Pitney Bowes 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

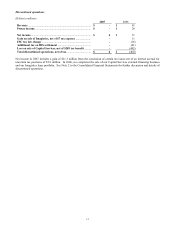

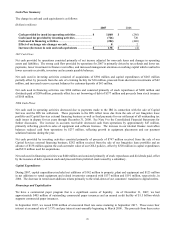

Cash Flow Summary

The change in cash and cash equivalents is as follows:

(Dollars in millions)

2007 2006

Cash provided by (used in) operating activities...................... $ 1,060 $ (286)

Cash (used in) provided by investing activities ....................... (726) 720

Cash used in financing activities .............................................. (204) (440)

Effect of exchange rate changes on cash.................................. 8 2

Increase (decrease) in cash and cash equivalents ................... $ 138 $ (4)

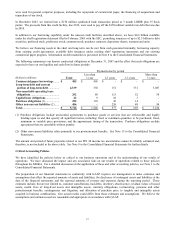

2007 Cash Flows

Net cash provided by operations consisted primarily of net income adjusted for non-cash items and changes in operating

assets and liabilities. The strong cash flow provided by operations for 2007 is primarily driven by tax refunds and lower tax

payments, lower investment in finance receivables, and increased management attention on working capital which resulted in

lower accounts receivable, inventory and accounts payable balances.

Net cash used in investing activities consisted of acquisitions of $594 million and capital expenditures of $265 million

partially offset by proceeds from the sale of a training facility for $30 million, proceeds from short-term investments of $42

million, and increased reserve account balances for customer deposits of $63 million.

Net cash used in financing activities was $204 million and consisted primarily of stock repurchases of $400 million and

dividends paid of $289 million, primarily offset by a net borrowing of debt of $377 million and proceeds from stock issuance

of $108 million.

2006 Cash Flows

Net cash used in operating activities decreased due to payments made to the IRS in connection with the sale of Capital

Services and the IRS tax settlement. These payments to the IRS reflect taxes due from the sale of our Imagistics lease

portfolio and Capital Services external financing business as well as final payments for our settlement of all outstanding tax

audit issues in dispute for tax years through December 31, 2000. See Note 9 to the Consolidated Financial Statements for

further discussion. The increase in accounts receivable decreased cash from operations by approximately $47 million,

primarily reflecting growth in sales of equipment and software licenses. The increase in our internal finance receivables

balances reduced cash from operations by $237 million, reflecting growth in equipment placements and our payment

solutions business during the year.

Net cash provided by investing activities consisted primarily of proceeds of $747 million received from the sale of our

Capital Services external financing business, $282 million received from the sale of our Imagistics lease portfolio and an

advance of $138 million against the cash surrender value of our COLI policies, offset by $328 million in capital expenditures

and $231 million used for acquisitions.

Net cash used in financing activities was $440 million and consisted primarily of stock repurchases and dividends paid, offset

by the issuance of debt, common stock and proceeds from preferred stock issued by a subsidiary.

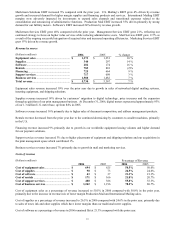

Capital Expenditures

During 2007, capital expenditures included net additions of $142 million to property, plant and equipment and $123 million

in net additions to rental equipment and related inventories compared with $137 million and $191 million, respectively, in

2006. The decrease in rental asset additions relates primarily to the wind-down of our customers’ transition to digital meters.

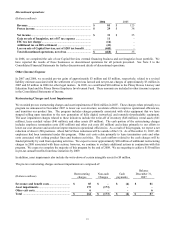

Financings and Capitalization

We have a commercial paper program that is a significant source of liquidity. As of December 31, 2007, we had

approximately $405 million of outstanding commercial paper issuances and an unused credit facility of $1.5 billion which

supports commercial paper issuances.

In September 2007, we issued $500 million of unsecured fixed rate notes maturing in September 2017. These notes bear

interest at an annual rate of 5.75% and pay interest semi-annually beginning in March 2008. The proceeds from these notes