Pitney Bowes 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

56

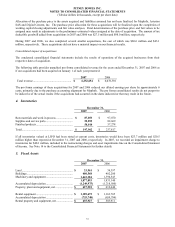

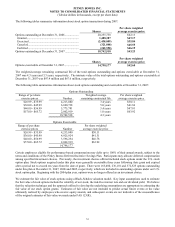

In countries outside the U.S., banks generally lend to our non-finance subsidiaries on an overdraft or term-loan basis. These

overdraft arrangements and term-loans, for the most part, are extended on an uncommitted basis by banks and do not require

compensating balances or commitment fees.

Reserve account deposits represent customers’ prepayment of postage. Deposits are held by our subsidiary, Pitney Bowes

Bank. See Note 18 to the Consolidated Financial Statements for further details.

Notes payable are issued as commercial paper, loans against bank lines of credit, or to trust departments of banks and others

at below prevailing prime rates. The weighted average interest rates were 4.3% and 5.3% on notes payable and overdrafts

outstanding at December 31, 2007 and 2006, respectively.

At December 31, 2007, notes payable totaled $405.2 million. We had unused credit facilities of $1.5 billion at December 31,

2007, primarily to support commercial paper issuances. Fees paid to maintain lines of credit were $0.8 million, $0.9 million

and $0.7 million in 2007, 2006 and 2005, respectively.

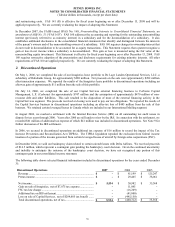

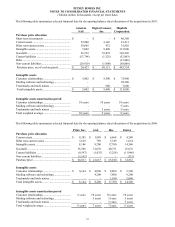

8. Long-term Debt

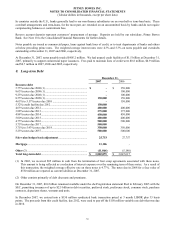

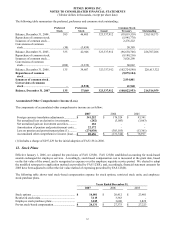

December 31,

2007

2006

Recourse debt

5.75% notes due 2008 (1).......................................................... $ - $ 350,000

8.63% notes due 2008 (1) .......................................................... -

100,000

9.25% notes due 2008 (1) .......................................................... -

100,000

8.55% notes due 2009 (1) .......................................................... 150,000 150,000

4.65% to 5.57% notes due 2010 ................................................ -

150,000

5.32% credit facility due 2012................................................... 150,000 -

4.63% notes due 2012................................................................ 400,000 400,000

3.88% notes due 2013................................................................ 375,000 375,000

4.88% notes due 2014................................................................ 450,000 450,000

5.00% notes due 2015................................................................ 400,000 400,000

4.75% notes due 2016................................................................ 500,000 500,000

5.75% notes due 2017................................................................ 500,000 -

3.75% to 5.43% notes due 2018 ................................................ 350,000 350,000

5.25% notes due 2037................................................................ 500,000 500,000

Fair value hedges basis adjustment........................................ 25,753 27,757

Mortgage................................................................................... 13,186 -

Other (2) ................................................................................... (11,864) (5,140)

Total long-term debt................................................................ $ 3,802,075 $ 3,847,617

(1) In 2002, we received $95 million in cash from the termination of four swap agreements associated with these notes.

This amount is being reflected as a reduction of interest expense over the remaining term of these notes. As a result of

this transaction, the weighted average effective rate on these notes is 4.77%. The notes due in 2008 for a face value of

$550 million are reported as current liabilities at December 31, 2007.

(2) Other consists primarily of debt discounts and premiums.

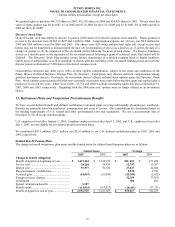

On December 31, 2007, $0.6 billion remained available under the shelf registration statement filed in February 2005 with the

SEC, permitting issuances of up to $2.5 billion in debt securities, preferred stock, preference stock, common stock, purchase

contracts, depositary shares, warrants and units.

In December 2007, we entered into a $150 million syndicated bank transaction priced at 3 month LIBOR plus 35 basis

points. The proceeds from this credit facility, due 2012, were used to pay off the $150 million variable rate debt that was due

in 2010.