Pitney Bowes 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

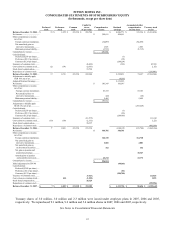

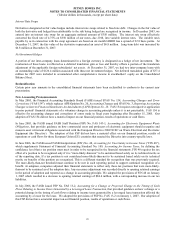

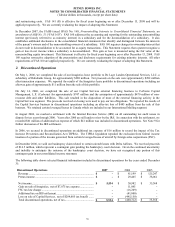

PITNEY BOWES INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except per share data)

Preferred

stock

Preference

stock

Common

stock

Capital in

excess

of par value

Comprehensive

income

Retained

earnings

Accumulated other

comprehensive

income (loss)

Treasury stoc

k

at cost

Balance, December 31, 2004.....

$ 19 $ 1,252 $ 323,338 $ 201,704 $ 4,100,771 $ 135,526 $ (3,413,458)

Net income .................................. $ 508,611 508,611

Other comprehensive income,

net of tax:

Foreign currency translations. (54,499) (54,499)

Net unrealized gain on

derivative instruments..........

1,605

1,605

Minimum pension liability..... (5,715) (5,715)

Comprehensive income............... $ 450,002

Cash dividends:

Preferred ($2.00 per share) .... (1)

Preference ($2.12 per share) .. (93)

Common ($1.24 per share) .... (284,254)

Issuances of common stock......... (8,468) (583) 85,569

Conversions to common stock .... (2) (94) (2,056) 2,152

Stock-based compensation.......... 31,728

Repurchase of common stock ..... (258,803)

Balance, December 31, 2005..... 17 1,158 323,338 222,908 4,324,451 76,917 (3,584,540)

Adjustment to initially apply

SAB 108, net of tax..................

(4,618)

Adjusted Retained Earnings........ 4,319,833

Net income .................................. $ 105,347 105,347

Other comprehensive income,

net of tax:

Foreign currency translations 83,183 83,183

Net unrealized loss on

derivative instruments..........

(20)

(20)

Minimum pension liability..... 5,405 5,405

Comprehensive income............... $ 193,915

Adjustment to initially apply

SFAS 158, net of tax ................

(297,229)

Cash dividends:

Preferred ($2.00 per share) .... (1)

Preference ($2.12 per share) .. (86)

Common ($1.28 per share) .... (284,965)

Issuances of common stock......... (11,575) 113,142

Conversions to common stock .... (10) (90) (2,132) 2,232

Stock-based compensation.......... 26,357

Repurchase of common stock ..... (400,000)

Balance, December 31, 2006..... 7

)1,068) 323,338) 235,558 4,140,128)(131,744) (3,869,166)

Net income .................................. $ 366,781 366,781

Other comprehensive income,

net of tax:

Foreign currency translations. 164,728 164,728

Net unrealized gain on

derivative instruments..........

2,801

2,801

Net unrealized gain on

on investment securities ....... 352 352

Net gain on pension and

postretirement plans ............. 30,347

Amortization of pension

and postretirement costs...... 22,172

22,172

Comprehensive income............... $ 556,834

Initial ad

j

ustment for FIN 48

(

84

,

363

)

Cash dividends:

Preferred ($2.00 per share) ....

Preference ($2.12 per share) .. (81)

Common ($1.32 per share) .... (288,709)

Issuances of common stock......... (7,967) 111,925

Conversions to common stock .... (65) (1,530) 1,595

Stock-based compensation.......... 26,124

Repurchase of common stock ..... (399,996)

Balance, December 31, 2007..... $ 7 $ 1,003 $ 323,338 $ 252,185 $ 4,133,756 $ 88,656 $ (4,155,642)

Treasury shares of 3.0 million, 3.0 million and 2.3 million were issued under employee plans in 2007, 2006 and 2005,

respectively. We repurchased 9.1 million, 9.2 million and 5.4 million shares in 2007, 2006 and 2005, respectively.

See Notes to Consolidated Financial Statements