Pitney Bowes 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

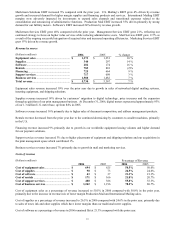

New Accounting Pronouncements

In May 2005, the Financial Accounting Standards Board (FASB) issued SFAS No. 154, Accounting Changes and Error

Corrections (“FAS 154”), which replaces APB Opinion No. 20, Accounting Changes and SFAS No. 3, Reporting Accounting

Changes in Interim Financial Statements-An Amendment of APB Opinion No. 28. FAS 154 requires retrospective application

to prior periods’ financial statements of a voluntary change in accounting principle unless it is not practicable. FAS 154 is

effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005. Our

adoption of SFAS 154 did not have a material impact on our financial position, results of operations or cash flows.

In June 2005, the FASB issued FASB Staff Position (FSP) No. FAS 143-1, Accounting for Electronic Equipment Waste

Obligations, that provides guidance on how commercial users and producers of electronic equipment should recognize and

measure asset retirement obligations associated with the European Directive 2002/96/EC on Waste Electrical and Electronic

Equipment (the Directive). The adoption of this FSP did not have a material effect on our financial position, results of

operations or cash flows for those European Union (EU) countries that enacted the Directive into country-specific laws.

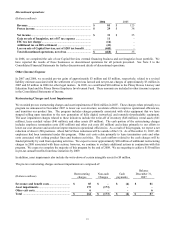

In June 2006, the FASB issued FASB Interpretation (FIN) No. 48, Accounting for Uncertainty in Income Taxes (“FIN 48”),

which supplements Statement of Financial Accounting Standard No. 109, Accounting for Income Taxes, by defining the

confidence level that a tax position must meet in order to be recognized in the financial statements. FIN 48 requires the tax

effect of a position to be recognized only if it is “more-likely-than-not” to be sustained based solely on its technical merits as

of the reporting date. If a tax position is not considered more-likely-than-not to be sustained based solely on its technical

merits, no benefits of the position are recognized. This is a different standard for recognition than was previously required.

The more-likely-than-not threshold must continue to be met in each reporting period to support continued recognition of a

benefit. At adoption, companies adjusted their financial statements to reflect only those tax positions that were more-likely-

than-not to be sustained as of the adoption date. Any necessary adjustment was recorded directly to opening retained earnings

in the period of adoption and reported as a change in accounting principle. We adopted the provisions of FIN 48 on January

1, 2007 which resulted in a decrease to opening retained earnings of $84.4 million, with a corresponding increase in our tax

liabilities.

In July 2006, the FASB issued FSP No. FAS 13-2, Accounting for a Change or Projected Change in the Timing of Cash

Flows Relating to Income Taxes Generated by a Leveraged Lease Transaction, that provided guidance on how a change or a

potential change in the timing of cash flows relating to income taxes generated by a leveraged lease transaction affected the

accounting by a lessor for the lease. We adopted the provisions of FSP No. FAS 13-2 on January 1, 2007. Our adoption of

this FSP did not have a material impact on our financial position, results of operations or cash flows.

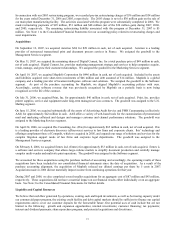

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“FAS 157”), to define how the fair value of

assets and liabilities should be measured in accounting standards where it is allowed or required. In addition to defining fair

value, the statement establishes a framework within GAAP for measuring fair value and expands required disclosures

surrounding fair-value measurements. While it will change the way companies currently measure fair value, it does not

establish any new instances where fair value measurement is required. FAS 157 defines fair value as an amount that a

company would receive if it sold an asset or paid to transfer a liability in a normal transaction between market participants in

the same market where the company does business. It emphasizes that the value is based on assumptions that market

participants would use, not necessarily only the company that might buy or sell the asset. The FASB issued FASB Staff

Position (FSP) No. FAS 157-a, Application of FASB Statement No. 157 to FASB Statement No. 13 and Its Related

Interpretive Accounting Pronouncements That Address Leasing Transactions, which eliminated lease accounting from the

scope of this standard. FAS 157, as issued, is effective for fiscal years beginning after November 15, 2007. The FASB

issued FASB Staff Position (FSP) No. FAS 157-b, Effective Date of FASB Statement No. 157, which delays the effective date

by one year for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value

in the financial statements on a recurring basis, at least annually. We do not expect that the adoption of this statement for

financial assets and liabilities, effective January 1, 2008, will have a material impact on our financial position, results of

operations, or cash flow. We continue to evaluate the impact of adopting this statement for the nonfinancial items deferred

until January 1, 2009.

In September 2006, the FASB issued SFAS No. 158, Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans an amendment of FASB Statements No. 87, 88, 106 and 132(R) (“FAS 158”), which required

recognition of the overfunded or underfunded status of pension and other postretirement benefit plans on the balance sheet.

Under FAS 158, gains and losses, prior service costs and credits, and any remaining transition amounts under SFAS 87 and

SFAS 106 that have not yet been recognized through net periodic benefit cost were recognized in accumulated other

comprehensive income, net of tax effects, until they are amortized as a component of net periodic cost. Our adoption of the

provisions of FAS 158 reduced stockholders’ equity by $297 million at December 31, 2006. FAS 158 did not affect our

results of operations or cash flows.