Pitney Bowes 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

50

and restructuring costs. FAS 141 (R) is effective for fiscal years beginning on or after December 15, 2008 and will be

applied prospectively. We are currently evaluating the impact of adopting this Statement.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements, an

amendment of ARB No. 51 (“FAS 160”). FAS 160 addresses the accounting and reporting for the outstanding noncontrolling

interest (previously referred to as minority interest) in a subsidiary and for the deconsolidation of a subsidiary. It also

establishes additional disclosures in the consolidated financial statements that identify and distinguish between the interests

of the parent’ s owners and of the noncontrolling owners of a subsidiary. FAS 160 requires changes in ownership interest that

do not result in deconsolidation to be accounted for as equity transactions. This Statement requires that a parent recognize a

gain or loss in net income when a subsidiary is deconsolidated. This gain or loss is measured using the fair value of the

noncontrolling equity investment. This Statement is effective for fiscal years beginning on or after December 15, 2008. FAS

160 requires retroactive adoption of the presentation and disclosure requirements for existing minority interests. All other

requirements of FAS 160 are applied prospectively. We are currently evaluating the impact of adopting this Statement.

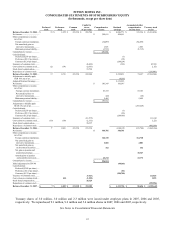

2. Discontinued Operations

On May 1, 2006, we completed the sale of our Imagistics lease portfolio to De Lage Landen Operational Services, LLC, a

subsidiary of Rabobank Group, for approximately $288 million. Net proceeds on the sale were approximately $282 million

after transaction expenses. We reported the results of the Imagistics lease portfolio in discontinued operations including an

after-tax gain of approximately $11 million from the sale of this portfolio.

On July 14, 2006, we completed the sale of our Capital Services external financing business to Cerberus Capital

Management, L.P. (Cerberus) for approximately $747 million and the assumption of approximately $470 million of non-

recourse debt and other liabilities. This sale resulted in the disposition of most of the external financing activity in the

Capital Services segment. The proceeds received at closing were used to pay our tax obligations. We reported the results of

the Capital Services business in discontinued operations including an after-tax loss of $445 million from the sale of this

business. We retained certain leveraged leases in Canada which are included in our International Mailing segment.

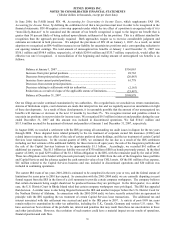

In August 2006, we reached a settlement with the Internal Revenue Service (IRS) on all outstanding tax audit issues in

dispute for tax years through 2000. Years after 2000 are still under review by the IRS. In connection with the settlement, we

recorded $61 million of additional tax expense of which $41 million was included in discontinued operations. See Note 9 for

further discussion of the IRS settlement.

In 2006, we accrued in discontinued operations an additional tax expense of $16 million to record the impact of the Tax

Increase Prevention and Reconciliation Act (TIPRA). The TIPRA legislation repealed the exclusion from federal income

taxation of a portion of the income generated from certain leveraged leases of aircraft by foreign sales corporations (FSC).

In December 2006, we sold our bankruptcy claim related to certain aircraft leases with Delta Airlines. We received proceeds

of $14.5 million, which represent a contingent gain pending the bankruptcy court decision. Given the continued uncertainty

and inability to anticipate the outcome of the bankruptcy court decision, we have not recognized any portion of this

contingent gain in our consolidated income statement.

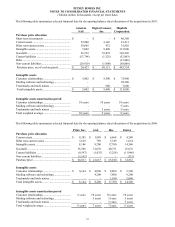

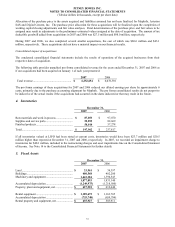

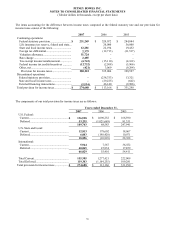

The following table shows selected financial information included in discontinued operations for the years ended December

31:

Discontinued Operations 2007 2006 2005

Revenue .......................................................................................... $ -

$ 81,199 $ 125,247

Pretax income ................................................................................. $ -

$ 29,465 $ 38,061

Net income...................................................................................... $ 5,534

$ 30,982 $ 35,368

Gain on sale of Imagistics, net of $7,075 tax expense ................... -

11,065 -

FSC tax law change ........................................................................ -

(16,209) -

Additional tax on IRS settlement.................................................... -

(41,000) -

Loss on sale of Capital Services, net of $284,605 tax benefit ....... -

(445,150) -

Total discontinued operations, net of tax ........................................ $ 5,534

$ (460 ,3 12 ) $ 35,368