Pitney Bowes 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

58

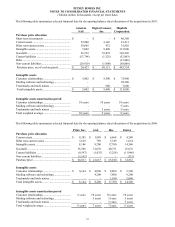

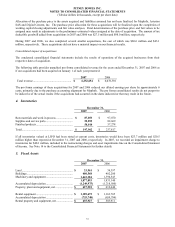

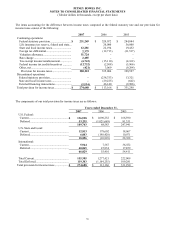

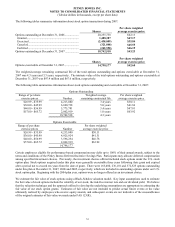

The items accounting for the difference between income taxes computed at the federal statutory rate and our provision for

income taxes consist of the following:

2007 2006 2005

Continuing operations:

Federal statutory provision .............................$ 231,249

$ 320,072 $ 284,084

Life insurance tax reserve, federal and state... -

20,000 56,000

State and local income taxes .......................... 12,281

22,194 19,452

Foreign tax differential................................... 2,379

(12,713) (11,517)

Valuation allowance....................................... 51,724

- -

Rate change .................................................... 2,485

- -

Tax exempt income/reimbursement ............... (6,743) (15,110) (4,162)

Federal income tax credits/incentives ............ (12,732) (2,508) (5,966)

Other, net........................................................ (421) 3,069 (9,294)

Provision for income taxes........................... 280,222

335,004 328,597

Discontinued operations:

Federal statutory provision.............................. -

(238,753) 13,321

State and local income taxes ........................... -

(29,225) (642)

External financing transactions....................... (5,534) 46,140 (9,986)

Total provision for income taxes........................$ 274,688

$ 113,166 $ 331,290

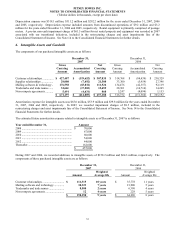

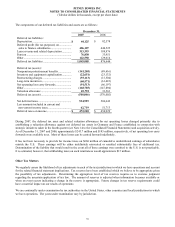

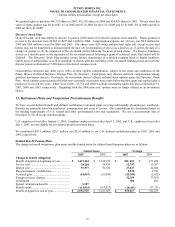

The components of our total provision for income taxes are as follows:

Years ended December 31,

2007 2006 2005

U.S. Federal:

Current.......................................................

$ 136,528

$ 1,090,252 $ 166,590

Deferred.....................................................

53,235

(1,021,669) 81,351

189,763

68,583 247,941

U.S. State and Local:

Current.......................................................

12,813

179,602 18,867

Deferred.....................................................

6,083

(190,420) 10,071

18,896

(10,818) 28,938

International:

Current.......................................................

5,964

7,567 36,552

Deferred.....................................................

60,065

47,834 17,859

66,029

55,401 54,411

Total Current ...............................................

155,305

1,277,421 222,009

Total Deferred..............................................

119,383

(1,164,255) 109,281

Total provision for income taxes ...................

$ 274,688

$ 113,166 $ 331,290