Pitney Bowes 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

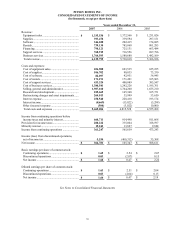

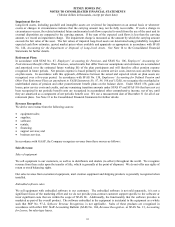

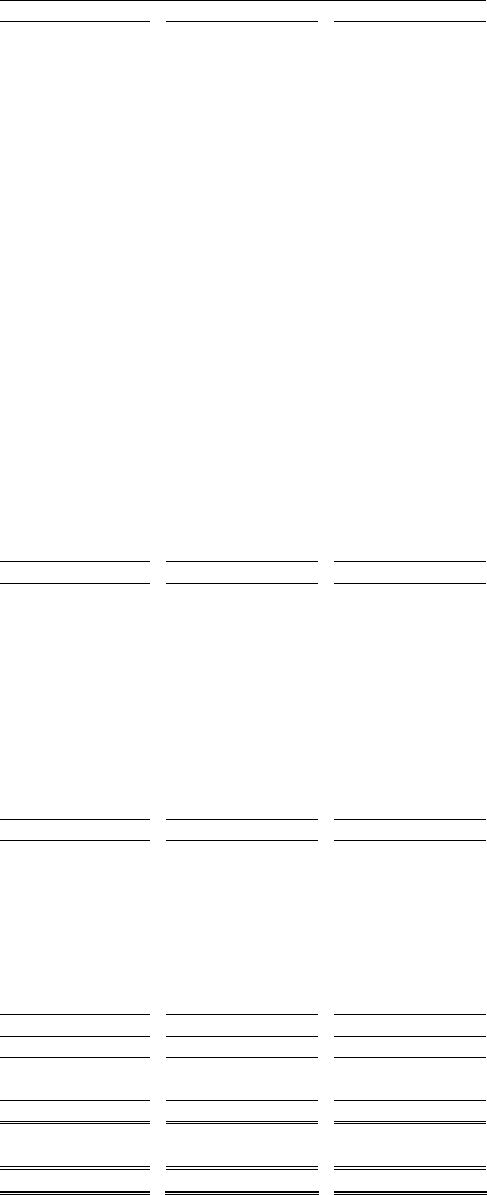

PITNEY BOWES INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Years ended December 31,

2007 2006 2005

Cash flows from operating activities:

Net income ................................................................................ $ 366,781

$ 105,347

$ 508,611

Gain on sale of a facility, net of tax .......................................... (1,623) -

-

Loss on sale of Capital Services, net of tax............................... - 445,150

-

Gain on sale of Imagistics, net of tax ........................................ - (11,065)

-

Non-cash charge from FSC tax law change .............................. - 16,209

-

Non-cash tax charge.................................................................. - 61,000

-

Tax and bond payments related to IRS settlement

and Capital Services sale......................................................

-

(1,040,700)

(200,000)

Restructuring and other charges, net of tax ............................... 223,486

23,040

42,248

Restructuring and other payments............................................. (31,568)

(51,566)

(88,544)

Adjustments to reconcile net income ........................................

to net cash provided by (used in) operating activities:

Depreciation and amortization .............................................. 383,141 363,258

331,963

Stock-based compensation .................................................... 24,131 27,375

27,223

Pension plan contributions .................................................... - -

(76,508)

Changes in operating assets and liabilities, excluding

effects of acquisitions:

Accounts receivable .......................................................... 35,853

(46,623)

(87,646)

Net investment in internal finance receivables .................. (86,238)

(236,872)

(105,358)

Inventories......................................................................... 7,710

(142)

(7,835)

Other current assets and prepayments ............................... 906

(11,360)

(12,114)

Accounts payable and accrued liabilities........................... 32,789

42,231

3,324

Current and non-current income taxes............................... 123,636

52,784

185,628

Advance billings................................................................ 1,745

(6,029)

19,508

Other, net........................................................................... (20,284)

(18,611)

(10,059)

Net cash provided by (used in) operating activities............... 1,060,465

(286,574)

530,441

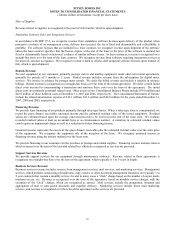

Cash flows from investing activities:

Short-term investments ............................................................. 42,367

(1,295)

(44,099)

Proceeds from the sale of facilities............................................ 29,608

-

30,238

Capital expenditures.................................................................. (264,656)

(327,877)

(291,550)

Net investment in external financing......................................... (2,214)

109,050

117,595

Net proceeds from sale of Imagistics lease portfolio................. - 281,653

-

Net proceeds from sale of Capital Services............................... - 746,897

-

Cash included in the sale of Capital Services............................ - (25,488)

-

Advance against COLI cash surrender value ............................ - 138,381

-

Acquisitions, net of cash acquired............................................. (594,110)

(230,628)

(294,176)

Reserve account deposits .......................................................... 62,666

28,780

9,800

Net cash (used in) provided by investing activities ............... (726,339)

719,473

(472,192)

Cash flows from financing activities:

(Decrease) increase in notes payable, net.................................. (89,673)

(26,790)

(31,150)

Proceeds from long-term obligations ........................................ 640,765

493,285

1,050,000

Principal payments on long-term obligations............................ (174,191)

(396,755)

(695,724)

Proceeds from issuance of stock ............................................... 107,517

101,449

92,164

Proceeds from issuance of preferred stock in a subsidiary........ - 74,165

-

Stock repurchases...................................................................... (399,996)

(400,000)

(258,803)

Dividends paid .......................................................................... (288,790)

(285,051)

(284,348)

Net cash used in financing activities ..................................... (204,368)

(439,697)

(127,861)

Effect of exchange rate changes on cash..................................... 8,316

2,391

(3,096)

Increase (decrease) in cash and cash equivalents ........................ 138,074

(4,407)

(72,708)

Cash and cash equivalents at beginning of year .......................... 239,102

243,509

316,217

Cash and cash equivalents at end of year .................................... $ 377,176

$ 239,102

$ 243,509

Cash interest paid ........................................................................ $ 236,697

$ 225,837

$ 196,964

Cash income taxes paid, net ........................................................ $ (178,469) $ 1,315,437 $ 164,068

See Notes to Consolidated Financial Statements