Pitney Bowes 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

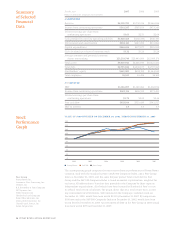

Financial

Highlights

From Our CFO

Michael Monahan

The year 2007 held both successes and challenges for Pitney Bowes.

Although we made signifi cant progress in advancing our growth

strategies and generated unprecedented levels of free cash fl ow, we

did not achieve our earnings objectives and our stock price declined

during the year.

We have taken decisive actions to achieve stronger performance going

forward and to deliver enhanced shareholder value. To this end, we

have launched a series of transition initiatives to reduce costs, accelerate

improvements in operational effi ciencies, and position our product

line for the current and future regulatory environment.

In addition, we continue to investigate strategic alternatives for our

U.S. Management Services business to best align our resources for

sustained profi table growth.

Our revenue grew by 7 percent during 2007. This includes 2 percent

from favorable currency translation and 4 percent from acquisitions,

including that of MapInfo, our largest acquisition to date.

Excluding the transition initiatives charges and other items, we

grew our adjusted earnings per share from $2.69 to $2.72 per share.

However, this performance was below our expectations of $2.90

to $2.98 when we started the year. (See page 15 for a reconciliation

of adjusted-to-GAAP earnings per share.) Our earnings per share

from continuing operations on a GAAP basis was $1.63, which was

less than the prior year, primarily because of the charges related to

our transition initiatives.

In the fourth quarter, we took a pretax charge of $264 million

related to the transition initiatives. This included a non-cash charge

of $173 million related to the write-down of certain products that

will be discontinued, as well as $85 million related to net headcount

reductions of approximately 1,400. Other write-downs accounted for

the remaining $6 million. We expect these actions to generate annu-

alized savings of $150 million by 2009, half of which we expect to

reinvest in the business to enhance our growth and competitiveness.

Some of our businesses performed much better than expected, notably

our software and mail services segments and our operations in the

Asia-Pacifi c region. However, these strong results were offset by a con-

fl uence of other factors, including the wind-down of electronic-to-digital

12 PITNEY BOWES ANNUAL REPORT 2007