Pitney Bowes 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

75

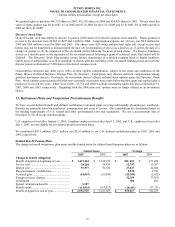

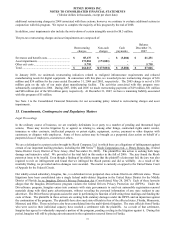

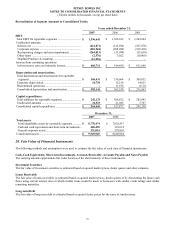

Leveraged Leases

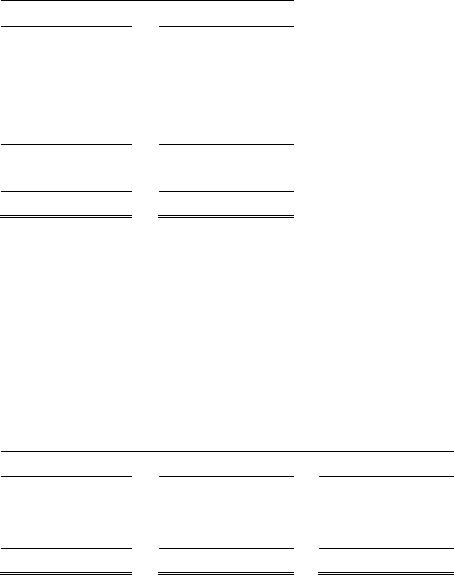

Our investment in leveraged lease assets consists of the following:

December 31,

2007

2006

Rental receivables............................................................. $ 1,889,083

$ 1,687,730

Unguaranteed residual values ........................................... 32,487

28,536

Principal and interest on non-recourse loans .................... (1,478,555) (1,326,361)

Unearned income .............................................................. (193,824) (174,534)

Investment in leveraged leases ......................................... 249,191

215,371

Less: Deferred taxes related to leveraged leases............... (117,500) (90,716)

Net investment in leveraged leases ................................... $ 131,691

$ 124,655

In the fourth quarter of 2006, we determined the need to adjust the accounting for our remaining leveraged lease transactions.

As a result, we recorded a $4.6 million reduction to our opening retained earnings. This reflects the cumulative effect of

these adjustments. We also adjusted the related lease assets and liabilities on our Consolidated Balance Sheet. See Note 1 to

the Consolidated Financial Statements for further discussion.

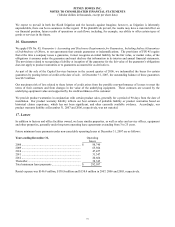

The following is a summary of the components of income from leveraged leases. The income amounts in prior years from

Capital Services have been reclassified as discontinued operations:

December 31,

2007

2006 2005

Pre-tax leveraged lease income......................................... $ 4,270

$ 8,019 $ 10,897

Income tax effect .............................................................. 1,186

(923) (3,814)

Income from leveraged leases........................................... $ 5,456

$ 7,096 $ 7,083

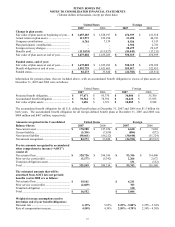

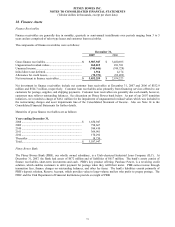

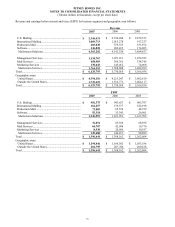

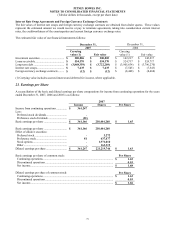

19. Business Segment Information

We conduct our business activities in seven business segments within the Mailstream Solutions and Mailstream Services

business groups. For a description of our reportable segments and the types of products and services from which each

reportable segment derives its revenue, see Item 1 - Business on page 3. That information is incorporated herein by

reference. The information set forth below should be read in conjunction with such information. The accounting policies of

the segments are the same as those described in the summary of significant accounting policies, with the exception of the

items outlined below.

EBIT is determined by deducting from revenue the related costs and expenses attributable to the segment. Segment EBIT

excludes general corporate expenses, restructuring charges, interest expense, other income (expense) and income taxes.

Identifiable assets are those used in our operations and exclude cash and cash equivalents, short-term investments and general

corporate assets. Long-lived assets exclude finance receivables and investment in leveraged leases.