Pitney Bowes 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

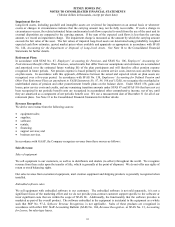

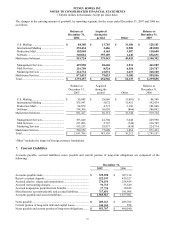

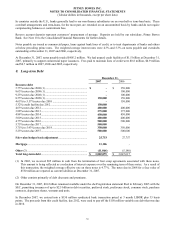

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

47

We record deferred tax assets for awards that result in deductions on our income tax returns, based on the amount of

compensation cost recognized and our statutory tax rate in the jurisdiction in which we will receive a deduction. Differences

between the deferred tax assets recognized for financial reporting purposes and the actual tax deduction reported in our

income tax return are recorded in capital in excess of par value (if the tax deduction exceeds the deferred tax asset or to the

extent that previously recognized credits to paid-in-capital are still available if the tax deduction is less than the deferred tax

asset).

Translation of Non-U.S. Currency Amounts

Assets and liabilities of subsidiaries operating outside the U.S. are translated at rates in effect at the end of the period and

revenue and expenses are translated at average monthly rates during the period. Net deferred translation gains and losses are

included in accumulated other comprehensive income in stockholders’ equity in the Consolidated Balance Sheets.

Derivative Instruments

In the normal course of business, the company is exposed to the impact of interest rate changes and foreign currency

fluctuations. The company limits these risks by following established risk management policies and procedures, including

the use of derivatives. The derivatives are used to manage the related cost of debt and to limit the effects of foreign exchange

rate fluctuations on financial results.

In our hedging program, we normally use forward contracts, interest-rate swaps, and currency swaps depending upon the

underlying exposure. We do not use derivatives for trading or speculative purposes. Changes in the fair value of the

derivatives are reflected as gains or losses. The accounting for the gains or losses depends on the intended use of the

derivative, the resulting designation, and the effectiveness of the instrument in offsetting the risk exposure it is designed to

hedge.

To qualify as a hedge, a derivative must be highly effective in offsetting the risk designated for hedging purposes. The

hedge relationship must be formally documented at inception, detailing the particular risk management objective and strategy

for the hedge. The effectiveness of the hedge relationship is evaluated on a retrospective and prospective basis.

As a result of the use of derivative instruments, we are exposed to counterparty risk. To mitigate such risks, we enter into

contracts with only those financial institutions that meet stringent credit requirements as set forth in our derivative policy.

We regularly review our credit exposure balances as well as the creditworthiness of our counterparties.

Foreign Exchange Contracts

We enter into foreign exchange contracts to minimize the impact of exchange rate fluctuations on inter-company loans and

related interest that are denominated in a foreign currency. The revaluation of the short-term inter-company loans and

interest and the mark-to-market on the derivatives are both recorded to income. At December 31, 2007, we had 16

outstanding foreign exchange contracts to buy or sell various currencies with an asset value of $1.9 million. The contracts

will expire by December 23, 2008.

We also enter into foreign currency exchange contracts arising from the anticipated purchase of inventory between affiliates.

These contracts are designed as cash flow hedges. The effective portion of the gain or loss on the cash flow hedges is

included in other comprehensive income in the period that the change in fair value occurs and is reclassified to income in the

same period that the hedged item affects income. At December 31, 2007, we had no outstanding contracts associated with

these anticipated transactions.

Certain foreign currency derivatives have been entered into to manage foreign currency transactional exposures associated

with the transactions between affiliates. These derivatives have no specific hedging designation so gains or losses are

recorded in income in the period that changes in fair value occur together with the offsetting foreign exchange gains or losses

on the underlying assets and liabilities. At December 31, 2007, the fair value of these derivatives was a liability of $1.9

million.