Pitney Bowes 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

66

We granted rights to purchase 446,755 shares in 2007, 435,592 shares in 2006 and 434,428 shares in 2005. The per share fair

value of rights granted was $8 in 2007, $7 in 2006 and $7 in 2005 for the U.S. ESPP and $7 in 2007, $8 in 2006 and $8 in

2005 for the U.K. ESPP.

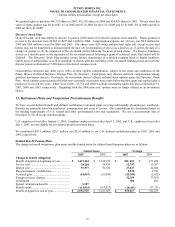

Directors’ Stock Plan

Under this plan, each non-employee director is granted 2,200 shares of restricted common stock annually. Shares granted at

no cost to the directors were 24,665 in 2007 and 14,000 in 2006. Compensation expense, net of taxes, was $0.8 million for

2007 and $0.4 million a year for 2006 and 2005. The shares carry full voting and dividend rights but, except as provided

herein, may not be transferred or alienated until the later of (1) termination of service as a director, or, if earlier, the date of a

change of control, or (2) the expiration of the six-month period following the grant of such shares. If a director terminates

service as a director prior to the expiration of the six-month period following a grant of restricted stock, that award will be

forfeited. The Directors’ Stock Plan permits certain limited dispositions of restricted common stock to family members,

family trusts or partnerships, as well as donations to charity after the expiration of the six-month holding period, provided the

director retains a minimum of 7,500 shares of restricted common stock.

Non-employee directors may defer up to 100% of their eligible compensation, subject to the terms and conditions of the

Pitney Bowes Deferred Incentive Savings Plan for directors. Participants may allocate deferred compensation among

specified investment choices. Previously, the investment choices offered included stock options under the Directors’ Stock

Plan. Stock options acquired under this plan were generally exercisable three years following their grant and expired after a

period not to exceed ten years. There were 22,091, 41,716 and 48,019 options outstanding under this plan at December 31,

2007, 2006 and 2005, respectively. Beginning with the 2004 plan year, options were no longer offered as an investment

choice.

13. Retirement Plans and Nonpension Postretirement Benefits

We have several defined benefit and defined contribution retirement plans covering substantially all employees worldwide.

Benefits are primarily based on employees’ compensation and years of service. Our contributions are determined based on

the funding requirements of U.S. federal and other governmental laws and regulations. We use a measurement date of

December 31 for all of our retirement plans.

U.S. employees hired after January 1, 2005, Canadian employees hired after April 1, 2005, and U.K. employees hired after

July 1, 2005, are not eligible for our defined benefit retirement plans.

We contributed $30.5 million, $28.1 million and $22.6 million to our U.S. defined contribution plans in 2007, 2006 and

2005, respectively.

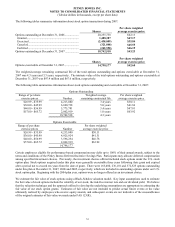

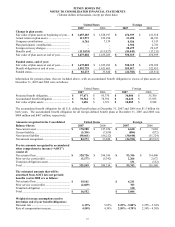

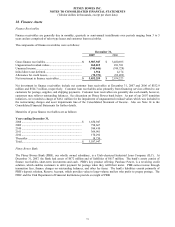

Defined Benefit Pension Plans

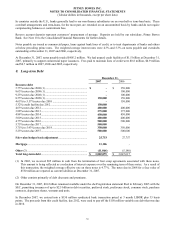

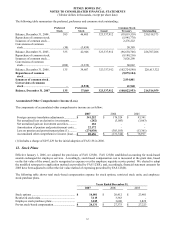

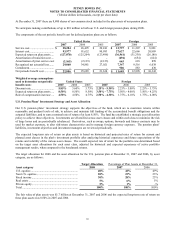

The change in benefit obligations, plan assets and the funded status for defined benefit pension plans are as follows:

United States Foreign

2007

2006 2007 2006

Change in benefit obligation:

Benefit obligation at beginning of year ............. $ 1,621,463

$ 1,638,252

$ 522, 451

$ 471,420

Service cost ....................................................... 28,204

26,495

12,797 11,207

Interest cost ....................................................... 93,977

91,652

27,627 22,666

Plan participants’ contributions......................... -

-

2,924 2,781

Actuarial gain .................................................... (41,067)

(21,909)

(25,544) (2,655)

Foreign currency changes.................................. - -

32,299 33,360

Curtailment ....................................................... - -

906 883

Special termination benefits ............................. 1,187 -

- -

Benefits paid...................................................... (111,035)

(113,027)

(18,443) (17,211)

Benefit obligation at end of year ....................... $ 1,592,729

$ 1,621,463

$ 555,017

$ 522,451