Pitney Bowes 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

52

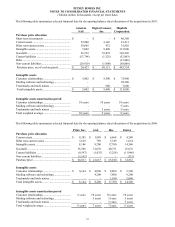

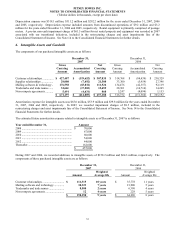

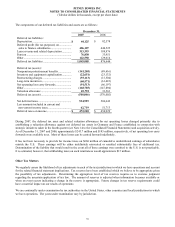

The following table summarizes selected financial data for the opening balance sheet allocations of the acquisitions in 2007:

Asterion

SAS Di

g

ital Cement,

Inc. MapInfo

Corporation

Purchase price allocation

Short-term investments ...................................... $ - $ -

$ 46,308

Current assets..................................................... 52,900

2,146

41,213

Other non-current assets .................................... 30,685 932

35,826

Intangible assets ................................................. 5,802 9,400 113,000

Goodwill ............................................................ 26,763 39,878 326,296

Current liabilities ............................................... (57,794) (1,325) (52,963)

Debt.................................................................... - - (13,866)

Non-current liabilities ........................................ (29,929) (1,900) (50,060)

Purchase price, net of cash acquired ................. $ 28,427 $ 49,131 $ 445,754

Intangible assets

Customer relationships....................................... $ 5,802 $ 8,500

$ 75,900

Mailing software and technology....................... - -

29,500

Trademarks and trade names ............................. - 900

7,600

Total intangible assets....................................... $ 5,802

$ 9,400

$ 113,000

Intangible assets amortization period

Customer relationships....................................... 10 years

10 years

10 years

Mailing software and technology....................... - -

5 years

Trademarks and trade names ............................. - 2 years

5 years

Total weighted average ...................................... 10 years 9 years

8 years

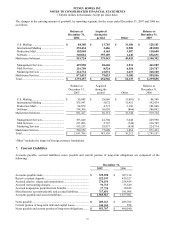

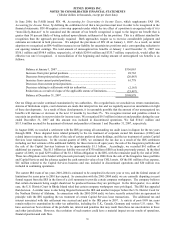

The following table summarizes selected financial data for the opening balance sheet allocations of the acquisitions in 2006:

Print, Inc. AAS Ibis Emtex

Purchase price allocation

Current assets..................................................... $ 9,385

$ 1,989

$ 6,468 $ 4,240

Other non-current assets .................................... 1,610 789

3,349 1,034

Intangible assets ................................................. 8,144 8,200

17,700 14,540

Goodwill ............................................................ 36,588 31,670 40,751 25,076

Current liabilities ............................................... (8,547) (1,033) (3,258) (11,946)

Non-current liabilities ........................................ (1,163) - - (112)

Purchase price.................................................... $ 46,017 $ 41,615 $ 65,010 $ 32,832

Intangible assets

Customer relationships....................................... $ 8,144 $ 4,000

$ 8,800 $ 3,300

Mailing software and technology....................... - 4,200

7,800 9,200

Trademarks and trade names ............................. - -

1,100 2,040

Total intangible assets........................................ $ 8,144

$ 8,200

$ 17,700 $ 14,540

Intangible assets amortization period

Customer relationships....................................... 6 years 10 years

10 years 10 years

Mailing software and technology....................... - 5 years

5 years 5 years

Trademarks and trade names ............................. - -

3 years 5 years

Total weighted average ...................................... 6 years 7 years

7 years 6 years