Pitney Bowes 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

57

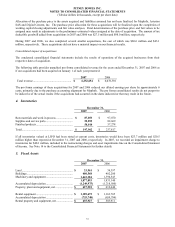

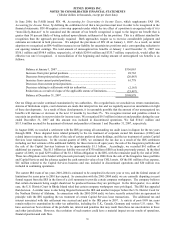

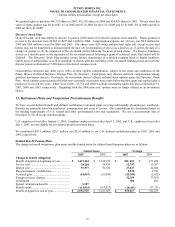

In September 2007, we issued $500 million of unsecured fixed rate notes maturing in September 2017. These notes bear

interest at an annual rate of 5.75% and pay interest semi-annually beginning in March 2008. The proceeds from these notes

were used for general corporate purposes, including the repayment of commercial paper, the financing of acquisitions, and

repurchase of our stock.

In November 2006, we issued $500 million of unsecured fixed rate notes maturing in January 2037. These notes bear interest

at an annual rate of 5.25% and pay interest semi-annually beginning in July 2007. The proceeds from these notes were used

for general corporate purposes, including the repayment of commercial paper, the financing of acquisitions and repurchase of

the Company’ s stock.

The annual maturities of the outstanding debt during each of the next five years are as follows: 2008, $550 million; 2009,

$150 million; 2010 – no maturities; 2011 – no maturities; 2012, $550 million; and $3,075 million thereafter.

The mortgage relates to debt assumed with the acquisition of MapInfo Corporation. The annual maturities of the outstanding

mortgage for 2008 - 2012 are $0.3 million each year and $12.0 million thereafter.

The fair value hedges basis adjustment represents the revaluation of fixed rate debt that has been hedged in accordance with

SFAS No. 133. See Note 1 to the Consolidated Financial Statements.

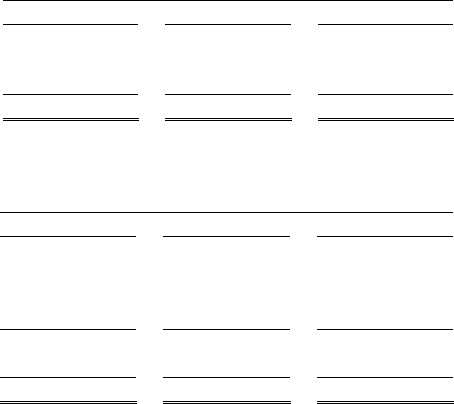

9. Income Taxes

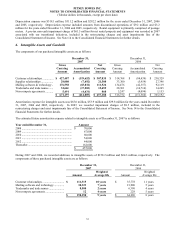

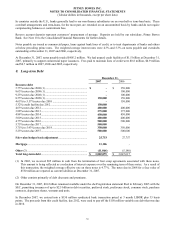

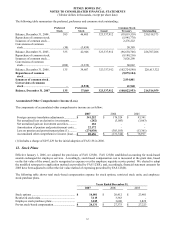

Years ended December 31,

2007 2006 2005

Continuing operations:

Total current ................................................

$ 160,839

$ 298,364 $ 217,042

Total deferred ..............................................

119,383

36,640 111,555

Provision for income taxes ........................

$ 280,222

$ 335,004 $ 328,597

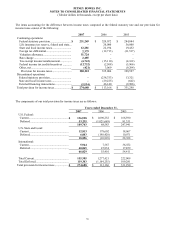

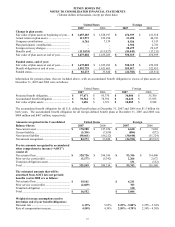

U.S. and international components of income from operations before income taxes and minority interest are as follows:

Years ended December 31,

2007 2006 2005

Continuing operations:

U.S............................................................. $ 624,030

$ 719,931 $ 623,529

International .............................................. 36,681

194,559 188,139

Total continuing operations....................... 660,711

914,490 811,668

Discontinued operations................................. -

(682,149) 38,061

Total............................................................... $ 660,711

$ 232,341 $ 849,729

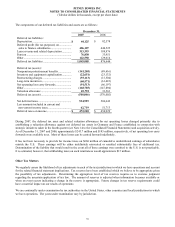

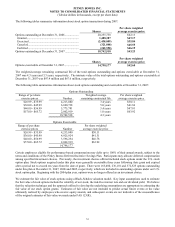

The effective tax rates for continuing operations for 2007, 2006 and 2005 were 42.4%, 36.6% and 40.5%, respectively. The

effective tax rate for 2007 included $54 million of tax charges related principally to a valuation allowance for certain deferred

tax assets and tax rate changes outside of the U.S. The effective tax rate for 2006 and 2005 included a $20 million and $56

million charge, respectively, related to the IRS settlement discussed below.