Pitney Bowes 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

were used for general corporate purposes, including the repayment of commercial paper, the financing of acquisitions and

repurchase of our stock.

In December 2007, we entered into a $150 million syndicated bank transaction priced at 3 month LIBOR plus 35 basis

points. The proceeds from this credit facility, due 2012, were used to pay off the $150 million variable rate debt that was due

in 2010.

In addition to our borrowing capability under the unused credit facilities described above, we have $0.6 billion available

under the shelf registration statement filed in February 2005 with the SEC, permitting issuances of up to $2.5 billion in debt

securities, preferred stock, preference stock, common stock, purchase contracts, depository shares, warrants and units.

We believe our financing needs in the short and long term can be met from cash generated internally, borrowing capacity

from existing credit agreements, available debt issuances under existing shelf registration statements and our existing

commercial paper program. Information on debt maturities is presented in Note 8 to the Consolidated Financial Statements.

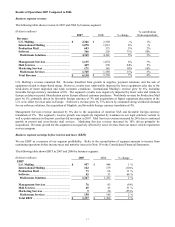

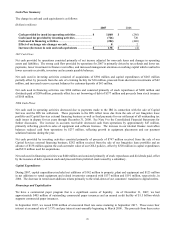

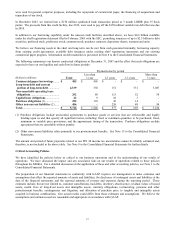

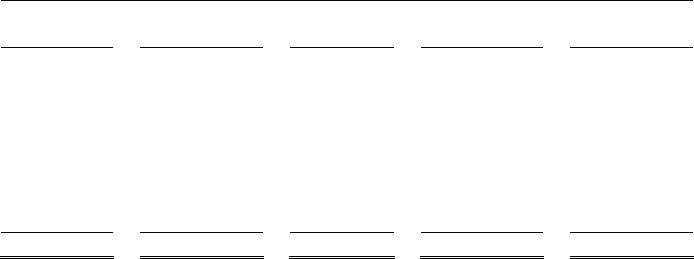

The following summarizes our known contractual obligations at December 31, 2007 and the effect that such obligations are

expected to have on our liquidity and cash flow in future periods:

Payments due by period

(Dollars in millions)

Total

Less than

1 year

1-3 years

3-5 years

More than

5 years

Commercial paper borrowings ....... $ 405 $ 405 $ - $ - $ -

Long-term debt and current

portion of long-term debt ...............

4,339

550

151

551

3,087

Non-cancelable operating lease

obligations........................................

292

89

113

52

38

Capital lease obligations .................. 22 9 10 3 -

Purchase obligations (1)................... 252 193 45 14 -

Other non-current liabilities (2) ...... 406 -

258 49 99

Total................................................... $ 5,716 $ 1,246 $ 577 $ 669 $ 3,224

(1) Purchase obligations include unrecorded agreements to purchase goods or services that are enforceable and legally

binding upon us and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed,

minimum or variable price provisions; and the approximate timing of the transaction. Purchase obligations exclude

agreements that are cancelable without penalty.

(2) Other non-current liabilities relate primarily to our postretirement benefits. See Note 13 to the Consolidated Financial

Statements.

The amount and period of future payments related to our FIN 48 income tax uncertainties cannot be reliably estimated and,

therefore, is not included in the above table. See Note 9 to the Consolidated Financial Statements for further details.

Critical Accounting Policies

We have identified the policies below as critical to our business operations and to the understanding of our results of

operations. We have discussed the impact and any associated risks on our results of operations related to these policies

throughout the MD&A. For a detailed discussion on the application of these and other accounting policies, see Note 1 to the

Consolidated Financial Statements.

The preparation of our financial statements in conformity with GAAP requires our management to make estimates and

assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the

date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. These

estimates include, but are not limited to, customer cancellations, bad debts, inventory obsolescence, residual values of leased

assets, useful lives of long-lived assets and intangible assets, warranty obligations, restructuring, pensions and other

postretirement benefits, contingencies and litigation, and allocation of purchase price to tangible and intangible assets

acquired in business combinations. Our actual results could differ from those estimates and assumptions. We believe the

assumptions and estimates used are reasonable and appropriate in accordance with GAAP.