Pitney Bowes 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

59

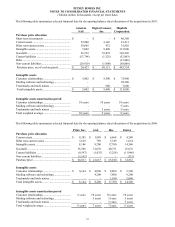

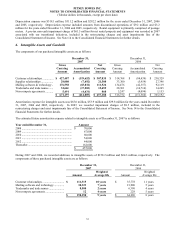

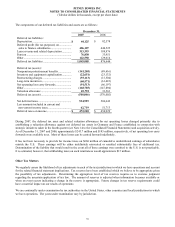

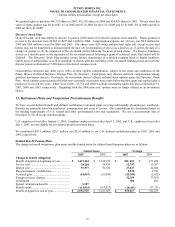

The components of our deferred tax liabilities and assets are as follows:

December 31,

2007

2006

Deferred tax liabilities:

Depreciation ......................................................$ 44,125

$ 82,578

Deferred profit (for tax purposes) on.................

sales to finance subsidiaries............................. 486,107

440,525

Lease revenue and related depreciation ............. 313,393

189,976

Pension .............................................................. 76,830

33,951

Other.................................................................. 122,550

129,614

Deferred tax liabilities ....................................... 1,043,005

876,644

Deferred tax (assets):

Nonpension postretirement benefits .................. (141,205)

(89,416)

Inventory and equipment capitalization............. (22,651)

(23,132)

Restructuring charges ........................................ (93,113)

(15,504)

Long-term incentives......................................... (60,571)

(61,422)

Net operating loss carry forwards...................... (91,513)

(66,197)

Other.................................................................. (168,785)

(147,894)

Valuation allowance .......................................... 69,792

33,563

Deferred tax (assets) .......................................... (508,046)

(370,002)

Net deferred taxes.............................................. 534,959

506,642

Less amounts included in current and

non-current income taxes.................................

62,719

51,713

Deferred taxes on income ..................................$ 472,240

$ 454,929

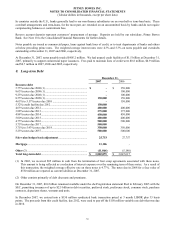

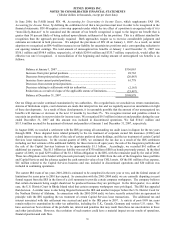

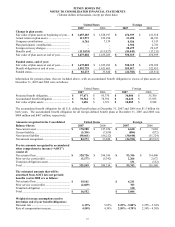

During 2007, the deferred tax asset and related valuation allowances for net operating losses changed primarily due to

establishing a valuation allowance against net deferred tax assets in Germany and France established in connection with

strategic initiatives taken in the fourth quarter (see Note 14 to the Consolidated Financial Statements) and acquisition activity.

As of December 31, 2007 and 2006, approximately $243.7 million and $185 million, respectively, of net operating loss carry

forwards were available to us. Most of these losses can be carried forward indefinitely.

It has not been necessary to provide for income taxes on $660 million of cumulative undistributed earnings of subsidiaries

outside the U.S. These earnings will be either indefinitely reinvested or remitted substantially free of additional tax.

Determination of the liability that would result in the event all of these earnings were remitted to the U.S. is not practicable.

It is estimated, however, that withholding taxes on such remittances would approximate $15 million.

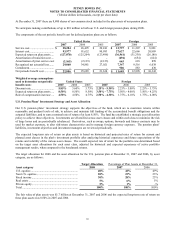

Other Tax Matters

We regularly assess the likelihood of tax adjustments in each of the tax jurisdictions in which we have operations and account

for the related financial statement implications. Tax reserves have been established which we believe to be appropriate given

the possibility of tax adjustments. Determining the appropriate level of tax reserves requires us to exercise judgment

regarding the uncertain application of tax law. The amount of reserves is adjusted when information becomes available or

when an event occurs indicating a change in the reserve is appropriate. Future changes in tax reserve requirements could

have a material impact on our results of operations.

We are continually under examination by tax authorities in the United States, other countries and local jurisdictions in which

we have operations. The years under examination vary by jurisdiction.