Pitney Bowes 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

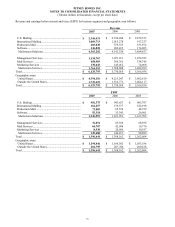

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

67

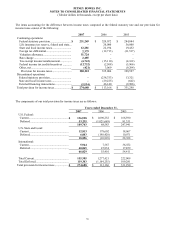

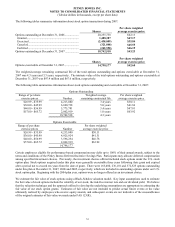

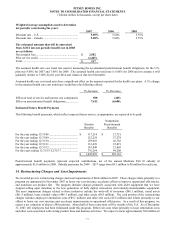

United States Foreign

2007

2006 2007 2006

Change in plan assets:

Fair value of plan assets at beginning of year.... $ 1,655,283

$ 1,528,917

$ 476,939 $ 411,518

Actual return on plan assets............................... 121,973 232,254

31,490 40,721

Company contributions ..................................... 8,781 7,139

8,926 9,513

Plan participants’ contributions......................... -

-

2,924 2,781

Foreign currency changes.................................. -

-

28,479 29,617

Benefits paid...................................................... (111,035) (113,027)

(18,443) (17,211)

Fair value of plan assets at end of year.............. $ 1,675,002 $ 1,655,283

$ 530,315

$ 476,939

Funded status, end of year:

Fair value of plan assets at end of year.............. $ 1,675,002 $ 1,655,283

$ 530,315 $ 476,939

Benefit obligations at end of year...................... 1,592,729 1,621,463

555,017 522,451

Funded status..................................................... $ 82,273 $ 33,820

$ (24,702)

$ (45,512)

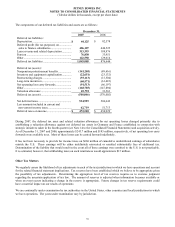

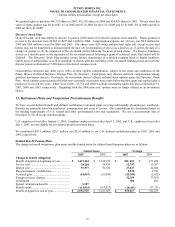

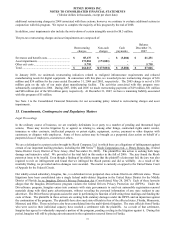

Information for pension plans, that are included above, with an accumulated benefit obligation in excess of plan assets at

December 31, 2007 and 2006 were as follows:

United States Foreign

2007 2006 2007 2006

Projected benefit obligation............................... $ 97,671 $ 95,370

$ 36,086

$ 35,700

Accumulated benefit obligation ........................ $ 78,564 $ 78,392

$ 34,428

$ 33,955

Fair value of plan assets .................................... $ 1,656 $ 1,521

$ 10,885

$ 9,548

The accumulated benefit obligation for all U.S. defined benefit plans at December 31, 2007 and 2006 was $1.5 billion for

both years. The accumulated benefit obligation for all foreign defined benefit plans at December 31, 2007 and 2006 was

$484 million and $467 million, respectively.

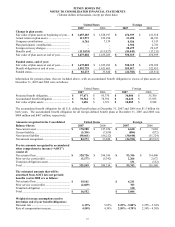

Amounts recognized in the Consolidated United States Foreign

Balance Sheets: 2007 2006 2007

2006

Non-current asset............................................... $ 178,288

$ 127,670

$ 6,630

$ 7,084

Current liability ................................................. (5,354) (7,638)

(884) (872)

Non-current liability .......................................... (90,661) (86,212)

(30,448) (51,724)

Net amount recognized...................................... $ 82,273 $ 33,820

$ (24,702) $ (45,512)

Pre-tax amounts recognized in accumulated

other comprehensive income (“AOCI”)

consist of:

Net actuarial loss ............................................... $ 328,726 $ 394,556

$ 93,346 $ 114,400

Prior service cost/(credit) .................................. (3,177) (5,342)

2,266 2,672

Transition obligation (asset).............................. -

-

131 (532)

Total .................................................................. $ 325,549 $ 389,214

$ 95,743 $ 116,540

The estimated amounts that will be

amortized from AOCI into net periodic

benefits cost in 2008 are as follows:

Net actuarial loss ............................................... $ 19,161

$ 4,211

Prior service cost/(credit) .................................. (2,609)

703

Transition obligation ........................................ -

130

Total .................................................................. $ 16,552

$ 5,044

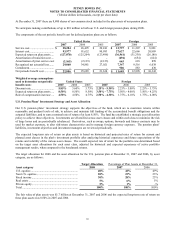

Weighted average assumptions used to

determine end of year benefit obligations:

Discount rate ..................................................... 6.15%

5.85% 2.25% - 5.80% 2.25% - 5.30%

Rate of compensation increase .......................... 4.50%

4.50% 2.50% - 4.70% 2.50% - 4.30%