Pitney Bowes 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

44

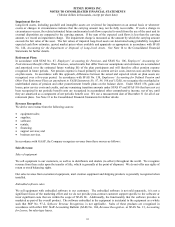

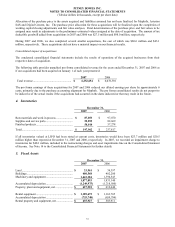

Impairment Review

Long-lived assets, including goodwill and intangible assets are reviewed for impairment on an annual basis or whenever

events or changes in circumstances indicate that the carrying amount may not be fully recoverable. If such a change in

circumstances occurs, the related estimated future undiscounted cash flows expected to result from the use of the asset and its

eventual disposition are compared to the carrying amount. If the sum of the expected cash flows is less than the carrying

amount, we record an impairment charge. The impairment charge is measured as the amount by which the carrying amount

exceeds the fair value of the asset. The fair values of impaired long-lived assets are determined using probability weighted

expected cash flow estimates, quoted market prices when available and appraisals as appropriate in accordance with SFAS

No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. See Note 14 to the Consolidated Financial

Statements for further details.

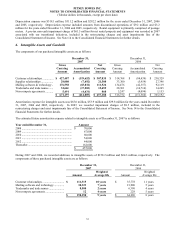

Retirement Plans

In accordance with SFAS No. 87, Employers’ Accounting for Pensions, and SFAS No. 106, Employers’ Accounting for

Postretirement Benefits Other Than Pensions, actual results that differ from our assumptions and estimates are accumulated

and amortized over the estimated future working life of the plan participants and will therefore affect pension expense

recognized in future periods. Net pension expense is based primarily on current service costs, interest costs and the returns

on plan assets. In accordance with this approach, differences between the actual and expected return on plan assets are

recognized over a five-year period. In accordance with SFAS No. 158, Employers’ Accounting for Defined Pension and

Other Post Retirement Plans an amendment to FASB Statements No. 87, 88, 106 and 132(R), we recognize the overfunded or

underfunded status of pension and other postretirement benefit plans on the balance sheet. Under SFAS 158, gains and

losses, prior service costs and credits, and any remaining transition amounts under SFAS 87 and SFAS 106 that have not yet

been recognized in net periodic benefit costs are recognized in accumulated other comprehensive income, net of tax, until

they are amortized as a component of net periodic benefit cost. We use a measurement date of December 31 for all of our

retirement plans. See Note 13 to the Consolidated Financial Statements for further details.

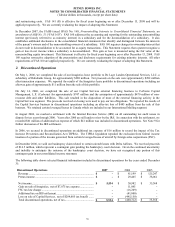

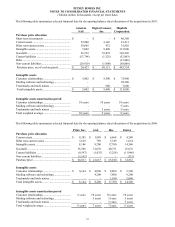

Revenue Recognition

We derive our revenue from the following sources:

• equipment sales;

• supplies;

• software;

• rentals;

• financing;

• support services; and

• business services.

In accordance with GAAP, the Company recognizes revenue from these sources as follows:

Sales Revenue

Sales of equipment

We sell equipment to our customers, as well as to distributors and dealers (re-sellers) throughout the world. We recognize

revenue from these sales upon the transfer of title, which is generally at the point of shipment. We do not offer any rights of

return or stock balancing rights.

Our sales revenue from customized equipment, mail creation equipment and shipping products is generally recognized when

installed.

Embedded software sales

We sell equipment with embedded software to our customers. The embedded software is not sold separately, it is not a

significant focus of the marketing effort and we do not provide post-contract customer support specific to the software or

incur significant costs that are within the scope of SFAS 86. Additionally, the functionality that the software provides is

marketed as part of the overall product. The software embedded in the equipment is incidental to the equipment as a whole

such that SOP No. 97-2, Software Revenue Recognition, is not applicable. Sales of these products are recognized in

accordance with either SEC Staff Accounting Bulletin (SAB) No. 104, Revenue Recognition, or SFAS No. 13, Accounting

for Leases, for sales-type leases.