Pitney Bowes 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

62

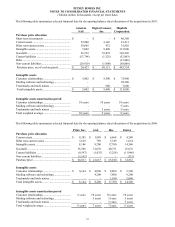

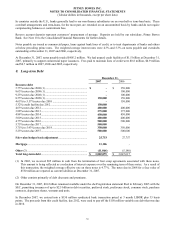

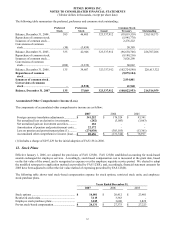

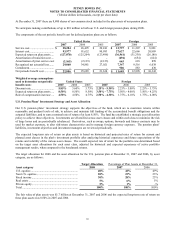

The following table summarizes the preferred, preference and common stock outstanding:

Common Stock

Preferred

Stock

Preference

Stock Issued Treasury Outstanding

Balance, December 31, 2004 . 385 46,405 323,337,912 (93,019,539) 230,318,373

Repurchase of common stock. (5,945,778)

Issuances of common stock ... 2,276,222

Conversions of common

stock.....................................

(50)

(3,459)

58,389

Balance, December 31, 2005 . 335 42,946 323,337,912 (96,630,706) 226,707,206

Repurchase of common stock. (9,180,216)

Issuances of common stock ... 3,026,290

Conversions of common

stock..................................... (200) (3,339) 60,042

Balance, December 31, 2006 . 135 39,607 323,337,912) (102,724,590) 220,613,322)

Repurchase of common

stock ....................................

(9,075,104)

Issuances of common stock . 2,934,801

Conversions of common

stock ....................................

-

(2,538)

41,940

Balance, December 31, 2007 135 37,069 323,337,912 (108,822,953) 214,514,959

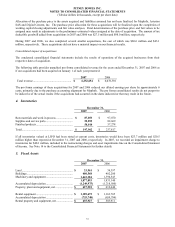

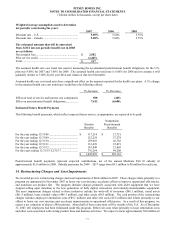

Accumulated Other Comprehensive Income (Loss)

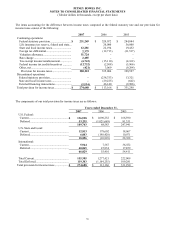

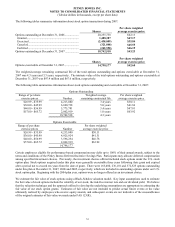

The components of accumulated other comprehensive income are as follow:

2007 2006 2005

Foreign currency translation adjustments ................. $ 341,252

$ 176,524) $ 93,341

Net unrealized loss on derivative investments.......... (282)

(3,083) (3,063)

Net unrealized gain on investment securities............ 352

- -

Amortization of pension and postretirement costs.... 22,172

- -

Loss on pension and postretirement plans (1)........... (274,838)

(305,185) (13,361)

Accumulated other comprehensive income (loss) .... $ 88,656

$ (131,744) $ 76,917

(1) Includes a charge of $297,229 for the initial adoption of FAS 158 in 2006.

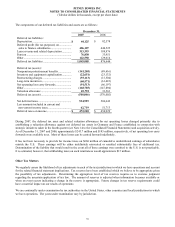

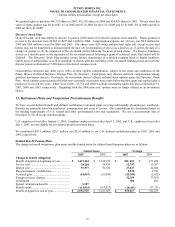

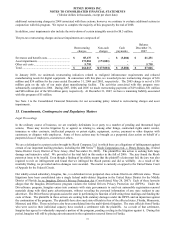

12.1Stock Plans

Effective January 1, 2006, we adopted the provisions of FAS 123(R). FAS 123(R) established accounting for stock-based

awards exchanged for employee services. Accordingly, stock-based compensation cost is measured at the grant date, based

on the fair value of the award, and is recognized as expense over the employee requisite service period. We elected to adopt

the modified retrospective application method as provided by FAS 123(R), and, accordingly, financial statement amounts for

2005 have been adjusted to reflect the fair value method of expensing prescribed by FAS 123(R).

The following table shows total stock-based compensation expense for stock options, restricted stock units, and employee

stock purchase plans.

Years Ended December 31,

2007 2006 2005

Stock options ............................................................ $ 14,001

$ 20,412 $ 23,401

Restricted stock units................................................ 7,115

3,363 -

Employee stock purchase plans ................................ 3,015

3,600 3,822

Pre-tax stock-based compensation ................................ $ 24,131

$ 27,375 $ 27,223