed in any forward-looking statement made by or on our behalf include:

• changes in international or national political conditions, including any terrorist attacks

• negative developments in economic conditions, including adverse impacts on customer demand

• changes in postal regulations

• timely development and acceptance of new products

• success in gaining product approval in new markets where regulatory approval is required

• successful entry into new markets

• mailers’ utilization of alternative means of communication or competitors’ products

• our success at managing customer credit risk

• our success at managing costs associated with our strategy of outsourcing functions and operations not central to our

business

• changes in interest rates

• foreign currency fluctuations

• cost, timing and execution of our transition plans including any potential asset impairments

• regulatory approvals and satisfaction of other conditions to consummation of any acquisitions and integration of

recent acquisitions

• interrupted use of key information systems

• changes in privacy laws

• intellectual property infringement claims

• impact on mail volume resulting from current concerns over the use of the mail for transmitting harmful biological

agents

• third-party suppliers’ ability to provide product components

• negative income tax adjustments for prior audit years and changes in tax laws or regulations

• changes in pension and retiree medical costs

• acts of nature