Pitney Bowes 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

60

In June 2006, the FASB issued FIN. 48, Accounting for Uncertainty in Income Taxes, which supplements FAS 109,

Accounting for Income Taxes, by defining the confidence level that a tax position must meet in order to be recognized in the

financial statements. FIN 48 requires a two-step approach under which the tax effect of a position is recognized only if it is

“more-likely-than-not” to be sustained and the amount of tax benefit recognized is equal to the largest tax benefit that is

greater than 50 percent likely of being realized upon ultimate settlement of the tax position. This is a different standard for

recognition than the approach previously required. Both approaches require us to exercise considerable judgment and

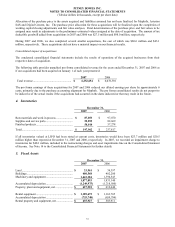

estimates are inherent in both processes. We adopted the provisions of FIN 48 on January 1, 2007. As a result, on initial

adoption we recognized an $84.4 million increase in our liability for uncertain tax positions and a corresponding reduction to

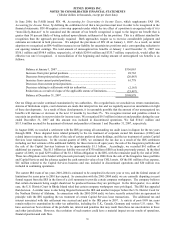

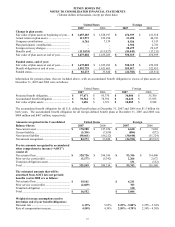

our opening retained earnings. The total amount of unrecognized tax benefits at January 1 and December 31, 2007 was

$356.1 million and $398.9 million, respectively, of which $299.6 million and $335.7 million, respectively, would affect the

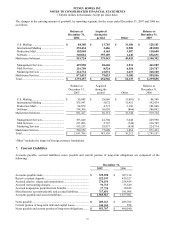

effective tax rate if recognized. A reconciliation of the beginning and ending amount of unrecognized tax benefits is as

follows:

Balance at January 1, 2007..................................................................................

$356,063

Increases from prior period positions .................................................................. 28,762

Decreases from prior period positions................................................................. (20,063)

Increases from current period positions............................................................... 61,778

Decreases from current period positions ............................................................. -

Decreases relating to settlements with tax authorities ......................................... (2,165)

Reductions as a result of a lapse of the applicable statute of limitations............. (25,497)

Balance at December 31, 2007............................................................................ $398,878

Our tax filings are under continual examination by tax authorities. On a regular basis we conclude tax return examinations,

statutes of limitations expire, court decisions are made that interpret tax law and we regularly assess tax uncertainties in light

of these developments. As a result of these developments, it is reasonably possible that the amount of our unrecognized tax

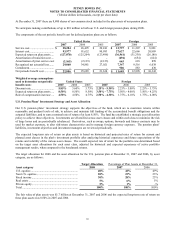

benefits will increase or decrease in the next 12 months by less than 5%. We recognize interest and penalties related to

uncertain tax positions in our provision for income taxes. We recognized $9.5 million in interest and penalties during the year

ended December 31, 2007 and this amount was included in discontinued operations. We had $104.1 million and

$113.6 million accrued for the payment of interest and penalties at January 1 and December 31, 2007, respectively.

In August 2006, we reached a settlement with the IRS governing all outstanding tax audit issues in dispute for the tax years

through 2000. These disputed items related primarily to the tax treatment of corporate owned life insurance (COLI) and

related interest expense, the tax effect of the sale of certain preferred share holdings, and the tax treatment of certain Capital

Services lease transactions. In the second quarter of 2006, we estimated the tax due as a result of the IRS settlement

including our best estimate of the additional liability for these items in all open years, the sale of the Imagistics portfolio and

the sale of the Capital Services business to be approximately $1.1 billion. Accordingly, we recorded $61 million of

additional tax expense. The $1.1 billion tax liability was net of $330 million of IRS tax bonds previously posted. In the third

quarter of 2006, we paid $239 million of the $1.1 billion obligation to the IRS, with the remainder paid by the end of 2006.

These tax obligations were funded with proceeds previously received in 2006 from the sale of the Imagistics lease portfolio

and Capital Services and the advance against the cash surrender value of our COLI assets. Of the $61 million of tax expense,

$41 million related to the Capital Services business and was included in discontinued operations and $20 million was

included in continuing operations.

The current IRS exam of tax years 2001-2004 is estimated to be completed in the next year or two, and the federal statute of

limitations for years prior to 2001 has expired. In connection with the 2001-2004 audit, we are currently disputing a recent

formal request from the IRS in the form of a civil summons to provide certain company workpapers. The company believes

that certain documents being sought should not be produced because they are privileged. In the third quarter, in a similar

case, the U.S. District Court in Rhode Island ruled that certain company workpapers were privileged. The IRS has appealed

that decision. A similar issue is also being litigated between the IRS and another taxpayer before the U.S. District Court for

the Northern District of Alabama. In connection with the 2001-2004 audit, we have recently entered into an agreement in

principle with the IRS regarding the tax treatment of certain Capital Services lease transactions. The additional tax and

interest associated with this settlement was accrued and paid to the IRS prior to 2007. A variety of post-1999 tax years

remain subject to examination by other tax authorities, including the U.K., Canada, Germany and various U.S. states. We

have accrued our best estimate of the probable tax, interest and penalties that may result from these tax uncertainties in these

and other jurisdictions. However, the resolution of such matters could have a material impact on our results of operations,

financial position and cash flow.